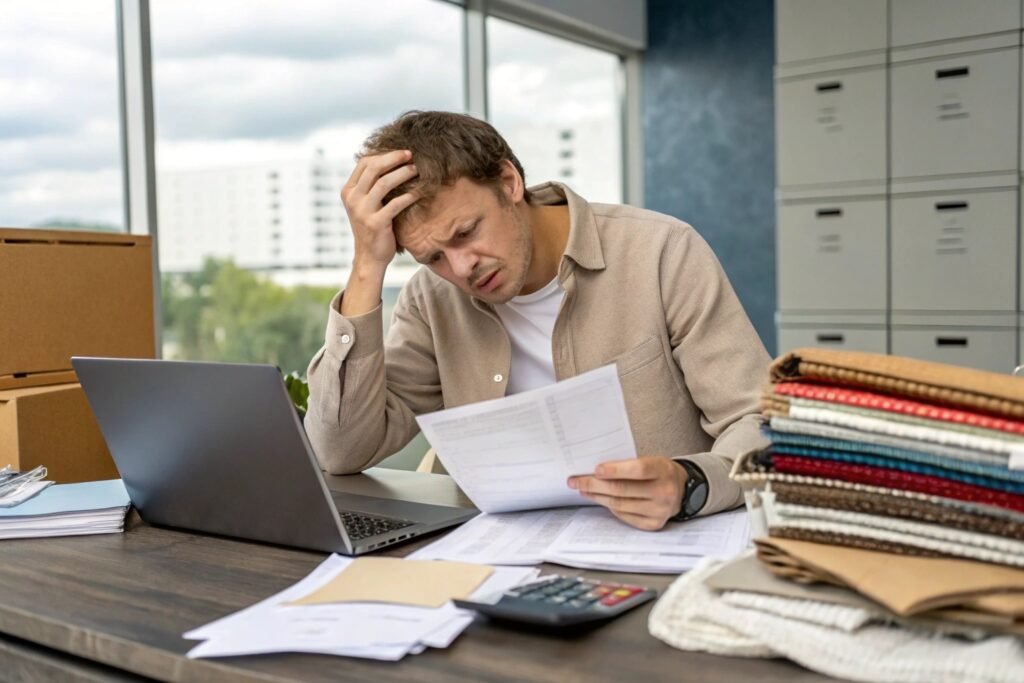

You’ve sourced the perfect fabric. The price seems right. But then comes the shock—freight, tariffs, warehouse fees, and suddenly your “cheap” import isn’t so cheap. If you're an importer like Ron, focused on budget accuracy and ROI, calculating landed cost is non-negotiable. Without it, you risk margin loss or overpricing your final garment.

Total landed cost includes all expenses from supplier door to your warehouse shelf.

This isn’t just the unit price. It’s the full sum of product cost, freight, duties, taxes, insurance, and handling fees. Whether you’re buying 200 yards of cotton or 20,000 meters of jacquard, understanding these layers will save you money—and headaches. Let me break it down with real-world logic and experience from Fumao’s fabric export flow.

With a full landed cost calculation, you quote confidently, price precisely, and avoid unwanted surprises at customs.

What Costs Are Included in a Landed Cost Calculation?

Too many importers look only at invoice price. But landed cost includes much more—especially for bulk fabric shipments.

Key cost categories in landed cost are: product cost, international shipping, customs duties, taxes, insurance, inland transport, and documentation fees.

These costs vary by shipment mode (air/sea), destination, and fabric classification. For U.S. buyers, duties and taxes often take up 10–30% of total cost depending on HS codes and origin country.

What Is the Formula for Landed Cost?

Here’s a simplified version:

Landed Cost = Product Cost + Freight + Insurance + Duty + Customs Clearance + Local Delivery + Other Charges

“Other charges” might include:

- Port handling

- Import broker fees

- Packaging (e.g., pallets)

- Inspection or testing fees

Is FOB Enough to Start With?

FOB (Free on Board) pricing includes the cost of fabric and delivery to the export port. It’s a good base, but won’t tell you what you’ll spend from there to your U.S. warehouse. Always get an end-to-end quote if you want full landed transparency.

How Do HS Codes and Duties Impact the Final Cost?

Two fabrics, same price per meter, can have very different duties. It’s all in the classification.

HS codes (Harmonized System) determine what import duty and taxes you’ll pay—so getting them right is critical.

Each fabric type (based on fiber, weave, finish) has a unique 8–10 digit code. For example, cotton plain weave may be taxed at 6.5%, but polyester coated fabrics could reach 18%. A misclassified item can delay customs and lead to fines or retroactive payments.

How to Classify Fabric with HS Codes?

Use the following criteria:

- Fiber content (e.g., 100% cotton vs. polyester-cotton blend)

- Construction (woven, knit, coated)

- Use (apparel, home textile, technical fabric)

Fumao provides pre-filled HS codes based on lab tests and official classification. For example, our jacquard poly-rayon blend falls under 5516.92.00.

Are U.S. Tariffs Still Active on Chinese Fabrics?

Yes. Section 301 tariffs may add up to 25% on certain Chinese-origin fabrics. However, some categories are excluded or eligible for exemption. We help clients identify duty-free substitutions or route via DDP if needed.

How Does Freight Mode Affect Landed Costs?

Your choice of transport can double or halve your landed cost. But speed comes at a price.

Air freight is faster but costlier—ideal for samples or urgent small runs. Ocean freight is slower but much cheaper per meter, especially for bulk fabric.

For example, air shipping 500kg of fabric from Shanghai to LA might cost $3,000+, while sea freight for 5,000kg may cost under $2,000 including port fees. However, ocean shipping comes with longer lead times and potential port congestion.

What Factors Determine Freight Cost?

- Weight and volume of fabric

- Destination port and inland delivery

- Fuel surcharges

- Container size (LCL vs. FCL)

Fumao provides both air and sea freight quotes at the time of order. For small brands, we consolidate multiple small orders to fill containers and lower unit costs.

Is DDP Worth It?

For many U.S. buyers, Delivered Duty Paid (DDP) makes life easier. We handle all logistics, customs, and inland delivery with a single invoice. While DDP adds 3–5% markup, it simplifies budgeting and reduces compliance risk.

How to Avoid Hidden Fees in Fabric Importing?

You calculated everything—but forgot about warehouse fees or courier handoffs. These surprises hurt margins.

Common hidden charges in landed cost include: demurrage, warehousing, customs exam fees, inland handling, and bank wire costs.

These vary by port, forwarder, and how efficiently your documentation is prepared. One missing HS code or wrong declaration can cause customs holds, storage fees, or penalties.

What Are the Most Overlooked Charges?

- Demurrage: charged if your container isn’t picked up on time

- CFS fees: for deconsolidation at warehouse

- Inspection fees: if your fabric is pulled for random testing

- Bank wire costs: often missed in price comparison

Fumao offers cost prediction tools and pre-alert systems so you know your full costs before shipment. Our logistics team checks all documentation twice before cargo sails.

Can I Audit My Own Landed Costs?

Yes—and you should. Use landed cost templates in Excel or tools like IncoDocs or Freightos calculator. Cross-check freight bills and duty rates with your broker. If needed, ask suppliers to provide pre-shipment landed cost estimates.

Conclusion

Landed cost is where profit is won or lost in fabric importing. You can’t rely on the unit price alone. With tariffs, shipping, compliance, and logistics all affecting the bottom line, understanding the full landed cost picture helps you price competitively and plan accurately. At Fumao, we walk our clients through each cost layer—from FOB to warehouse—so there are no surprises, just better sourcing decisions.