As an experienced fabric supplier working with international clients daily, I recognize that payment method selection profoundly impacts your supply chain efficiency and financial security. The choice between T/T (Telegraphic Transfer) and L/C (Letter of Credit) represents a critical decision point that can either streamline your operations or create significant bottlenecks. Understanding these mechanisms is essential because they directly affect your cash flow, risk exposure, and ultimately, your bottom line.

For high-volume fabric wholesale orders, the decision between T/T and L/C fundamentally balances transaction speed against financial security. T/T offers straightforward processing and faster execution, making it ideal for established business relationships. Conversely, L/C provides enhanced protection through bank guarantees, serving as a safer option for new partnerships or high-value transactions. Consequently, the optimal choice depends on your specific risk tolerance, existing supplier relationships, and order parameters.

To help you navigate this crucial decision, let's systematically examine both payment methods, their operational frameworks, and practical implications for your fabric sourcing business.

What are the Pros and Cons of T/T Payment?

When supply chain velocity is paramount, T/T payment emerges as the preferred choice for many importers. However, this method carries distinct advantages and limitations that must be carefully evaluated before committing funds. Understanding these factors will help you determine when T/T aligns with your business objectives.

T/T payment operates as a direct bank-to-bank electronic funds transfer. The process typically involves an initial deposit (commonly 30%) upon contract signing, with the balance paid before shipment. This method's primary advantage lies in its administrative simplicity and rapid processing. Specifically, it avoids the document-intensive procedures characteristic of L/C transactions. Therefore, for repeat orders with trusted partners, T/T often represents the most efficient pathway to accelerate production initiation.

Why Does T/T Payment Accelerate Fabric Sourcing Timelines?

T/T significantly outperforms L/C in transaction speed due to its streamlined electronic processing. Whereas L/C transactions require meticulous document verification by multiple banks, T/T transfers typically clear within 2-5 business days. This accelerated timeline directly benefits your production schedule because once we receive the T/T deposit, we can immediately authorize our weaving and dyeing facilities to commence production. In contrast, the L/C process can extend payment confirmation by 1-2 weeks, consequently delaying material procurement and manufacturing initiation. For time-sensitive projects where meeting narrow shipping windows is critical, T/T's expedited processing provides a substantial competitive advantage.

How Can Importers Mitigate Risks Associated with T/T Payments?

While T/T offers speed advantages, it inherently carries greater financial risk for importers, particularly with new suppliers. Since funds transfer directly without bank intermediation, recourse options are limited if performance issues arise. To address this vulnerability, we recommend implementing a risk mitigation strategy. First, begin with smaller trial orders to assess supplier reliability before committing to larger volumes. Second, incorporate third-party verification through organizations like SGS for pre-shipment quality inspections. Additionally, leverage supplier verification platforms like Alibaba to evaluate track records and customer feedback. These protective measures, combined with our transparent operational documentation and 20-year market presence, collectively reduce T/T transaction risks to manageable levels.

Why Choose L/C for Large Fabric Orders?

When order values escalate or supplier relationships are nascent, L/C transactions provide crucial financial safeguards that justify their additional complexity. This payment mechanism fundamentally restructures the risk allocation between trading partners, offering assurances that facilitate larger transactions.

An L/C essentially substitutes the bank's creditworthiness for the buyer's, creating a secure payment framework. Under this arrangement, the bank commits to pay the supplier upon presentation of documents proving strict compliance with all L/C terms. These conditions might include specific quality standards, shipment deadlines, and mandatory inspection certificates. Consequently, this method ensures payment occurs only after contractual obligations are verifiably met, thereby protecting buyers from prepayment exposure while assuring suppliers of payment certainty.

What Documentation Requirements Govern L/C Transactions?

L/C transactions are fundamentally document-driven, requiring precise alignment between shipping documents and L/C stipulations. The core document package typically includes Commercial Invoice, Packing List, Bill of Lading, Certificate of Origin, and often independent inspection reports. Critically, the specified International Commercial Terms (Incoterms) determine document responsibility allocation between parties. For example, CIF terms require the supplier to provide insurance documents, while FOB terms shift this responsibility to the buyer. Any discrepancy between presented documents and L/C requirements—however minor—triggers payment delays until resolved. Therefore, meticulous L/C draft review before issuance is imperative to prevent operational and financial disruptions.

How Do L/C Structures Enhance Quality Assurance?

L/C mechanisms provide powerful quality control leverage by linking payment directly to verification of product compliance. Buyers can stipulate that payment is contingent upon submission of passing inspection reports from designated third-party agencies. This creates a compelling incentive for suppliers to maintain quality standards, since the bank will withhold payment if quality documentation requirements remain unfulfilled. Furthermore, this formalized verification process establishes an objective quality benchmark, reducing disputes and ensuring alignment between expected and delivered fabric characteristics. For high-value orders where quality consistency is paramount, this structured approach offers superior protection compared to T/T's trust-based model.

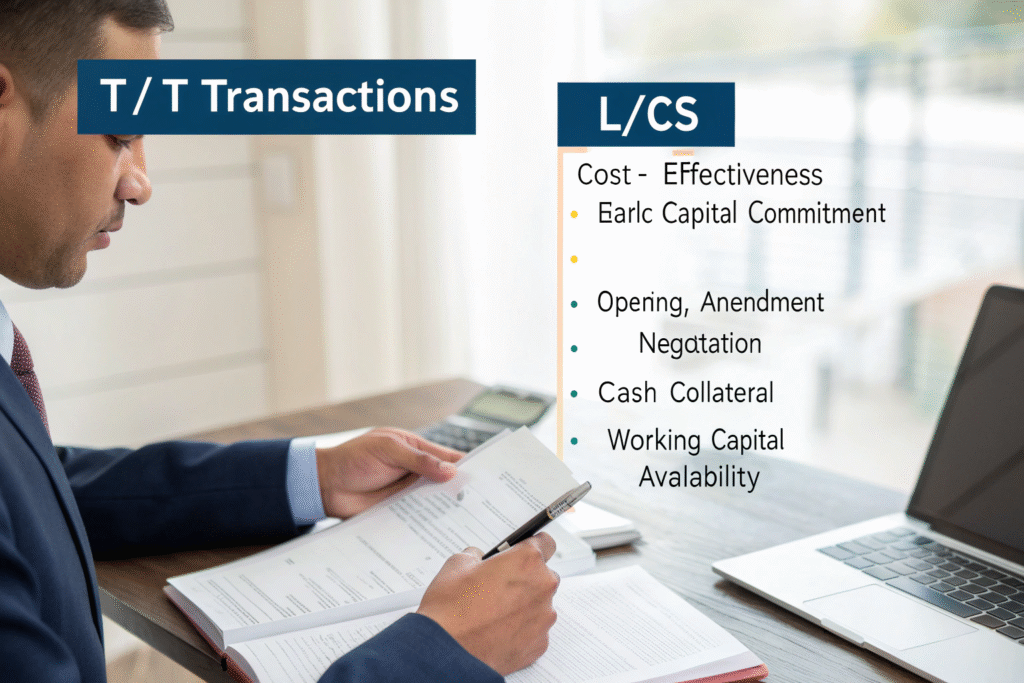

How Do Payment Methods Impact Financial Performance?

Payment selection directly influences both immediate transaction costs and broader financial management. A comprehensive understanding of these economic implications enables more informed decisions that align with your company's financial strategy and cash flow requirements.

T/T transactions typically incur lower direct bank charges, making them superficially more cost-effective. However, they require earlier capital commitment, potentially straining cash flow. Conversely, L/Cs involve various fees—including opening, amendment, and negotiation charges—that increase transaction costs. Additionally, L/Cs often necessitate cash collateral, temporarily restricting working capital availability. The following comparison clarifies these financial implications:

| Financial Consideration | T/T (Telegraphic Transfer) | L/C (Letter of Credit) |

|---|---|---|

| Direct Banking Costs | Lower; primarily transfer fees | Higher; multiple specialized fees |

| Transaction Speed | Faster; typically 2-5 business days | Slower; 1-3 weeks for document processing |

| Cash Flow Impact | Early capital commitment required | Capital may be tied as security margin |

| Risk Allocation | Buyer assumes prepayment risk | Risk shared through bank intermediation |

| Optimal Application | Repeat orders with trusted partners | New suppliers or high-value transactions |

When Does T/T Deliver Superior Cost Efficiency?

T/T payments consistently demonstrate lower direct costs for mid-range transactions where established supplier relationships minimize performance risk. The absence of L/C-associated banking fees creates measurable savings, particularly for orders between $20,000-$50,000. However, true cost assessment must incorporate risk-adjusted calculations. For instance, while T/T might save $800 in bank fees on a $30,000 order, this advantage disappears entirely if quality issues arise without recourse. Therefore, T/T's cost efficiency directly correlates with supplier reliability and relationship history, making it most valuable for repeat business with verified partners.

What Hidden Costs Complicate L/C Transactions?

Beyond apparent bank charges, L/Cs contain several potential cost escalators that buyers must anticipate. Amendment fees represent a common surprise; even minor L/C modifications after issuance typically incur charges. More significantly, discrepancy fees apply when documents contain errors versus L/C requirements, sometimes reaching hundreds of dollars per occurrence. These documentation issues can subsequently cause shipment delays, potentially triggering demurrage charges at destination ports if document resolution extends beyond free storage periods. Consequently, working with logistics partners experienced in textile L/C requirements becomes essential to minimize these hidden cost exposures.

Which Payment Method Aligns with Your Business Strategy?

Selecting between T/T and L/C ultimately transcends transactional convenience, reflecting broader strategic priorities regarding risk management, partnership development, and financial optimization. The appropriate choice evolves with your business circumstances and supplier relationships.

For ongoing collaborations with demonstrated reliability, T/T typically delivers optimal value through its combination of speed, simplicity, and cost efficiency. The trust established through successful previous transactions justifies streamlined payment processes. Conversely, new supplier relationships or exceptionally large orders warrant L/C's structured security despite higher complexity. This approach safeguards financial interests while building partnership foundations on verified performance.

How Can Importers Systematically Develop T/T Relationships?

Transitioning to T/T terms with new suppliers requires deliberate trust-building through verifiable actions. We recommend a phased approach beginning with smaller trial orders to assess performance consistency. Simultaneously, implement verification mechanisms including virtual factory audits, third-party quality certifications, and physical sample validation before full-order commitment. Additionally, leverage digital platforms like Alibaba to verify transaction histories and customer feedback. As successful interactions accumulate, gradually increase order volumes while maintaining quality verification. This systematic approach methodically reduces perceived risk, eventually justifying T/T's operational advantages.

When Do Circumstances Mandate L/C Utilization?

Certain scenarios virtually necessitate L/C implementation regardless of relationship status. First, orders exceeding your organization's risk tolerance threshold—typically above $100,000—require L/C protection. Second, transactions with suppliers lacking established track records or comprehensive quality certifications justify the additional safeguards. Third, when internal compliance policies mandate bank guarantees for international transfers above specific values, L/C becomes obligatory. Finally, politically or economically volatile regions often necessitate L/Cs to mitigate country-specific risks. In these circumstances, the L/C's additional cost and complexity represent prudent investments in financial security.

Conclusion

Payment method selection between T/T and L/C represents a strategic balancing act between operational efficiency and financial protection. T/T excels in established partnerships where speed and cost minimization are priorities, while L/C provides essential safeguards for high-value transactions or new relationships. Rather than seeking a universal solution, successful importers match payment mechanisms to specific transaction contexts and risk profiles.

At Fumao Textiles, we maintain flexibility across both payment platforms to accommodate your evolving business needs. Our extensive experience with international clients has refined our processes for both T/T and L/C executions, ensuring seamless transactions regardless of method selected. If you're seeking a reliable fabric partner capable of navigating complex international trade requirements while delivering consistent quality, we invite you to connect with our specialized team. For detailed discussions regarding your specific payment preferences and fabric requirements, please contact our Business Director, Elaine, at elaine@fumaoclothing.com. She will coordinate comprehensive support tailored to your operational objectives and risk management criteria.