Importing fabrics from China in 2026 feels like navigating a minefield with a blindfold on. You want premium quality at competitive prices, but US tariffs can wipe out your margin in a heartbeat. One wrong classification or missed documentation can lead to costly delays, seized shipments, or surprise bills that turn a profitable order into a loss. The pressure is real—balancing cost, quality, and compliance seems impossible.

The most effective way to import high-quality fabrics from China to the USA and mitigate tariffs in 2026 is a three-pronged strategy: First, strategically source fabrics not listed on the Section 301 tariffs, focusing on technical textiles, certain man-made fibers, or products manufactured with specific sustainable certifications that may qualify for exemptions. Second, master the art of accurate HTS code classification and valuation to ensure perfect customs declarations. Third, leverage a partner with deep supply chain integration in China who can optimize the pre-shipment value chain—like fabric processing, finishing, and packaging—to maintain quality while managing the declarable value. This isn't about evasion; it's about intelligent, compliant optimization.

This guide cuts through the complexity. We'll move beyond basic "how-to-import" lists and dive into the actionable, nuanced strategies that successful importers are using right now. From choosing the right fabric category to selecting a manufacturer that acts as your tariff-savvy logistics partner, we'll map out the path to a compliant and cost-effective supply chain.

Which Fabrics Are Actually Exempt from US Tariffs in 2026?

The landscape of U.S. tariffs on Chinese imports is complex, but not uncharted. The key is understanding that tariffs are not uniformly applied to all textiles. The Section 301 tariffs are the primary concern, but certain products have been excluded or face lower rates. As of now, many finished apparel items carry high tariffs, but certain raw fabrics, technical textiles, and eco-friendly materials may fall into categories with more favorable treatment or exist outside the main tariff lists.

For example, some specialized industrial fabrics, non-woven textiles for medical use, and certain types of coated fabrics might be classified under HTS codes that have not been subjected to the same level of additional duties. The opportunity lies in precise classification. A client of ours, a workwear brand from Texas, successfully avoided significant duties in late 2023 by shifting their sourcing to a specific flame-retardant (FR) treated cotton blend. The treatment process and end-use classification placed the fabric under a different HTS subheading that was not subject to the additional 7.5% Section 301 tariff, saving them over $15,000 on their first container.

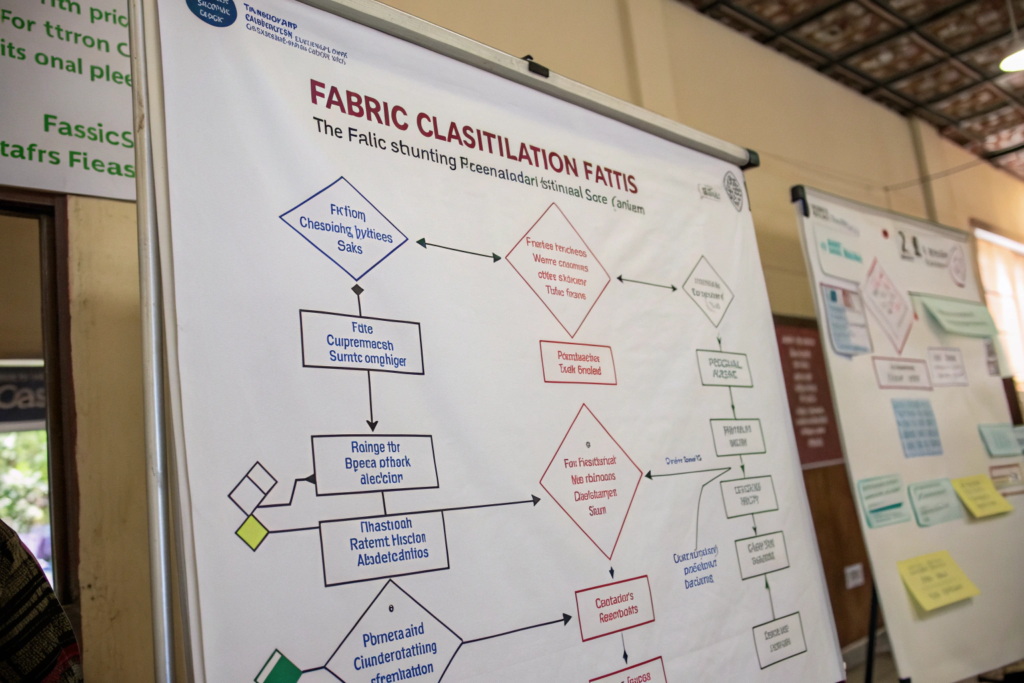

How Do I Find the Correct HTS Code for My Fabric?

This is the single most important step. The Harmonized Tariff Schedule (HTS) code is a 10-digit number that determines your duty rate. Getting it wrong can lead to underpayment (fines, audits) or overpayment (lost profit). You cannot rely solely on your supplier's proforma invoice; you must verify it.

The process is forensic: Start with the fabric's core composition (e.g., 65% polyester, 35% cotton). Then, consider its weight, weave (knit or woven), width, and any special finishes (e.g., coated, laminated, printed). Use the US International Trade Commission's (USITC) official HTS Search Tool to drill down. For complex cases, consulting a licensed customs broker is a wise investment. We assist our clients at Shanghai Fumao by providing detailed, technically accurate product descriptions and suggested classifications based on our 20 years of export experience, which their brokers can then verify. For ongoing updates, the Fashion Law Institute's blog often publishes clear analyses on navigating HTS classification for fashion imports.

Are Sustainable or Recycled Fabrics Treated Differently?

Potentially, yes, and this is a growing area of opportunity. While there is no blanket exemption, certain sustainable initiatives or end-uses can influence classification and qualification for existing exclusions. For instance, fabrics made from recycled materials that are used in performance or industrial applications may be viewed differently than standard apparel fabrics.

More concretely, some previously granted exclusions for specific HTS codes may be tied to environmental or health benefits. It's crucial to check the U.S. Trade Representative's (USTR) website for current and historical exclusion lists. In one case, a client importing GRS-certified recycled polyester for making reusable shopping bags qualified for a product-specific exclusion that was still in effect, effectively bringing their duty rate down to the normal Most Favored Nation (MFN) rate. Staying informed through resources like the National Council of Textile Organizations (NCTO) trade policy updates is essential for leveraging these nuances.

How Can My Chinese Supplier Help Minimize Tariff Impact?

Your supplier should be your first line of defense, not just a producer. A proactive, experienced Chinese manufacturer understands that their value extends beyond the factory gate. They can implement strategies within the production and shipping process that legally and ethically influence the landed cost for you.

The most direct lever is optimizing the "first sale" value. U.S. customs duty is typically calculated on the price paid to the manufacturer (the transaction value). If your supplier has an integrated supply chain—controlling yarn sourcing, weaving, and dyeing—they can provide a transparent cost breakdown. This establishes a solid, defensible export value. In contrast, a trading company that marks up goods from multiple factories creates a higher declarable value. Our integrated model at Shanghai Fumao means we work with clients on an open-cost basis, ensuring the declared value reflects the true manufacturing cost without unnecessary margins piled on before export.

What Supply Chain Strategies Reduce Declared Value Legally?

The goal is to ensure all value-adding steps are accurately captured before export. A sophisticated supplier can help with:

- Pre-Shipment Processing: Completing as much value-add work in China as possible under the same HTS code. For example, if you're importing fabric for curtains, could the hemming, heading tape application, or even packaging be done pre-shipment? If these processes don't change the essential character of the fabric, they might be more cost-effective in China, consolidating labor costs into a potentially lower-duty fabric classification rather than a higher-duty finished article classification in the U.S.

- Bonded Warehouse Operations: Some large suppliers or their logistics partners can utilize bonded warehouses in Chinese ports. Fabric can be finished, inspected, and packed in these zones, which are considered outside Chinese customs territory. This can streamline the export process and provide clearer valuation.

- Assisting with Duty Drawback: If you later export finished goods made from the imported fabric, you may be eligible for duty drawback (a refund of up to 99% of duties paid). A good supplier will provide you with all the necessary documentation (commercial invoices, packing lists, bills of lading) in perfect order to support a future drawback claim. The U.S. Customs and Border Protection (CBP) guide to duty drawback outlines the exact documentation required.

Can Packaging and Shipping Methods Affect Customs Valuation?

Yes, significantly. Incoterms define where costs and responsibilities transfer. Using EXW (Ex Works) or FOB (Free On Board) means the main cost (the fabric) is clearly defined at the Chinese port. Costs like international freight and insurance (which are part of CIF value) are not dutiable. A reliable supplier will correctly separate these costs on all documents.

Furthermore, proper packaging that protects the fabric from damage prevents claims and disputes over value. More importantly, a professional supplier will ensure the weight and quantity on the Bill of Lading match the commercial invoice exactly. Even minor discrepancies are red flags for CBP, triggering inspections and delays. We've seen shipments held for weeks because of a simple typo in roll counts. (Here's a pro tip: insist on photos of the packed container before sealing—it's your proof of shipment condition).

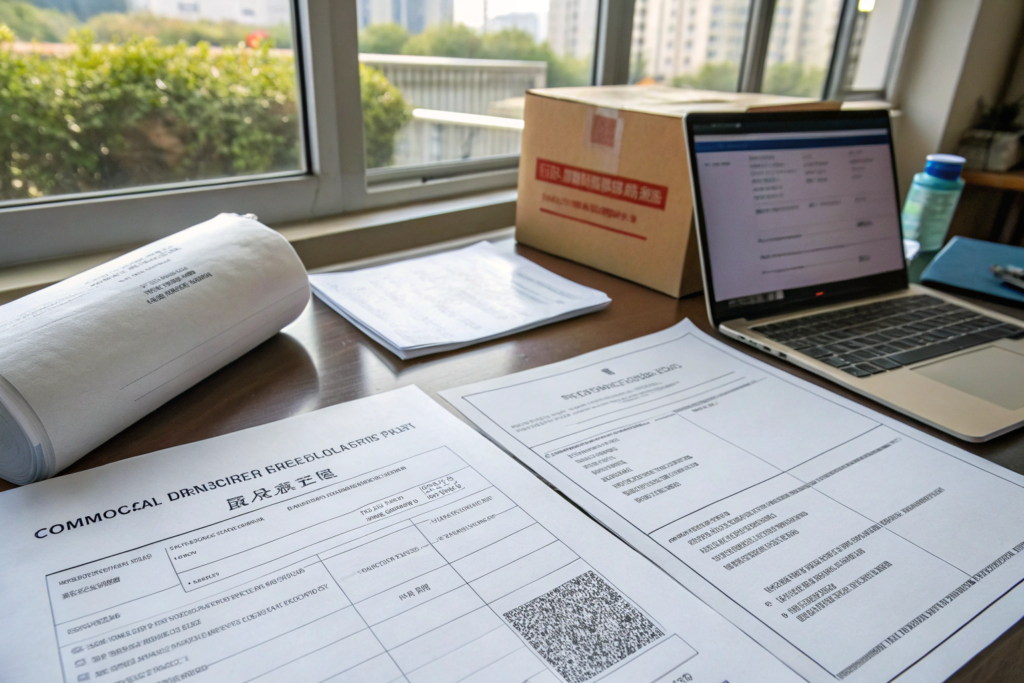

What Are the Must-Have Documents for Smooth Customs Clearance?

Paperwork is your passport. Incomplete or incorrect documentation is the #1 cause of customs delays, which lead to demurrage charges and missed production windows. You need a perfect, consistent set of documents that tell the same story from factory to U.S. port.

The non-negotiable documents include: Commercial Invoice (with accurate value, description, and HTS code), Packed List (detailed by carton/roll), Bill of Lading (the title document), and the Certificate of Origin. For fabrics, a Textile Certificate may be requested. Depending on the material, test reports (for flammability, chemical content) from labs like SGS or ITS can pre-emptively address potential compliance holds. We provide a digital dossier for every Shanghai Fumao shipment, including our own CNAS-lab test reports accessible via QR code, giving customs agents instant verification of composition and safety standards.

How Do I Handle Rules of Origin and the "Made in China" Label?

This is critical due to Section 301 tariffs applying specifically to goods of Chinese origin. The Certificate of Origin is the official document that states this. Your supplier must provide it, typically issued by the China Council for the Promotion of International Trade (CCPIT). It must align perfectly with the information on the invoice and bill of lading.

The "Made in China" label is a separate marking requirement for the goods themselves. For fabrics, this usually means the bolt or roll must be marked with the country of origin. Your supplier must ensure this is done correctly. Attempting to transship or misrepresent origin through a third country (e.g., Vietnam or Malaysia) without substantial transformation is illegal and carries severe penalties. The only legal way to avoid the "Made in China" mark is if your fabric undergoes a substantial transformation in a third country that is recognized under that country's trade agreement with the U.S. This is a complex, high-threshold process not suited to most importers.

What Role Does a Customs Broker Play, and How Do I Choose One?

Your customs broker is your legal representative to CBP. They file your entry, calculate duties, and navigate issues. You are ultimately responsible for the information they submit, so choosing a competent broker is vital.

Look for a broker who:

- Specializes in textiles and apparel.

- Asks detailed questions about your product's construction and composition.

- Is proactive in requesting documentation from your supplier.

- Can explain their classification rationale.

A good broker will want to communicate directly with your supplier's export team to clarify details. We often set up three-way email threads between the client, their broker, and our logistics manager to ensure zero miscommunication. For finding qualified professionals, the National Customs Brokers & Forwarders Association of America (NCBFAA) directory is an excellent starting point.

Beyond Tariffs: How Do I Guarantee Quality and On-Time Delivery?

Tariff mitigation is pointless if the fabric arrives late or is substandard. Your supplier's operational excellence is your safeguard. This means their internal systems must be robust enough to guarantee quality consistency and navigate China's production cycles, which directly impact delivery timelines and, therefore, your total cost of ownership.

The Chinese New Year shutdown (3-4 weeks) and the peak production seasons (March-May, August-October) are the most critical calendar events. A strategic supplier plans with you, not for you. For example, we mandate that clients finalize all pre-production details for post-CNY shipments at least 6 weeks before the holiday. This allows us to produce and ship fabric immediately upon reopening, securing vessel space during the less congested period. A client who ignored this advice in 2024 saw their May delivery push to July due to the post-holiday backlog—a delay that cost them more in lost sales than any tariff ever would.

What Quality Control Steps Are Non-Negotiable Before Shipment?

You cannot inspect quality at the U.S. port; it must be done before the container is sealed. A professional supplier will have a multi-stage QC protocol:

- Pre-Production Check: Verifying yarns/raw materials against specs.

- During Production Check (DUPRO): Spot-checking loom state fabric for weight, density, and weaving defects.

- Final Random Inspection (FRI): This is crucial. A minimum of 15% of rolls should be inspected post-finishing, using standardized lighting and equipment against an approved sample. Metrics like shade variation, width, length, and defect grading (using the 4-point system) must be documented. At our inspection facility, every roll is measured and examined, with results shared via video and report before payment is finalized. For industry standards, refer to the American Association of Textile Chemists and Colorists (AATCC) test methods.

How Can I Mitigate Risks from Production and Logistics Delays?

Diversify and communicate. While consolidating orders with one reliable supplier like Shanghai Fumao improves efficiency, having a backup for critical fabrics is prudent. More importantly, choose a supplier with strong logistics partnerships.

Ask your supplier:

- Do they have fixed allocations with major shipping lines?

- Can they offer routing options (e.g., via alternative ports like Ningbo or Shekou if Shanghai is congested)?

- Will they provide real-time tracking updates?

Ensure your contract includes clear Liquidated Damages (LD) clauses for late delivery due to supplier fault, not force majeure. This aligns their incentives with yours. Understanding the current state of transpacific shipping lanes and freight rates is also key, and platforms like Freightos provide valuable market intelligence.

Conclusion

Successfully importing high-quality fabric from China to the USA in 2026 is a disciplined balance of strategic sourcing, meticulous compliance, and deep partnership. It requires moving beyond a simple buyer-seller transaction to a collaborative alliance where your Chinese supplier is a transparent, integrated partner in your supply chain. The goal isn't just to "avoid tariffs" through loopholes, but to build a legally optimized, resilient, and quality-driven import channel that withstands regulatory scrutiny and market volatility.

The journey starts with selecting the right fabric category and the right partner—one who offers not just quality materials but also the expertise in classification, documentation, and logistics necessary to navigate the complex trade landscape. By mastering HTS codes, leveraging supplier capabilities for value optimization, and enforcing rigorous quality and timeline controls, you transform import challenges into a sustainable competitive advantage.

If you're looking to build or refine your fabric import pipeline with a partner that understands both the intricacies of textile manufacturing and the complexities of U.S. import compliance, let's connect. At Shanghai Fumao, we combine our vertical integration in Keqiao with a sharp focus on providing our clients with the data, documentation, and strategic planning needed for smooth and cost-effective imports. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss how we can tailor our production and export services to your specific needs and help you navigate the import landscape of 2026 with confidence.