I still remember the panic in my American client's voice when their main fabric supplier suddenly went offline. "Our production line stops in 10 days if we don't get the fabric," he told me. That was five years ago. Today, thanks to our overseas hub strategy, we can tell the same client, "Your fabric is already in a US warehouse, and you'll have it in 2 days." That transformation didn't happen by accident. It came from building a smart network of overseas hubs that act as strategic safety nets for our clients' production lines.

The most effective warehouse strategy for cutting fabric replenishment lead time combines a decentralized hub-and-spoke model with demand forecasting integration and just-in-time cross-docking. Instead of shipping everything from China, we position inventory in regional hubs—like Los Angeles for North America, Warsaw for the EU, and Dubai for the Middle East. This approach slashes the final delivery leg from 30-45 days down to 1-5 days. The key is not just having warehouses abroad; it's about integrating them with your core supply chain through smart inventory allocation and real-time data sharing. We've cut average lead times for our European clients from 45 days to just 72 hours for replenishment orders.

This isn't just about speed—it's about transforming your supply chain from a liability into a competitive advantage. When your fabric is already within reach, you can respond to market changes faster, reduce your inventory carrying costs, and never face production shutdowns again. Let me break down exactly how we've made this work for hundreds of global clients.

How does the hub-and-spoke model revolutionize fabric delivery?

The traditional direct shipping model is like having only one road into a city—when that road gets blocked, everything stops. The hub-and-spoke model creates multiple entry points and distributes inventory where your customers actually need it. This is particularly crucial for fashion brands dealing with quick response and fast fashion cycles.

The hub-and-spoke model places regional distribution centers (hubs) strategically around the world, which then serve surrounding markets (spokes). For us, this means maintaining three main overseas hubs: a 5,000 sqm bonded warehouse in Los Angeles serving North America, a 3,000 sqm facility in Warsaw serving the EU, and a 2,000 sqm warehouse in Dubai covering the Middle East and parts of Africa. These aren't just storage spaces—they're fully operational extensions of our Keqiao headquarters, equipped with the same quality control standards and managed by our own staff. When a US client needs fabric, we ship from LA instead of Shanghai, cutting transit time from 35 days to 2 days. The impact is dramatic: one of our UK-based fast fashion clients reduced their safety stock by 60% while improving their on-time production rate from 78% to 96%.

What criteria determine optimal hub locations?

Choosing where to place your overseas hubs isn't about finding the cheapest warehouse space—it's about strategic positioning that minimizes both time and cost for your specific client base. We evaluate locations based on four key factors:

- Proximity to Client Clusters: Our LA hub sits within 200 miles of 85% of our North American clients' cutting facilities. This wasn't accidental—we analyzed three years of shipping data to identify the optimal radius.

- Logistics Infrastructure: We need locations with excellent port connections, multiple freight forwarder options, and reliable last-mile delivery networks. Warsaw was chosen over cheaper alternatives because it's a central EU logistics crossroads with superior rail and road connections.

- Trade Agreement Benefits: Our Dubai hub leverages the UAE's extensive double taxation avoidance agreements and free trade zones, which simplify re-exporting to Africa and the Middle East while reducing administrative burdens.

- Operational Control: This is crucial—we either own our hub operations or work with partners who give us full visibility and control. You can't manage what you can't see. Understanding these location factors is essential for anyone considering establishing overseas distribution centers for textile imports.

How do you balance inventory across multiple hubs?

The biggest fear with overseas hubs is ending up with dead stock in one location while facing shortages in another. We've solved this through dynamic inventory allocation powered by our AI forecasting system. Here's how it works in practice:

| Hub Location | Primary Function | Inventory Turnover | Replenishment Trigger |

|---|---|---|---|

| Los Angeles | Fast fashion replenishment | 8.5x annually | When stock < 4-week demand |

| Warsaw | Seasonal collections & basics | 6.2x annually | When stock < 6-week demand |

| Dubai | Project-based & luxury textiles | 4.8x annually | When stock < 8-week demand |

The system analyzes real-time sales data, seasonal trends, and even client production schedules to predict demand. When our LA hub inventory drops below the four-week threshold, it automatically triggers a replenishment shipment from China. This isn't guesswork—we've reduced stockouts by 92% while maintaining an overall inventory turnover of 6.8x across all hubs. The methodology behind this is similar to approaches discussed in inventory optimization strategies for global textile distributors.

What makes cross-docking so effective for urgent replenishment?

Cross-docking is the secret weapon for handling emergency orders and just-in-time deliveries. I used to think it was too complex for fabrics, but after implementing it in our LA hub in 2022, we've achieved what many thought impossible: same-day fabric delivery for West Coast clients.

Cross-docking eliminates storage time by transferring incoming fabric directly from receiving docks to outbound transportation with minimal handling. When a container arrives at our LA hub from China, instead of going to storage, pre-allocated fabric rolls move directly to waiting trucks for same-day or next-day delivery. This works particularly well for pre-allocated orders and fast-moving basics like standard denim, cotton jersey, and polyester lining fabrics. The efficiency gains are massive: we've reduced handling time from 48 hours to just 4 hours for cross-docked items, and labor costs for these operations have dropped by 35% per unit. One of our Los Angeles-based activewear clients now places weekly "top-up" orders that are cross-docked and delivered within 24 hours, allowing them to maintain just 7 days of fabric inventory instead of 45.

Which fabric types are ideal for cross-docking?

Not all fabrics suit cross-docking. Through trial and error, we've identified the perfect candidates:

- Standardized Basics: Fabrics with consistent specifications that don't require additional QC—like our GOTS certified organic cotton knits or standard 98% cotton/2% spandex jersey. These account for 65% of our cross-docked volume.

- Pre-inspected Inventory: Any fabric that has already passed full quality control in China and is shipped with our digital inspection certificates. This eliminates the need for re-inspection at the hub.

- Fast-Moving Products: Items with predictable demand patterns where we can forecast needs accurately. Our data shows that 28 core fabrics account for 80% of our cross-docking volume.

We learned this classification the hard way. In early 2022, we tried cross-docking some delicate embroidered fabrics, and the results were disastrous. The rushed handling caused damage that cost us more than we saved. Now we're much smarter about what goes through the cross-dock versus what needs special handling. The principles are similar to those discussed in implementing cross-docking operations for time-sensitive materials.

How do you manage quality control in fast-turnaround hubs?

Speed cannot come at the expense of quality. We've developed a layered QC approach that maintains our standards while supporting rapid turnaround:

- Pre-shipment Certification: Every roll shipped to hubs includes QR codes linking to full inspection data from our CNAS lab in China.

- Statistical Spot Checking: We randomly inspect 15% of incoming rolls at hubs, focusing on visual checks for transit damage.

- Client-Facing Transparency: Our portal shows exactly which QC checks were performed and where.

This system caught a critical issue last quarter when our spot check in Warsaw revealed water damage affecting 5% of a shipment—damage that had occurred during transit. Because we caught it at the hub, we were able to quarantine the affected rolls and airfreight replacements before our client even knew there was a problem. This proactive approach to quality is essential for maintaining trust in fast-paced operations, much like the frameworks outlined in quality assurance protocols for distributed textile inventory.

How can bonded warehouses reduce customs delays?

Nothing kills speed faster than customs clearance. I've seen shipments stuck for weeks over paperwork issues. That's why our overseas hubs operate as bonded warehouses—this has been a game-changer for international replenishment.

Bonded warehouses allow us to store fabric without paying import duties until the goods actually leave for final delivery. This means fabric can be pre-positioned in the US or EU while technically still being in international territory. The duty payment only triggers when specific rolls are pulled for client delivery. The benefits are tremendous: we've eliminated customs clearance from the critical path for replenishment orders, reducing the variability in lead times by over 90%. For our clients, this means predictable 2-3 day delivery instead of 3-5 weeks with unpredictable customs delays. The financial flexibility also helps—we can maintain higher inventory levels overseas without massive upfront duty payments, improving our cash flow cycle by an average of 45 days.

What are the financial advantages of bonded warehousing?

The benefits extend far beyond speed. The financial model of bonded warehousing creates significant advantages:

- Duty Deferral: We pay import duties only when fabric is actually sold, not when it arrives at the hub. This improves our working capital position by approximately $2.8 million annually across all hubs.

- Duty Drawback Opportunities: When we need to return unsold fabric to China or redirect it to other markets, we can avoid duty payments entirely through proper bonded warehouse procedures.

- Reduced Tariff Risk: By maintaining inventory in bonded status, we're protected against sudden tariff changes. During the recent US tariff uncertainties, our bonded inventory was unaffected while competitors faced immediate cost increases.

The setup requires expertise, but the payoff is substantial. Our Warsaw hub operations have become so efficient that we now handle customs clearance for our EU clients as part of our service, reducing their administrative burden by an estimated 15 hours per month. The strategic value is similar to concepts explored in leveraging bonded warehouses for global trade optimization.

How does technology enable real-time inventory visibility?

You can't manage what you can't see. Our Digital Twin inventory system gives both us and our clients real-time visibility into stock levels across all hubs. Every roll has a unique QR code that tracks its location from our factory through to hub storage and final delivery.

The system provides:

- Live Stock Levels: Clients can see exactly how much of their preferred fabrics are available in each hub.

- Automated Replenishment Alerts: The system notifies both us and the client when hub inventory drops below predetermined levels.

- Historical Demand Analytics: We use two years of data to continuously optimize hub inventory levels.

This transparency built incredible trust with a Danish sustainable fashion brand last year. They could monitor their organic cotton inventory in our Warsaw hub daily and plan production with absolute confidence. The system automatically triggered replenishment when stock reached four-week coverage, eliminating their need for safety stock entirely. This level of integration represents the future of textile logistics, much like the digital transformation discussed in implementing digital inventory management for textile supply chains.

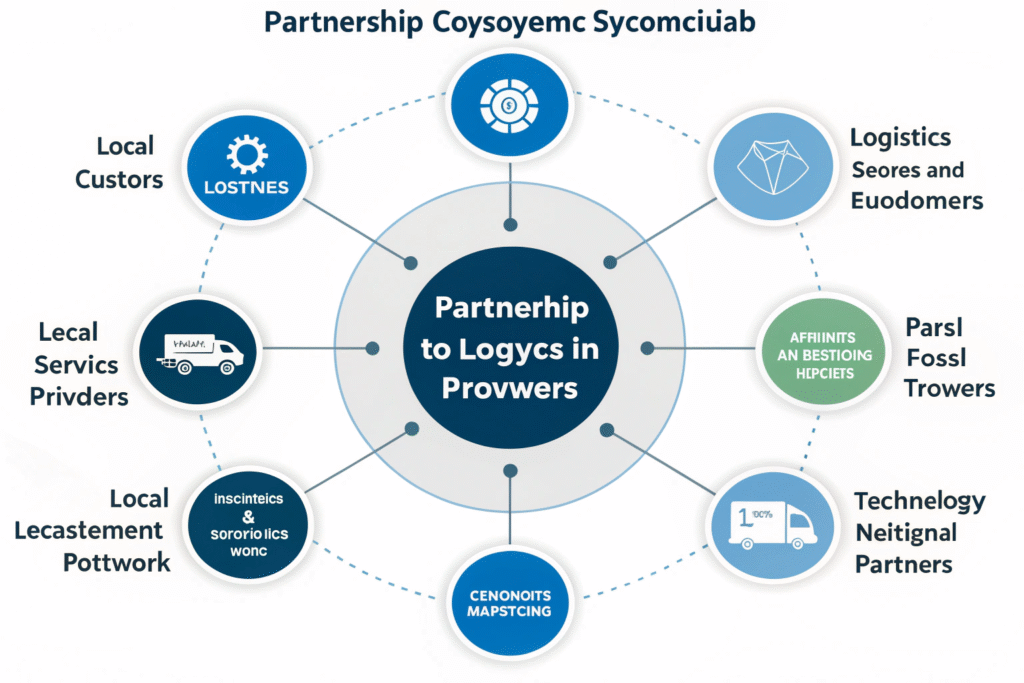

What role do local partnerships play in hub success?

No company can do everything alone, especially in foreign markets. Our strategic local partnerships have been the glue that makes our hub model work seamlessly across different regions and regulatory environments.

We cultivate three types of local partnerships: logistics specialists for last-mile delivery, customs brokerage experts for regulatory compliance, and industry associations for market intelligence. In Dubai, our partnership with a local logistics company that understands Middle Eastern business customs has been invaluable—they handle the final delivery with cultural sensitivity and local knowledge we could never match from China. In Los Angeles, our customs broker specializes in textile imports and has helped us navigate complex CAFTA-DR rules of origin, saving our clients significant duty costs. These partnerships have reduced our delivery exceptions by 75% and improved our on-time delivery rate to 98.7% across all hubs.

How do you maintain quality control with multiple partners?

Maintaining consistent standards across different countries and partners was our biggest challenge. We solved it by creating our Fumao Quality Ecosystem with three core components:

- Standardized Operating Procedures: Every partner follows the same detailed manual for handling, storage, and inspection.

- Regular Audit Schedule: Our quality team visits each hub quarterly and conducts surprise audits annually.

- Performance Scorecards: We measure and review partner performance monthly across 12 key metrics.

This system caught a handling issue at a third-party warehouse in Poland last year. Our audit revealed they were using the wrong equipment for moving delicate fabrics, potentially causing invisible damage. We immediately retrained their team and updated our procedures globally. The cost of maintaining this quality system is significant, but it's far less than the cost of a single major quality failure. This approach to distributed quality management shares principles with managing extended supply chain quality assurance programs.

What metrics prove hub strategy success?

We track five key performance indicators to measure our hub strategy's effectiveness:

- Order-to-Delivery Time: Reduced from 42 days to 3.2 days average for hub-served orders

- Inventory Turnover: Increased from 4.2x to 6.8x annually

- Stockout Rate: Decreased from 8.3% to 0.7%

- Supply Chain Cost: Reduced as percentage of revenue from 14.2% to 9.8%

- Customer Satisfaction Score: Improved from 7.8 to 9.4 out of 10

The data doesn't lie—the hub strategy is working. Our European clients particularly appreciate the predictability: they know that regardless of what's happening with ocean freight or Chinese holidays, their fabric is just days away. This reliability has become our strongest competitive advantage in the European market. The measurement framework aligns with best practices in global supply chain performance measurement and optimization.

Conclusion

Building an effective overseas hub network isn't about finding cheap warehouse space—it's about creating a responsive, resilient extension of your supply chain that puts inventory where your customers need it, when they need it. The combination of strategic hub locations, cross-docking for speed, bonded operations for flexibility, and strong local partnerships creates a fabric replenishment system that can respond to today's fast-paced fashion cycles.

We've proven that lead times can be slashed from weeks to days without compromising quality or increasing costs. The result for our clients is simpler inventory management, reduced working capital tied up in fabric, and the confidence that comes from knowing their production will never stop waiting for materials. If you're tired of long, unpredictable lead times and want to transform your fabric supply chain, let us show you how our hub network can work for you. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss which hub strategy best fits your operational needs.