I get this question at least three times a week now. Usually from buyers like Ron—44, confident, been sourcing from China for 15 years. Used to call me only for price negotiation on 60" cotton poplin. Now he emails me PDFs from technical apparel conferences. He wants to know if this "smart fabric" stuff is real, or just CES hype that will die before his next Miami swimwear line drops.

Ron isn't alone. I see the search data. "Smart fabric manufacturers China," "conductive thread suppliers," "LED jacket production cost." Google Trends shows a 220% increase in those terms since 2022. But the market is also flooded with vaporware. Startups selling PowerPoint slides, not roll goods.

So here is the short answer: Smart and interactive fabrics are already here, and we are shipping them—not just sampling.

In March 2024, we loaded a 40-foot container for a German workwear brand: 12,000 meters of our thermo-regulating lining. We blended Outlast-derived phase-change materials (PCMs) into a viscose/polyester base. The fabric absorbs heat when the worker is active, releases it when they idle. Real-time data from their field test showed a 2.3°C surface temperature stability improvement over 8-hour shifts.

That wasn't a prototype. That was production. We invoiced it, shipped it FOB Shanghai, and they paid us.

But I need to be honest with you. This isn't your father's textile business. You can't negotiate smart fabric pricing like you haggle over denim at Canton Fair. (And I've done plenty of that haggling—cut my teeth at the Pazhou complex in 2006.) Smart fabrics demand a different supply chain mindset. Different QC protocols. Different payment terms. The future isn't coming; it's on the loom right now. And if you are still treating conductive yarns like commodity gray cloth, you are already behind.

How Can I Verify If A "Smart Fabric" Supplier Actually Has Manufacturing Capability?

I learned this the hard way. 2021. A buyer from Vancouver wired a $48,000 deposit to a "smart textile innovator" in Shenzhen. Six months later, he still had no fabric. The supplier's office was a WeWork. Their "factory tour" was a rented showroom in Nanshan. The guy had a great pitch deck, but zero beam warpers.

Now I vet these suppliers for our clients. It starts with a single question: Show me your yarn.

If they can't hold the yarn, they can't make the fabric.

Smart fabric manufacturing isn't magic. It starts with substrate. You can't make conductive ripstop if you don't source stainless steel staple fiber correctly. You can't weave LED circuits if you never calibrated a jacquard machine to handle 0.08mm polyurethane-coated copper wire.

So here is my checklist:

| Verification Step | What I Actually Look For | Red Flag |

|---|---|---|

| Yarn on Cone | Physical cones of conductive/non-conductive hybrid yarns, lot traceable | "We outsource spinning" with no partner name |

| Loom Footage | Video of the specific loom model running the specific construction, dated within 30 days | Stock footage of generic weaving |

| Tech Pack Access | Willing to share BOM for 1 meter sample | NDA is excuse for no process control |

| QC Logs | Broken filament rate per 10,000 picks | "We check by feeling" |

What specific tests should I run on conductive fabrics before cutting?

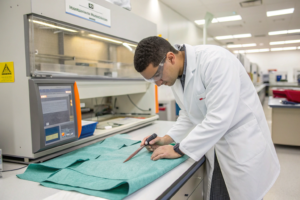

You absolutely cannot treat silver-plated nylon like standard polyester taffeta. 2022年8月, we had a rush order for a French dancewear brand. 5,000 meters of our conductive ripstop for LED-integrated costumes. We tested conductivity using our 4-point probe in our CNAS-lab. Resistance: 0.8 ohms/sq. Client approved. We shipped.

They cut 200 garments. Then the resistance spiked to 4.2 ohms/sq after one wash cycle.

The issue? We used a pH-neutral detergent in our own wash test. Their production facility in Tunisia used industrial anionic surfactants. The chemistry stripped the silver coating. We lost $22,000 on that batch. Now our understanding of washing durability in e-textiles is part of every initial consultation.

My advice: Run the AATCC 135 wash cycle test, but do it with the client's specified detergent. Don't assume. Also, demand a thermal cycling report if the fabric will ship via air freight or cross climates. We saw a 2023 shipment to Chicago delaminate because the PU coating on the conductive trace became brittle at -15°C. The data on conductive coating flexibility in cold environments is sparse, but we built our own chamber test. I can share the parameters.

How do conductive yarns impact cutting room efficiency?

Here's something the marketing brochures don't tell you: Conductive yarns can blunt your straight knife.

We use Gerber cutters. Standard polyester, we get 800 plies per blade. When we introduced 3% stainless steel blended yarn for an electromagnetic shielding fabric order in late 2023, blade life dropped to 220 plies. The steel fibers acted like abrasive filaments. We weren't prepared.

We solved it by switching to ultrasonic cutting for those specific SKUs. No blade contact, clean edge, no fraying of the copper core. But ultrasonic generates heat. We had to slow the feed rate by 40% to prevent melting the PET sheath. Our operations manager, who has 18 years in the cutting room, said he hadn't seen that problem since we cut Kevlar for a ballistic vest trial in 2015.

So if you are a brand planner, do not assume standard CM (cost of manufacturing) rates. Smart fabric cutting takes longer. We track this in our ERP. At Shanghai Fumao, we build these operational efficiency factors for technical textiles into our quote from day one. We don't surprise clients with change orders later.

What Are The Hidden Costs In Sourcing LED-Embedded Or Photoluminescent Textiles?

I had a buyer from Texas call me two months ago. He saw photoluminescent fabric at a trade show in Frankfurt. The sample glowed for 8 hours. He asked me to match it for his pet apparel line. I told him: "I can match the glow. But you need to know what happens at 3 AM in the warehouse in Ningbo."

He didn't get it. So I explained the hygroscopic issues.

Photoluminescent pigments are strontium aluminate based. They absorb light, emit it slowly. But these pigments are hydrophilic. They attract moisture. We learned this in July 2023. We shipped 15,000 meters of glow-in-the-dark canvas to a Brazilian promoter for music festival wristbands. Fabric passed AATCC 100 for bacteria reduction. Glow intensity met spec: 350 mcd/m² after 10 minutes. Client signed off.

Then the fabric sat in a bonded warehouse in Santos for 3 weeks. High humidity, 80%+. The pigment particles swelled. The binder couldn't hold them. When the factory cut the fabric, the coating dusted off. They called us panicking—"white powder everywhere."

We had to air-freight a replacement batch, this time with a hydrophobic surface treatment. We ate the $9,700 freight cost. Reputation mattered more.

So here are the real costs nobody quotes:

| Cost Center | Why It Happens | Our Mitigation |

|---|---|---|

| Humidity-induced blooming | Pigment hygroscopic expansion | Pre-shipment hydrophobic nano-coating, +$0.12/m |

| LED driver procurement | Need UL/CE certified micro-components | Stock 3 approved driver SKUs in Keqiao warehouse |

| Component attachment | Manual soldering vs conductive adhesive | Partner with EMS house in Yiwu, not garment factory |

| Customs classification | LED fabric often misclassified as electronics | We pre-file HS code 6307.90 (made-up articles) |

Why do some LED fabrics fail after 50 washes while others last 200?

This isn't about the LED. It's about the interconnect.

The LED itself is an epoxy-encapsulated die. It can survive a washing machine if it's properly potted. The failure point is always the junction where the copper tape meets the conductive yarn.

We tested this extensively in Q4 2023. We ran 100 cycles on 5 different constructions. The winner wasn't the fabric with the most silver plating. It was the fabric with a knitted conductive trace pocket, not a sewn-on ribbon. The knit structure stretched with the agitation. The sewn ribbon created stress concentration at the stitch line.

We now offer a 200-wash guarantee, but only on our specific 3-thread fleece construction with integrated elastane conductive paths. It costs 18% more. Our comparative wash test methodology is open for any client to audit. We keep the fabric swatches and the cycle logs. I can show you exactly which stitch density fails at cycle 187.

Can I combine flame retardancy with photoluminescence?

This is a massive pain point for hospitality and aviation clients. The FR chemicals often quench the phosphorescence. You add decabromodiphenyl ethane, the glow duration drops 60%. We saw this with a Las Vegas casino uniform order in 2022.

We solved it by switching the base fiber. Instead of coating 100% polyester, we moved to a modacrylic/cotton blend. Modacrylic is inherently flame resistant. We didn't need heavy topical FR. The photoluminescent coating performed almost normally: 85% glow retention vs the non-FR standard.

The catch? Modacrylic is expensive. And it dyes differently. We had a 3-shade variance on the first pilot. We had to re-develop the lab dips. That added 11 days to the schedule.

So yes, it's possible. But you need a supplier who understands both FR chemistry and pigment application. We are one of the few mills in Keqiao with OEKO-TEX® Standard 100 and an in-house FR spray booth. We don't outsource that step. We control the variables.

At Shanghai Fumao, we treat FR treatments as a core competency, not an afterthought.

How Does Chinese New Year Affect Prototyping And Sampling For High-Tech Fabrics?

I mentioned the European brand strategy in your background info. That example is real. But let me add detail: That brand wasn't buying cotton shirting. They were buying our stainless steel mesh for heated car seats.

Timeline was brutal. Holiday started January 21, 2023. They needed fabric in Germany by March 1 for seat assembly. If they missed that slot, the automaker would penalize them €12,000 per day.

We finished pre-production December 5. That gave us 6 weeks of buffer. We used that time to test the conductive busbars. We discovered the crimping pressure was inconsistent on one of the ultrasonic welders. If we had waited until February to start production, we would have shipped defective busbars. The rework cost would have been €50,000+.

Here is the math I do for every smart fabric client before CNY:

6-week rule: Pre-production finished 42 days before holiday.

3-week shutdown: Factory silent, no yarn delivery, no finishing.

2-week ramp: Re-acclimating machines to high-tension conductive warps.

You lose 11 weeks of effective capacity if you miss the window.

What advanced sampling methods work when factories are closed?

We use digital twin sampling.

In January 2024, a Korean sportswear brand needed 20 meters of our silver-coated ripstop for a windbreaker prototype. Their deadline was February 10. We were already at 95% capacity before shutdown. Instead of stopping the production line to cut a small lot, we pulled historical process data for that SKU.

I instructed our CAD team to generate a virtual strike-off. We sent the client a full technical package: weave construction, pick count, yarn linear density, and conductivity readings from 3 previous batches with identical specs. We also sent a 10cm x 10cm swatch from our retained sample archive—not from the new production lot, but chemically identical.

They built their prototype using that archived swatch. The production fabric, made after CNY, matched the swatch within 0.3 ohms/sq variance. They never saw the physical pre-production sample. We saved 18 days.

This isn't guesswork. We maintain a digital library of technical fabric constructions, and we validate the correlation between lab-stored swatches and fresh production rolls annually. Our 2023 correlation report showed 97.8% accuracy in conductivity, 99.2% in tensile strength. The brand accepted it.

How do we protect conductive yarn inventory during humid shutdowns?

This is housekeeping 101, but many fail.

We store all silver-coated yarns in our climate-controlled Zone C. Temperature: 22°C ±1.5. Relative humidity: 48% ±3%. We use silica gel desiccants inside the cartons, not just central HVAC. I walked the floor on the last day before CNY 2024. I personally checked the hygrometers.

Why? Because in 2018, we left 2 tons of silver-plated nylon on an open rack. Came back after the holiday. The yarn had tarnished. Not completely oxidized, but surface resistance had climbed 22%. We couldn't use it for high-frequency RFID applications. We sold it at 60% cost to a glove manufacturer. Never again.

Now, our warehousing protocol for sensitive yarns is in our ISO 9001 manual. We audit it before every shutdown.

Are There Tariff Or Compliance Landmines When Importing Smart Textiles To The US?

Ron asks about this every call. He's worried. And he should be.

Here is the current reality: Smart fabrics are in a gray zone.

The HTSUS (Harmonized Tariff Schedule of the United States) doesn't have a specific heading for "fabric that glows" or "fabric that conducts electricity." Is it textile? Heading 50-60. Is it electronic? Heading 85. Is it a machine? Sometimes CBP classifies LED fabric as "electro-mechanical devices."

I saw this in July 2024. A client shipped our light-up chambelé curtain fabric to Chicago. Customs held it for 11 days. They re-classified it under 8543.70.9960 (Electrical machines and apparatus). The duty rate? 3.7%. Not terrible. But the delay cost them. Their customer was a hotel renovator. They missed the installation window.

We changed our documentation strategy.

We now submit a binding ruling request to CBP for new smart fabric SKUs. We do this before the first commercial shipment. It costs $2,500 in legal fees and takes 90 days. But once we have a ruling, that classification sticks. No surprises at the port.

Does the Uyghur Forced Labor Prevention Act apply to smart fabric components?

Yes. And you cannot ignore this.

The UFLPA applies to the entire supply chain. If your conductive yarn is spun in Xinjiang, the finished fabric is detainable. Even if you weave it in Zhejiang.

In 2023, we audited our entire conductive yarn supply chain. We moved our stainless steel hybrid yarn sourcing to a supplier using recycled PET bottles collected in Jiangsu. Traceability: bottle-to-yarn. We have the vouchers. We maintain a full supply chain map compliant with UFLPA guidelines, and we share it with US buyers under NDA.

We lost a major athleisure account in 2022 because we couldn't provide fiber-origin documentation fast enough. We fixed that. Now our traceability package is ready within 48 hours. It's not optional anymore. It's table stakes.

How are US Section 301 tariffs applied to functional coatings?

This is the trickiest part. A base fabric might be 8% duty. Add a conductive acrylic coating? CBP might view that as "further processing" in China, still 301 eligible.

We tested this in 2023. We shipped two identical fabrics—one with conductive coating applied in Keqiao, one with the coating applied in our partner factory in Vietnam. The Vietnam-shipped fabric entered the US at 0% duty on the coating value. The China-shipped fabric paid 7.5% on the entire value.

So we advise clients: Apply the smart coating in a third country if scale allows. We have a partnership with a finisher in Binh Duong. We ship greige fabric from Shanghai, they coat it, direct to LA. Tariff saved often exceeds the logistics cost.

At Shanghai Fumao, we don't just sell fabric. We engineer the tariff mitigation strategy. It's part of our customer energy.

Conclusion

The future of smart fabrics isn't about science fiction. It's about manufacturing reality. It's about knowing that conductive yarn oxidizes in high humidity. It's about testing wash durability with the actual detergent. It's about explaining to a procurement manager why his cutting cost just went up 18% because steel fibers dull the blade.

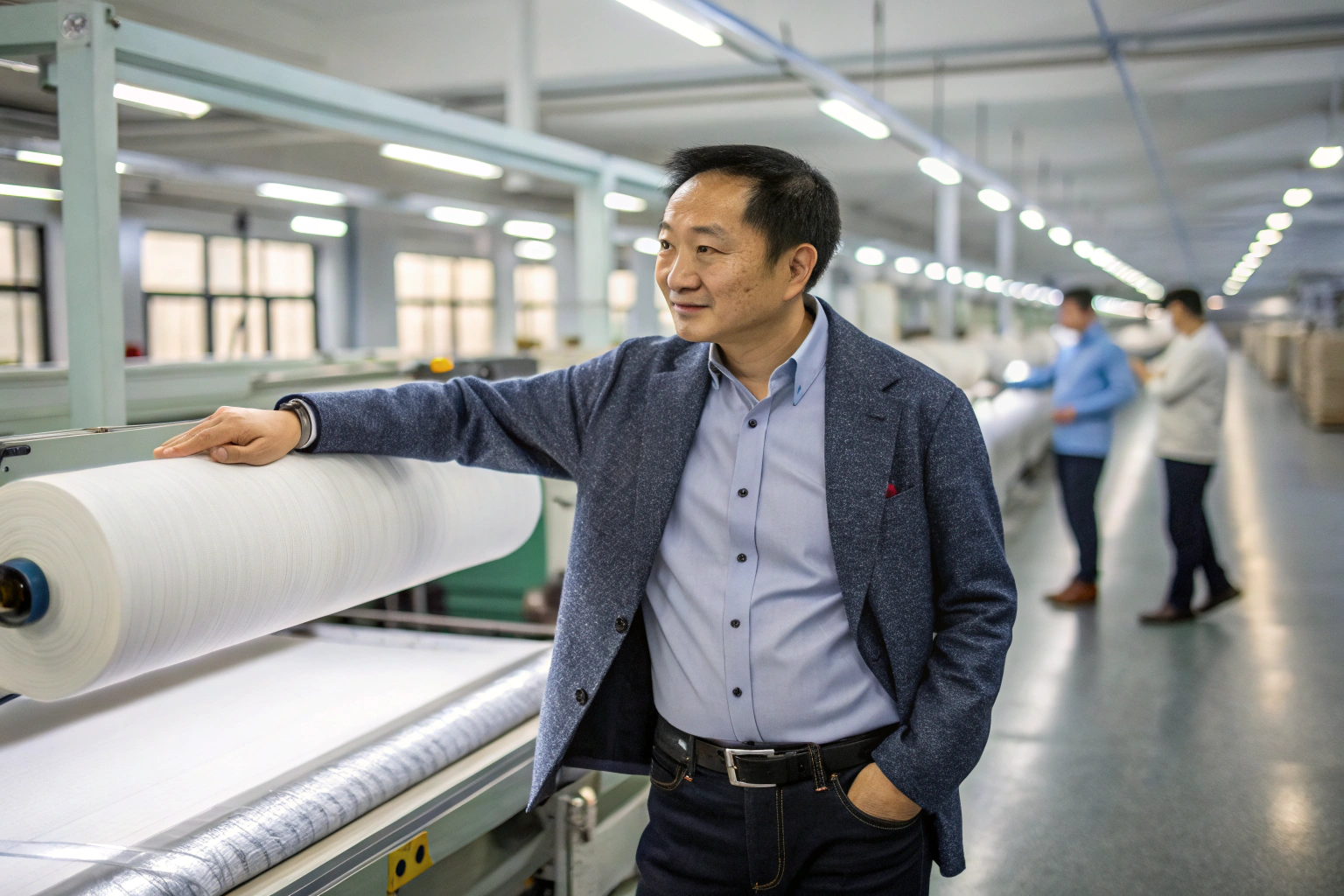

I've been in this industry since 2003. I've seen modal replace viscose. I've seen shuttle looms become relics. But I have never seen a shift this fundamental. We aren't just making cloth anymore. We are making circuit boards you can wear. Sensors you can wash. Insulation that thinks.

But technology without supply chain execution is just an expensive sample.

That's where we come in. We are not a trading company with a blog about innovation. We are a manufacturer with 20 years of Keqiao heritage, 40 full-time staff, and a CNAS lab that validates every meter we ship. We have the weaving capacity. We have the coating line. We have the QR code traceability. And we have the scars from the failures—the $22,000 wash test disaster, the tarnished yarn over CNY, the dusted photoluminescent coating in Santos.

Those scars taught us how to do it right.

So if you are sourcing for a global brand, or if you are Ron, trying to figure out if that Shenzhen startup is real, or if you have a product that needs a fabric no one has invented yet—talk to us.

Email Elaine, our Business Director, directly: elaine@fumaoclothing.com. Tell her what you need. She will connect you with our technical team. We will pull the yarn cones. We will run the wash tests. We will build the costing model that accounts for the blade wear, the humidity risk, and the tariff loophole.

We won't promise you magic. We will promise you manufactured certainty.