Tariffs are one of the most frustrating hidden costs in the textile import business. For many U.S. apparel brands and sourcing managers, China’s tariffs—especially the Section 301 tariffs—can raise landed costs by 7.5% to 25% overnight. That’s why global buyers are rethinking production geography.

Nearshoring fabric production to Southeast Asia—particularly countries like Vietnam, Indonesia, and Cambodia—allows U.S. importers to leverage Free Trade Agreements (FTAs), reduce exposure to U.S.-China tariff tensions, and improve supply chain resilience.

As the founder of a China-based textile manufacturer, I’ve guided many clients through hybrid sourcing strategies that balance China’s production capacity with Southeast Asia’s tariff advantages. In this article, I’ll break down why nearshoring works—and how to do it without sacrificing control or quality.

What Are the Key Tariff Risks with China-Origin Fabrics?

The U.S.–China trade relationship has been turbulent for years. Section 301 tariffs alone impact over $250 billion in Chinese imports—including many textile products, yarns, and finished garments.

Fabrics and apparel originating in China may face additional duties of 7.5%, 25%, or more depending on the HS code.

What Specific Tariffs Affect Fabric Buyers?

| Fabric Category | China Tariff (U.S.) | Vietnam Tariff (U.S.) |

|---|---|---|

| Synthetic Woven | 17% + 7.5% (301) | 0% under US-VN FTA |

| Cotton Knit | 16.5% + 7.5% | 0–5% |

| Home Textiles | 12% + 25% | 0% |

You can verify these figures on the U.S. Harmonized Tariff Schedule. Many brands who previously relied on bulk orders from China are now shifting fabric finishing, CMT (Cut Make Trim), or final garment production to countries with preferential trade access to the U.S.

What Is Section 301 and Why Does It Matter?

Section 301 is a U.S. law allowing the President to impose trade penalties. Since 2018, it has been used to apply punitive tariffs on Chinese goods. For textile buyers, it’s not just about price—it affects cash flow, customs clearance timing, and buyer-supplier negotiation dynamics.

How Do Free Trade Agreements Lower Textile Tariffs?

FTAs are international agreements that reduce or eliminate tariffs between member countries. The U.S. doesn’t have an FTA with China—but it does with several Southeast Asian countries, especially under CPTPP and US–Vietnam Bilateral Trade Agreements.

By shifting production or partial finishing to FTA countries, brands can legally claim reduced or zero tariffs on many fabric and garment products.

Which Agreements Offer the Best Textile Tariff Relief?

| FTA / Agreement | Countries | Tariff Benefit |

|---|---|---|

| US–Vietnam BTA | Vietnam | Up to 100% duty reduction |

| US–Singapore FTA | Singapore | Duty-free textile imports |

| GSP (until 2021 lapse) | Cambodia, Laos, etc. | Select items still exempt |

| RCEP (regional) | Indirectly benefits exports | Origin manipulation workaround |

For example, if we weave or finish polyester fabric in Vietnam—even using Chinese yarn—we can often change the COO (Country of Origin) and ship to the U.S. tariff-free if the rules of origin are satisfied.

What Is a Rule of Origin?

Rules of Origin (ROO) determine where a product is considered to be made for tariff purposes. To benefit from FTAs, fabric must usually be knit, dyed, or finished in the FTA country. We help clients ensure compliance through proper HS coding, bill of material breakdown, and COO certificates. You can reference guidelines from CBP.gov.

What Are the Strategic Benefits Beyond Tariff Savings?

Shifting or duplicating production to Southeast Asia isn’t just about avoiding duties—it’s a full-stack risk management move. COVID, geopolitical uncertainty, and labor cost inflation in China have accelerated the need for sourcing diversification.

Nearshoring helps reduce costs, improve agility, and build tariff resilience into your supply chain.

What Other Advantages Does Nearshoring Offer?

- Labor Cost Arbitrage: Vietnam and Cambodia offer lower minimum wages than China.

- Better U.S. Relations: Stable trade terms and friendlier geopolitical stance.

- Shorter Lead Times to U.S.: Ports like Hai Phong and Laem Chabang offer reliable schedules.

- Multimodal Shipping Options: Use sea-rail combinations via Singapore and Malaysia.

- Customs Compliance: FTA paperwork simplifies classification.

Our factory in China partners with knitting and finishing mills in Vietnam and Cambodia, enabling clients to split production across borders while still maintaining QC and development speed.

Does It Impact Product Quality?

No—when managed properly. We maintain shared dye recipes, standardized QC protocols, and real-time inspection reports between sites. If needed, we fly bulk greige goods from our weaving facility in Shaoxing to be finished and packed in Vietnam for U.S. shipment.

How Do You Execute a Nearshoring Strategy Smoothly?

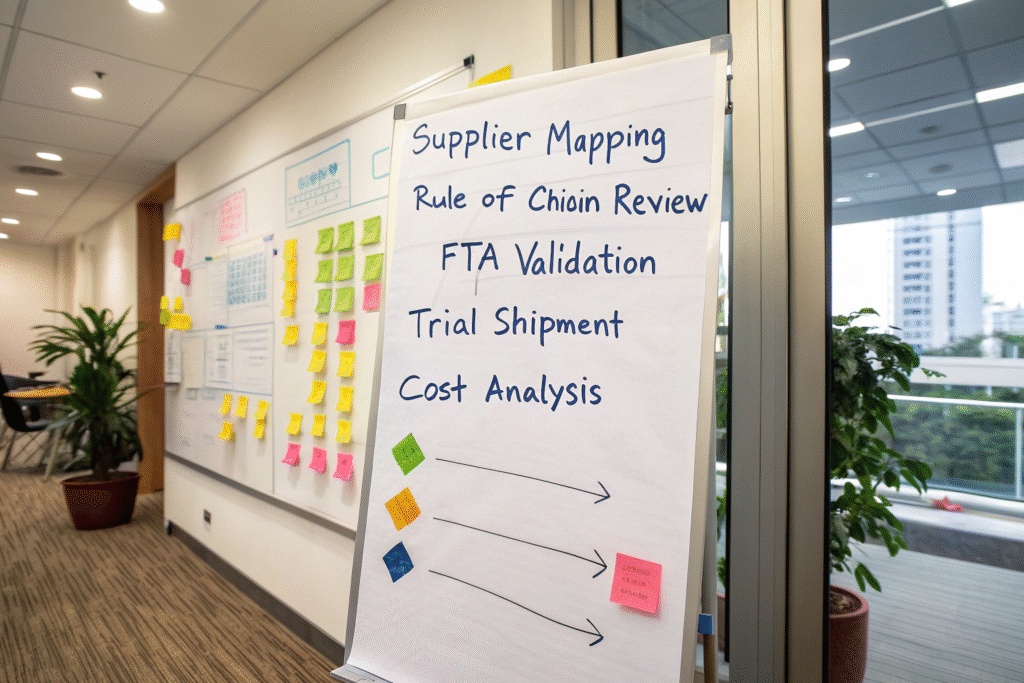

Nearshoring fabric production involves more than a location shift—it’s a structured realignment of your sourcing flow. Done right, it brings long-term savings and tariff clarity.

Follow a step-by-step plan to shift production while protecting quality and timelines.

What Steps Should You Follow?

- Product HS Code Review: Verify tariff exposure and possible exemptions.

- Rule of Origin Consultation: Confirm which operations need relocation.

- FTA Paperwork Setup: Prepare certificate templates, HS classification, and invoice tags.

- Partner Mill Selection: Choose compliant mills in Vietnam, Cambodia, or Thailand.

- Trial Runs: Send greige or semi-finished fabric for dyeing/finishing tests.

- Cost Impact Analysis: Factor in transport, FOB pricing, and potential FTA savings.

We provide FTA certificate drafting, Vietnam mill onboarding, and fabric pre-tests to make your shift seamless. Our logistics team handles DDP terms, minimizing complexity.

How Do You Maintain Supply Chain Visibility?

Using our QR tracking system, buyers get live updates on yarn source, dye lot, and warehouse entry—across both China and Vietnam. We also offer video inspections, dual PO management, and multi-origin invoices to help U.S. clients comply with CBP audits.

Conclusion

Nearshoring your fabric production to Southeast Asia is a smart, strategic move to avoid China tariffs, unlock FTA benefits, and diversify your sourcing footprint. With the right partners, you can do this without increasing lead times or sacrificing quality.

At Fumao Fabric, we support dual-region sourcing by managing China + Vietnam production pipelines, maintaining quality control, and guiding our clients through every compliance step—from HS code audits to FTA documentation.

To explore how nearshoring can lower your fabric import costs, or to request Vietnam-origin swatches, contact our Business Director Elaine at elaine@fumaoclothing.com. Let’s reduce duties and grow smarter together.