You've placed your fabric order, it's been inspected, and now it's sailing across the Pacific. The hard part's over, right? Not quite. For many importers, the real headache begins when the shipment hits US soil—navigating the complex web of customs clearance. A single missed form, an incorrect code, or a valuation dispute can strand your precious cargo at the port, racking up demurrage fees that can eclipse the fabric's own cost. I've seen too many clients celebrate a smooth production run, only to face a logistical nightmare at this final hurdle.

The truth is, customs clearance is a non-negotiable, procedural gatekeeper. It's how the US government controls what enters the country, collects owed duties, and enforces trade laws. For fabric imports, this process hinges on three pillars: accurate classification, proper valuation, and complete documentation. Get these right, and your goods clear smoothly. Get them wrong, and you face delays, fines, or even seizure. The goal isn't to avoid the process—that's impossible—but to master it, turning it from a barrier into a predictable step in your supply chain.

The good news? With preparation and the right partners, this process is entirely manageable. Whether you're a seasoned importer or sending your first container, understanding the roadmap will save you time, money, and immense stress. Let's demystify US customs clearance for fabric imports, step by step.

What are the Essential Documents for US Fabric Customs Clearance?

Think of your document packet as your shipment's passport and visa. Without every page in order, it's not going anywhere. Customs brokers and CBP officers rely on these documents to assess your goods instantly. Having them perfectly prepared is the single most impactful thing you can do to ensure a smooth clearance.

The mandatory core documents are non-negotiable:

- Commercial Invoice: This is the king of documents. It must detail the seller and buyer, a precise description of the fabrics (including fiber content, weight, width, and construction), the quantity, the value per unit and total value (in USD), the country of origin, and the Incoterms® 2020 (e.g., FOB Shanghai, CIF Los Angeles).

- Packing List: This breaks down the contents of each carton and container. It must match the commercial invoice exactly in description and quantity and detail the number of packages, their weights, and dimensions.

- Bill of Lading (B/L) or Air Waybill (AWB): This is the contract of carriage and title document issued by the carrier (shipping line or airline). The "Telex Release" or original copy is needed to take possession of the goods.

- Entry Filing (CBP Form 3461): This is the formal document filed by your customs broker to declare the goods to CBP. It includes the HTSUS code, value, and duties calculated.

For fabrics, several additional documents are frequently required and should be prepared proactively:- Textile Declaration: A statement declaring the fiber composition, weight, and origin of the textile products.

- Certificate of Origin: While not always mandatory, it's often requested, especially to prove country of origin for duty calculation or to claim preferential treatment under trade agreements.

- Potentially, a Customs Bond: This is an insurance guarantee between the importer, CBP, and a surety company, ensuring duties and fees will be paid. Most brokers will arrange this for you.

Why is the commercial invoice the most critical document?

Because it contains the data that determines everything else: the correct HTSUS code, the assessable value for duties, and the origin for potential trade agreement benefits or Section 301 China tariffs. A vague description like "polyester fabric" will cause delays. It must be specific: "100% Polyester, Woven, Twill Weave, 150cm width, 180 GSM, Dyed, for Apparel Making." Inaccuracies here lead to misclassification, which can trigger audits, penalties, and incorrect duty payments. We advise all our clients at Shanghai Fumao to review the proforma and commercial invoices with us line by line before shipment to ensure absolute alignment.

What special certificates might be needed for treated or specialty fabrics?

If your fabric has functional finishes or falls under specific regulations, you may need to provide test reports or certificates to CBP upon request. Examples include:

- Flame Resistance Certificates: For fabrics used in children's sleepwear or certain upholstery.

- EPA/TSCA Certifications: For imported chemical substances (relevant for some durable finishes).

- Proof of Anti-Dumping/Countervailing Duty Exemption: If applicable.

Being proactive is key. For a client importing waterproof laminated fabrics for outdoor gear last year, we included a statement of compliance and referenced applicable standards in the commercial invoice description. This pre-emptive detail helped their broker clear the shipment without additional information requests, avoiding a 3-5 day delay.

How Do I Correctly Classify Fabric with HTSUS Codes?

This is the cornerstone of customs compliance. The Harmonized Tariff Schedule of the United States (HTSUS) is a massive book that assigns a unique 10-digit code to every product imaginable. Your fabric's HTSUS code dictates its duty rate, informs quota requirements, and determines if it's subject to special tariffs (like the Section 301 tariffs on many Chinese goods). Classifying fabric is a specialized skill—it's part science, part art, and entirely critical.

Classification follows a logical hierarchy. You start by identifying the fiber (e.g., cotton, polyester), then the construction (woven, knitted, non-woven), then the weight (often in grams per square meter - GSM), and finally any special characteristics (e.g., printed, dyed, coated). A 100% cotton woven denim of 200 GSM is classified differently than a 100% cotton knitted jersey of the same weight. The difference can mean a duty rate of 8.4% versus 16.5%. Getting it wrong isn't just a clerical error; it's legally the importer's responsibility, and CBP can retroactively collect underpaid duties plus penalties for up to five years.

What are common classification pitfalls for blended fabrics?

Blends are where mistakes happen most often. The HTSUS has specific rules for determining the "chief weight" of a fabric. You must calculate the weight percentage of each component fiber. The fiber with the greatest weight by percentage usually dictates the heading. However, there are exceptions. For example, certain chapters have "note" rules that can change the classification. There's no shortcut here; it requires careful calculation and sometimes expert advice. Using a generic code for "poly-cotton blend" is a surefire way to get a CBP inquiry. Resources like the CBP's official HTSUS database and rulings are essential, but for complex blends, consulting your broker or a specialist is wise.

How do Section 301 China tariffs affect fabric classification?

This is a crucial, separate layer. First, you find the correct 10-digit HTSUS code. Then, you must check if that code appears on the Section 301 tariff lists. A vast majority of textile and apparel products from China are subject to these additional duties (often 7.5% or 25% on top of the normal duty rate). This is declared on a separate form (CBP Form 5205). The key is that the duty is based on the country of origin (where the fabric was substantially transformed), not the country of shipment. So, fabric woven and finished in China is subject to the tariff, even if shipped from a warehouse in Vietnam. There is a critical strategy here: sourcing fabric from countries with which the US has free trade agreements (like CAFTA-DR members) or no 301 tariffs can result in massive duty savings. This is a core part of the sourcing consulting we provide.

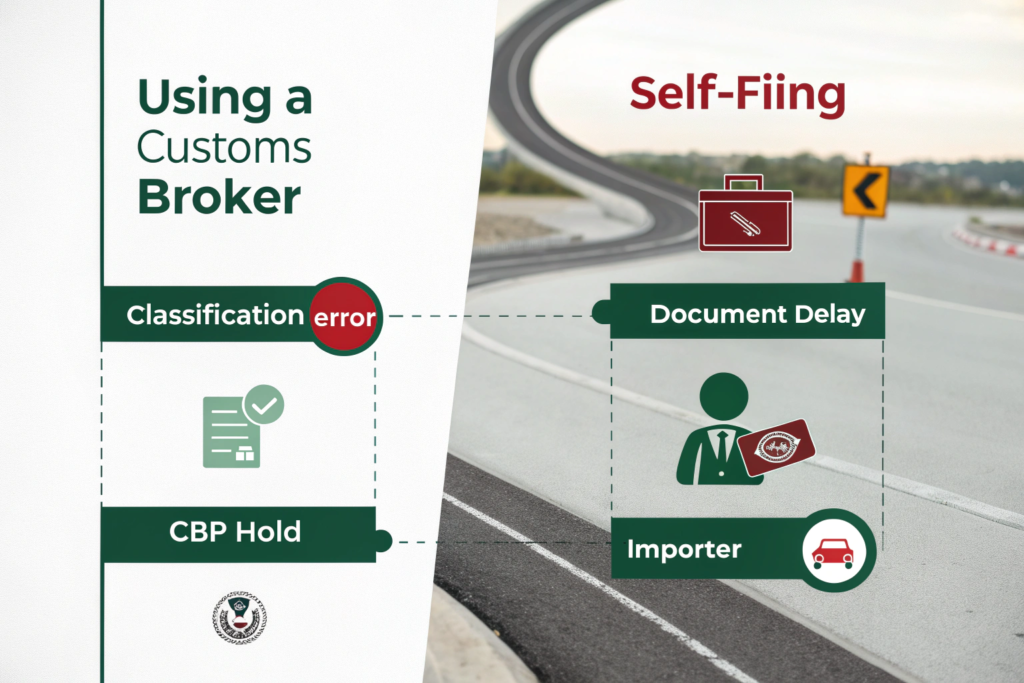

Should I Use a Customs Broker or Do It Myself (Self-Filing)?

This is the million-dollar question for new importers. Technically, any importer can self-file with CBP. But should you? For 99% of fabric importers, especially those moving full container loads, the answer is a resounding use a licensed customs broker. Think of them as your expert guide through a legal minefield. They are licensed by CBP, understand the ever-changing regulations, and have the software to file entries directly with the Automated Commercial Environment (ACE) system.

The value of a broker goes beyond just filing forms. They:

- Ensure Accurate Classification: They have databases and experience to assign the most accurate HTSUS code, minimizing audit risk.

- Calculate Duties and Taxes: They account for all fees: MPF (Merchandise Processing Fee), HMF (Harbor Maintenance Fee), and any applicable duties.

- Handle Problems: If CBP flags your shipment for examination (a "FDA hold" or "intensive exam"), your broker is your point of contact to resolve it quickly.

- Manage Bonds: They arrange the continuous customs bond required for most commercial shipments.

The cost of their service (typically $100-$300 per entry) is trivial compared to the cost of a single mistake—be it demurrage from a delay, a penalty, or overpaying duties for years.

How do I choose a reliable customs broker for textiles?

Don't just pick the cheapest. Look for:

- Textile/Apparel Specialization: Ask specifically about their experience with fabric imports. The rules are niche.

- Strong Communication: You need a responsive point of contact, not just a call center.

- Technology: They should offer a portal for document upload and tracking.

- References: Ask for references from other apparel/fabric importers.

A good broker will ask you detailed questions about your fabric to ensure proper classification. You can find brokers through the National Customs Brokers & Forwarders Association of America (NCBFAA) directory. Building a relationship with a skilled broker is as important as your relationship with your fabric supplier.

What are the scenarios where self-filing might be considered?

Self-filing might be feasible only for very experienced, high-volume importers with an in-house compliance team, or for extremely low-value, informal entries (under $800 in value, which can often be cleared de minimis with minimal formalities). For anyone else, especially those dealing with the complexities of textile quotas, trade programs, and China tariffs, the risk far outweighs the potential fee savings. The learning curve is steep, and the penalty for error is high.

What Triggers Customs Holds or Inspections, and How to Avoid Them?

No importer wants to see "EXAM" status on their shipment tracking. A CBP examination doesn't mean you've done something wrong—it's a routine compliance tool. However, it causes delays (from 24 hours to several days) and incurs extra handling charges. Understanding the triggers can help you minimize the risk.

Common triggers for fabric shipments include:

- Incomplete or Inconsistent Documentation: Mismatches between the invoice, packing list, and B/L are huge red flags.

- Vague Product Descriptions: "Fabric" or "textile" is an invitation for scrutiny.

- Incorrect or Unusual Valuation: Declaring a value that seems too low for the described goods will prompt a review.

- Targeted Random Checks: CBP uses risk assessment algorithms; sometimes, you're just statistically selected.

- Intellectual Property Rights (IPR) Concerns: If your fabric bears a copyrighted print or design, CBP may check for counterfeit goods.

- FDA Regulation: Fabrics making certain antimicrobial claims may be reviewed by the FDA.

How can proper packaging and labeling reduce inspection risk?

Clear, professional labeling on each carton is a sign of a professional shipper. It should match the packing list exactly. For fabrics, including a small swatch and the tech pack details in a clear sleeve on the outside of one master carton can be a genius move. It allows a CBP officer to quickly verify the contents without needing to open multiple boxes. We started doing this for all our high-value shipments to the US, and our brokers have reported feedback that it can expedite the physical inspection process if one is ordered.

What should I do if my shipment is placed on hold?

First, don't panic. Contact your customs broker immediately. They will contact CBP to find out the reason (exam type: document review, tailgate exam, or intensive exam). They will then tell you exactly what additional information or action is needed. Your job is to respond quickly and completely. The faster you provide what CBP asks for, the faster the hold is released. Having all your sourcing documents—including detailed product specifications and proof of value (like purchase orders and payment records)—organized and readily available is crucial for these moments.

How are Duties Calculated on Fabric Imports?

Finally, the bottom line: what will it cost? Duty calculation has several components. The basic formula is:

Duty Owed = (Duty Rate x Customs Value) + MPF + HMF + Other Fees (if any)

Let's break it down:

- Customs Value: This is usually the transaction value—the price you actually paid for the fabric, plus certain additions like packing costs, commissions, and any assists (e.g., free tools or molds supplied by you to the manufacturer). It's the number on your commercial invoice, adjusted to CBP's rules.

- Duty Rate: This is the percentage dictated by the HTSUS code. Rates for fabrics vary widely (from 0% for some to over 30% for others).

- Merchandise Processing Fee (MPF): A fixed ad valorem fee of 0.3464% of the entry value (minimum $27.23, maximum $538.40). It's paid on most formal entries.

- Harbor Maintenance Fee (HMF): 0.125% of the cargo value, levied on imports arriving by sea.

Crucially, if your fabric is subject to Section 301 tariffs from China, that additional percentage is applied to the customs value as well, before the MPF and HMF are calculated. This makes the financial impact of sourcing strategy (China vs. alternative origin) enormous.

Are there legal ways to reduce or eliminate duties?

Absolutely. This is strategic sourcing 101:

- Free Trade Agreements (FTAs): Source from countries with US FTAs. For example, fabric "originating" in CAFTA-DR countries, Mexico (USMCA), or Peru can often enter duty-free if you have the proper certificate of origin.

- Duty Drawback: If you later export garments made from imported fabric, you can reclaim 99% of the duties paid on the fabric through the Duty Drawback program. It's complex but valuable for manufacturers.

- First Sale for Export Rule: In a multi-tiered transaction (e.g., you buy from a trading company that buys from a mill), you may be able to base duty on the lower price the trading company paid the mill, if structured correctly. This requires expert legal/tax advice.

We helped a sportswear brand leverage the USMCA rules of origin by shifting production of a specific performance knit to a qualifying partner in Mexico. The fabric itself originated from an approved region, making the finished garments eligible for duty-free entry, neutralizing the cost advantage their competitors had from purely Asian sourcing.

Conclusion

Navigating US customs clearance for fabric imports is a detailed but conquerable process. Success lies in meticulous preparation—crafting flawless documents, securing accurate HTSUS classification, partnering with a skilled customs broker, and understanding the full duty landscape. It's a system that rewards precision and punishes assumption.

Viewing customs not as a fearsome barrier but as a structured, predictable part of your logistics chain is the mindset shift that separates seasoned importers from struggling ones. The rules are fixed; your job is to learn them and build processes that ensure compliance every single time.

If you want to focus on designing and selling while leaving the complexities of international logistics and compliance to experts, we can help streamline the entire journey from our mill to your warehouse. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss how our integrated supply chain and logistics support can make your US fabric imports seamless and predictable. At Shanghai Fumao, we don't just ship fabric; we deliver peace of mind.