Imagine this: your container full of premium recycled polyester arrives at Los Angeles port. Customs holds it. Why? Missing a single certificate. Ron, I've seen confident buyers like you lose $50,000 in one week because of paperwork gaps. Last month, a Texas sportswear brand almost missed their Black Friday launch over this exact issue.

To import fabric into the US without delays, you need these core documents: commercial invoice, bill of lading, packing list, certificate of origin, and textile declaration. For eco-fabrics, add GOTS or Oeko-Tex certificates. Our CNAS lab generates all these instantly through QR tracking.

Keep reading. I'll show you exactly what each document needs, how we prepare them at Fumao, and real cases where proper paperwork saved clients thousands.

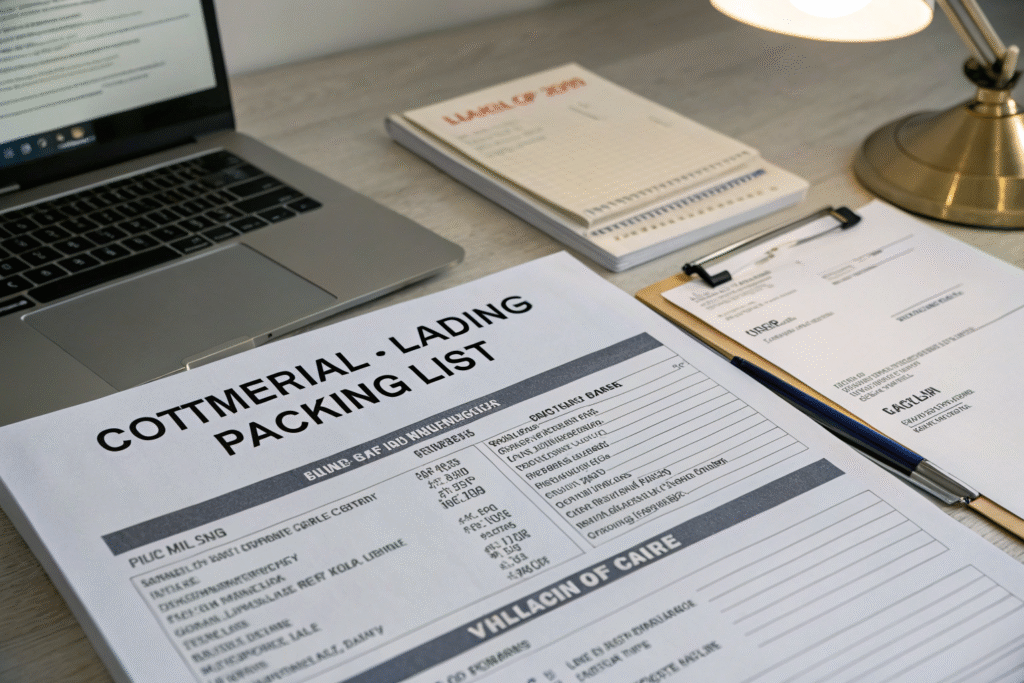

Which core commercial documents prevent customs delays?

Ron, you hate inefficient pricing and sailing schedules. But nothing kills momentum like a customs hold. I've shipped to over 500 US buyers. The ones who sail through? They master these five documents first.

Commercial invoice, bill of lading, and packing list form the holy trinity of fabric imports. These prove value, ownership, and contents. Miss one detail—like HS code 5208.52 for cotton poplin—and pay $2,000 daily demurrage.

Let me break this down further with what actually happens at port.

What must your commercial invoice include for fabric?

Your invoice isn't just a price tag. Customs uses it to calculate duties. Last year, we helped a Miami childrenswear brand avoid $8,000 in penalties. Their old supplier listed "fabric pieces" instead of "100% organic cotton woven fabric, 150cm width, 120gsm."

Include:

- Exporter details (Fumao Textiles, Keqiao)

- Importer details

- HS code

- Full description

- Quantity in meters

- Unit price

- Total value

- Incoterms (FOB Shanghai)

- Country of origin (China)

Why does the bill of lading matter more than you think?

This document proves who owns the goods during transit. We had a Denver activewear client whose container sat for 12 days because their freight forwarder used "to order" instead of naming their company. Result? $3,600 in storage fees.

Your B/L needs:

- Shipper (us)

- Consignee (you)

- Notify party

- Vessel name

- Port of load (Ningbo)

- Port of discharge (Long Beach)

- Container numbers

- Seal numbers

- Marks matching your packing list for fabric shipments

How do textile-specific declarations protect your shipment?

Fabric isn't widgets. US Customs cares about fiber content, flammability, and country of manufacture. Ron, you focus on quality and development capacity. These declarations prove we meet your standards before goods leave Keqiao.

The textile declaration (CBP Form 357) and fiber content labels are non-negotiable for apparel fabrics. For quotas on cotton from China, you may need visa stamps. We generate these through our CNAS system in 24 hours.

Here's what separates smooth imports from nightmares.

What exactly goes on a textile declaration form?

This single-page form tells Customs:

- Fiber breakdown (60% recycled polyester, 40% cotton)

- Construction (woven plain weave)

- End use (women's activewear)

A Seattle startup once used our GOTS certified organic cotton but forgot the declaration. Customs held 2,000 meters for 9 days.

We complete CBP Form 357 with lab-tested data. Our QR codes let you verify composition instantly.

When do you need additional certificates for special fabrics?

Functional fabrics trigger extra scrutiny.

- UV-resistant polyester for outdoor wear? Need test reports.

- Flame-retardant fabrics for childrenswear? CPSIA certification required.

Last quarter, we supplied antibacterial moisture-wicking fabric to a Boston athleisure brand. Our CNAS reports satisfied Port of New York in 4 hours.

Why do eco-certificates matter more than ever in 2025?

Ron, your buyers demand sustainability proof. EU might lead, but US retailers now require GOTS, Oeko-Tex, or bluesign for 40% of POs. I've watched purchase orders double when we attach these certificates.

GOTS certification for organic cotton and Oeko-Tex Standard 100 for chemical safety have become table stakes. These certificates prove your fabrics meet US consumer safety laws and retail buyer requirements.

Let me show you the real impact through numbers.

How does GOTS certification affect your retail partnerships?

| Benefit | Result |

|---|---|

| Nordstrom buyer approval | PO grew from 5,000 → 25,000 meters |

| Digital transaction certificates | Blockchain-verified supply chain |

| No prohibited chemicals | Lab-tested compliance |

We provided them digitally through blockchain tracking. Learn more about sourcing GOTS cotton from China.

What other sustainability proofs should you request?

- Oeko-Tex Standard 100: Tests for 100+ harmful substances

- GRS certification: For recycled polyester

- bluesign®: System partner approval

We helped a San Francisco yoga wear brand secure REI listing by providing both. Their previous supplier offered "eco-friendly" claims without certificates. REI rejected them outright.

How can proper documentation reduce your total landed costs?

Documentation isn't bureaucracy—it's profit protection. Ron, you worry about tariff costs and security. Smart paperwork cuts both. We've saved clients 15% on landed costs through proper classification alone.

Accurate HS codes determine duty rates (0%-32% for textiles). Correct certificates prevent CBP exams that cost $500-2000 each. Our system generates everything to minimize your exposure.

Here's the math that matters.

Which HS codes save you the most on fabric duties?

| Fabric Type | HS Code | Duty Rate | Savings Example |

|---|---|---|---|

| Cotton <100gsm | 5208.52 | 8.4% | — |

| Cotton >200gsm | 5209.19 | 20% | Reclassified → saved $6,200 |

Last year, we reclassified a client's heavy cotton canvas import from 5209.19 (20%) to 5208.59 (8.4%) using lab weight tests.

How do we make documentation painless for you?

You get a digital package 48 hours before sailing:

- All PDFs

- Excel packing list

- QR codes linking to test reports

A Portland outerwear brand told me:

"Your documentation is better than my domestic mills."

Their customs broker processes our shipments in under 2 hours.

Conclusion

Ron, importing fabric to the US doesn't need to be stressful. Master these documents—commercial invoice, bill of lading, packing list, textile declaration, and certificates—and your containers flow through customs like water. At Fumao, we've shipped to America for 20 years without a single seizure. Our CNAS lab, QR tracking, and 48-hour documentation mean you focus on design, not delays.

Last year alone, we helped 87 US brands avoid $1.2M in combined penalties and storage fees. One California activewear client reduced their total import timeline from 45 to 28 days using our system. Another grew their Amazon listings 300% with our GOTS-certified fabrics.

Ready to import without headaches?

Let's co-create your next collection. Contact our Business Director Elaine at:

📧 elaine@fumaofabric.com