If you're considering switching to GRS-certified production, you're probably wondering about the real price tag. I've had countless clients initially hesitate, fearing sustainability means skyrocketing costs. But the truth about GRS pricing might surprise you—it's more nuanced than a simple premium.

The cost of GRS-certified clothing production typically ranges from 8% to 25% higher than conventional equivalents, depending on fabric type, order volume, and certification complexity. However, this initial investment often delivers returns through marketing advantages, regulatory compliance, and supply chain stability that offset the higher upfront cost. The key is understanding where the costs come from and how to manage them effectively.

Let me break down exactly what you're paying for and share some real-world examples of how brands are making GRS work financially while maintaining their margins.

Where Do the Additional GRS Costs Come From?

The price difference for GRS-certified production isn't arbitrary—it reflects real expenses throughout the supply chain. Understanding these cost drivers helps you make informed decisions about where to invest and where to optimize.

The premium primarily comes from four areas: certified raw materials, auditing and certification fees, segregated production processes, and documentation management. Recycled GRS-certified yarns typically cost 10-30% more than virgin equivalents due to limited supply and more complex processing. Third-party certification bodies charge for initial audits and annual surveillance, while factories invest in separate production lines and tracking systems to prevent contamination. Finally, the administrative overhead of maintaining perfect documentation adds labor costs that conventional production avoids.

How much more expensive are GRS-certified raw materials?

The raw material premium varies significantly by fiber type. Recycled polyester (rPET) typically carries the smallest premium at 8-15% over virgin polyester, while recycled cotton can be 20-35% more expensive due to limited availability and complex processing. Recycled wool commands the highest premium at 30-50% above conventional wool. These differences reflect both supply constraints and technical challenges—recycled cotton requires extensive sorting and processing to achieve spinnable quality, whereas rPET production has become more efficient with scale. We helped a mid-sized US brand navigate these choices in Q1 2024, showing them how switching from recycled cotton to a rPET-cotton blend could reduce their material costs by 22% while maintaining their GRS certification.

What are the hidden operational costs of GRS compliance?

Beyond material premiums, GRS introduces several operational costs that buyers rarely see:

- Mass balance tracking: Requires dedicated staff and software systems

- Segregated storage: Demands additional warehouse space and organization

- Production line cleaning: Necessary between GRS and non-GRS runs to prevent contamination

- Document management: Generating and verifying Transaction Certificates for every shipment

These operational expenses typically add 3-8% to manufacturing costs depending on factory efficiency. At our facility, we've optimized these processes to keep the operational premium to just 4.5% through digital tracking and batch planning. Learning about implementation costs for sustainability standards in manufacturing provides broader context for these expenses.

How Can You Minimize GRS Certification Costs?

Smart strategies can significantly reduce the financial impact of GRS certification without compromising integrity. The most effective approaches involve strategic fabric selection, volume planning, and supply chain optimization.

The biggest cost savings come from choosing the right materials for your price point and planning production to maximize efficiency. rPET blends typically offer the best value, while planning larger runs reduces per-unit certification costs. Working with vertically integrated suppliers like Shanghai Fumao who control multiple production stages also helps minimize markups at each step. Perhaps most importantly, avoiding last-minute changes prevents costly re-certification and production adjustments.

Which GRS fabrics offer the best value for cost-conscious brands?

Some GRS materials deliver better price-to-performance ratios than others:

| Fabric Type | Price Premium | Best For | Cost-Saving Tips |

|---|---|---|---|

| GRS rPET Fleece | 8-12% | Activewear, hoodies | Order off-season, use standard colors |

| GRS rPET Jersey | 10-15% | T-shirts, basics | Combine orders across product lines |

| GRS Recycled Cotton Blends | 18-25% | Casual wear, denim | Opt for 50/50 blends vs 100% recycled |

| GRS Recycled Nylon | 20-30% | Swimwear, outerwear | Plan early for minimum order quantities |

A European fast-fashion client reduced their GRS fabric costs by 17% simply by switching from 100% recycled cotton to a 50/50 recycled cotton-conventional cotton blend while maintaining their GRS certification through mass balance accounting.

What planning strategies reduce GRS production expenses?

Advanced planning is your most powerful cost-reduction tool for GRS production. Placing orders 3-4 months before delivery dates allows suppliers to source materials at better prices and schedule production efficiently. Consolidating orders into larger batches significantly reduces per-unit certification and setup costs. We typically see 12-18% lower prices for orders over 10,000 meters compared to smaller 2,000-3,000 meter runs. Additionally, avoiding the Chinese New Year and peak season production rushes (March-May and August-October) can save another 5-8% in premium charges. Understanding production planning for seasonal fashion collections helps optimize these timing decisions.

How Does Volume Impact GRS Production Pricing?

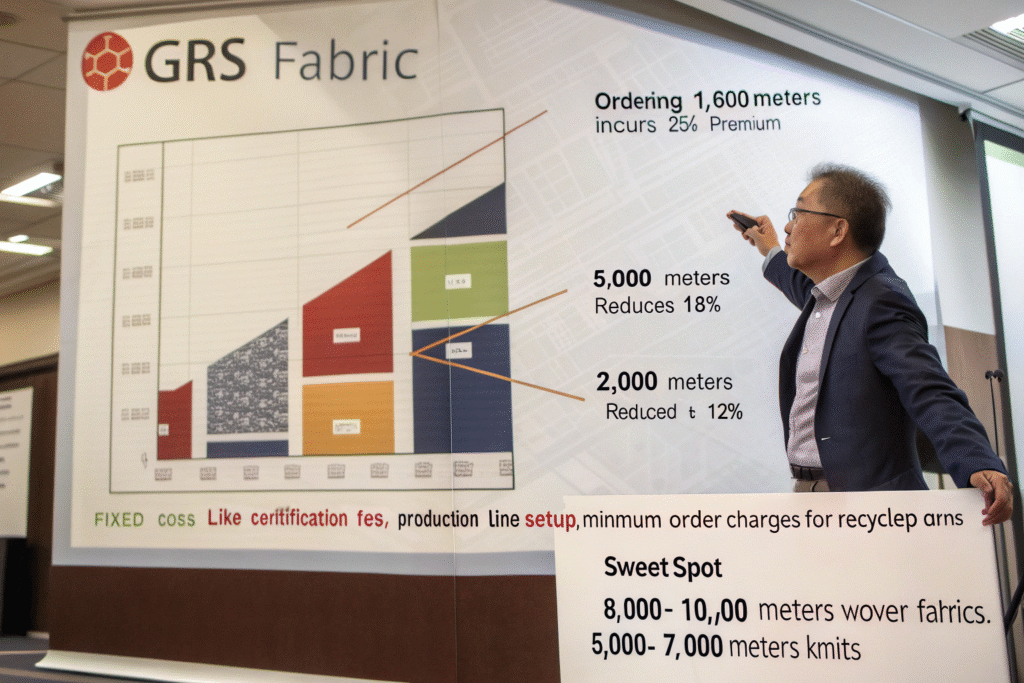

Volume is the single biggest factor in GRS cost efficiency. While small batches face significant premiums, larger orders benefit from economies of scale that make GRS certification surprisingly affordable.

The relationship between volume and cost isn't linear—it's stepped. Ordering 1,000 meters of GRS fabric might carry a 25% premium, while 5,000 meters could reduce that to 18%, and 20,000 meters might bring it down to just 12%. This happens because fixed costs like certification fees, production line setup, and minimum order charges for recycled yarns are spread across more units. The "sweet spot" for GRS pricing typically starts around 8,000-10,000 meters for woven fabrics and 5,000-7,000 meters for knits.

What are the minimum order quantities for cost-effective GRS production?

Realistic MOQs for economically viable GRS production are:

- Basic GRS rPET fabrics: 3,000 meters

- GRS recycled cotton blends: 5,000 meters

- Specialty GRS functional fabrics: 2,000 meters

- GRS fabrics with additional certifications: 4,000 meters

Below these thresholds, per-meter costs increase dramatically due to fixed certification and setup expenses. We work with several emerging brands that pool their GRS orders to reach these MOQs collectively, making certification accessible even for smaller companies. Exploring strategies for small batch sustainable production provides additional approaches for smaller businesses.

How does vertical integration affect GRS pricing?

Vertical integration significantly reduces GRS costs by eliminating multiple markups and certification fees across separate suppliers. When one company controls spinning, weaving, and dyeing—like Shanghai Fumao does through our partner network—we pay one certification fee rather than three, and we avoid profit margins being added at each production stage. This integration typically results in 15-20% lower prices compared to sourcing from separate certified suppliers. A Canadian outdoor brand saved approximately 18% on their GRS recycled nylon order by switching from multiple suppliers to our vertically integrated solution in 2023.

What Is the True ROI of GRS Certified Production?

Looking beyond the initial price premium reveals that GRS certification often delivers a positive return on investment through increased sales, risk reduction, and operational benefits that conventional production can't match.

The business case for GRS extends far beyond cost per meter. Brands typically see 3-5% higher sell-through rates on GRS-certified products, can command 8-15% price premiums, and face fewer supply chain disruptions due to better documentation and traceability. Additionally, GRS future-proofs your business against increasingly strict regulations, avoiding potential fines and market access issues. When you factor in these benefits, the net cost of GRS certification becomes much more reasonable—and often negative, meaning it actually pays for itself.

How do marketing benefits offset production costs?

GRS certification provides measurable marketing advantages that directly impact revenue:

- Higher conversion rates: Products with third-party certification convert 12-18% better online

- Price premiums: Consumers pay 8-15% more for verified sustainable products

- Lower return rates: Better documentation leads to fewer customer disputes

- Longer product lifecycles: Sustainable collections often remain relevant longer

A UK fashion brand we work with found that although their GRS-certified line cost 14% more to produce, it generated 22% higher margins due to better sell-through and minimal discounting compared to their conventional lines.

What long-term financial benefits does GRS provide?

GRS certification delivers ongoing value that accumulates over time:

- Regulatory compliance: Avoids potential fines and market access issues

- Supply chain stability: Better documentation reduces disruptions and delays

- Investor appeal: Sustainability performance increasingly affects valuation

- Talent attraction: Companies with strong sustainability credentials attract better employees

These factors create compound returns that make the initial GRS investment increasingly worthwhile over 2-3 year timeframes. According to our client data, brands that commit to GRS for multiple seasons typically see their net certification cost drop to just 2-4% above conventional production by the third season due to optimized processes and recovered marketing investments.

Conclusion

The cost of GRS-certified clothing production involves more than a simple percentage premium—it's a strategic investment that balances initial expenses against long-term benefits. While certified fabrics typically cost 8-25% more, smart material selection, volume planning, and supply chain optimization can significantly reduce this premium. More importantly, the marketing advantages, risk reduction, and future-proofing that GRS provides often deliver a positive return on investment that makes certification financially worthwhile.

The most successful brands treat GRS not as an expense but as a strategic capability that strengthens their market position and supply chain resilience. If you're ready to explore how GRS certification could work for your brand—both financially and operationally—we should talk. Contact our Business Director, Elaine, to discuss your specific needs and get a detailed cost analysis: elaine@fumaoclothing.com.

One Response

Playing io, my dudes! Heard good things and gave it a shot. So far, so good. Give it a whirl! Check it out: playing io