The clock is ticking on PFAS in textiles. With regulations advancing globally and major brands committing to PFAS-free timelines, many manufacturers face a critical transition period. The wrong preparation could mean product recalls, legal liability, or being locked out of key markets. At Fumao, we've guided dozens of brands through this transition, testing over 50 PFAS-free alternatives to identify truly viable solutions.

Preparing for PFAS restrictions requires a multi-phase approach: immediate compliance auditing, intermediate alternative testing and qualification, and long-term supply chain transformation. The most successful transitions begin with understanding current PFAS content across all products, then systematically testing and implementing PFAS-free DWR alternatives that match your performance requirements. Companies starting now will need 6-18 months for full transition, depending on product complexity.

The regulatory landscape is moving faster than most companies realize. Let's examine the practical steps to navigate this transition successfully while maintaining performance standards.

What Are the Current and Upcoming PFAS Regulations?

The regulatory environment for PFAS is evolving rapidly across all major markets. Understanding the specific timelines and requirements in your target markets is the essential first step. The EU leads with the most comprehensive restrictions, but North America and Asia are advancing quickly with their own regulatory frameworks.

The EU's REACH restriction proposal aims to ban all PFAS—approximately 10,000 substances—in textiles, with some exemptions for protective clothing. This broad "ban all" approach means companies can't simply substitute one PFAS for another. Meanwhile, individual US states including California, New York, and Maine are implementing their own PFAS bans in apparel and textiles, creating a complex regulatory patchwork. Even without federal legislation, the US market is effectively moving toward PFAS-free through state-level actions and brand commitments.

Which Markets Have the Most Urgent Compliance Deadlines?

Compliance timelines vary significantly by region. The EU's REACH restriction could be finalized as early as 2025, with implementation periods of 18 months to 5 years depending on the application. Several US states have laws taking effect between 2025-2027, with Maine's PFAS in products reporting requirement already active since 2023. California's AB 1817 bans intentionally added PFAS in textiles starting January 1, 2025. The table below shows key deadlines:

| Region | Key Regulation | Effective Date | Scope |

|---|---|---|---|

| California, USA | AB 1817 | January 2025 | Apparel, textiles with intentionally added PFAS |

| New York, USA | S6291A | December 2024 | Apparel with intentionally added PFAS |

| Maine, USA | PFAS in Products Law | January 2023 (reporting) | All products with intentionally added PFAS |

| EU | REACH PFAS Restriction | 2025-2027 (proposed) | All PFAS in textiles |

| Germany | Consumer Goods Ordinance | July 2020 | C8 chemistry PFAS |

A European outdoor brand faced product seizure at US customs in 2023 due to non-compliance with Washington state's PFAS regulations, highlighting the real-world consequences of inadequate preparation.

How Do You Navigate the "Regulatory Patchwork" Challenge?

The varying regional requirements create significant compliance complexity. The strictest regulation often becomes the de facto global standard, as manufacturers struggle to maintain separate production lines for different markets. Many companies are adopting a "comply with the strictest" approach to simplify logistics and avoid costly mistakes. This means preparing for the EU's comprehensive PFAS ban, even if your primary market currently has weaker restrictions. We recommend creating a compliance dashboard that tracks all relevant regulations and their effective dates, with regular updates as new legislation emerges.

What PFAS-Free DWR Alternatives Actually Work?

The transition to PFAS-free DWR requires understanding three main alternative technologies: silicone-based, hydrocarbon-based, and dendrimer/wax hybrid systems. Each offers different performance profiles, durability, and environmental characteristics. The "best" alternative depends on your specific application, performance requirements, and sustainability goals.

Silicone-based DWRs provide excellent water repellency with good durability, but may have limitations on oil repellency and can affect fabric breathability. Hydrocarbon (paraffin-based) DWRs offer good initial performance but typically show reduced durability through washing. Dendrimer and hybrid technologies represent the latest generation, offering balanced performance across multiple parameters but at higher cost. Each technology requires different application methods and curing parameters, meaning production adjustments are inevitable.

![]()

How Do Performance and Durability Compare to Traditional PFAS DWR?

Performance comparisons reveal trade-offs across different metrics. Traditional C8 PFAS DWR typically achieves 90+ initial spray rating with 80+ rating after 20 washes. The best PFAS-free alternatives achieve similar initial performance (90 spray rating) but may drop to 70-75 after 20 washes. Oil repellency represents the biggest challenge—while C8 chemistry achieves grade 6-8 oil rating, most alternatives manage only grade 1-3. This means PFAS-free DWR works well for water-based precipitation but offers limited protection against oil-based stains. A German outdoor brand successfully transitioned their hiking collection to silicone-hydrocarbon hybrid DWR, accepting slightly reduced oil protection in exchange for complete PFAS elimination.

What Application and Production Changes Are Required?

Transitioning to PFAS-free DWR requires significant production adjustments. Application methods, curing temperatures, and equipment cleaning protocols all need modification. Silicone-based DWRs typically require higher curing temperatures (160-180°C vs 140-160°C for PFAS), potentially affecting energy consumption and production speed. Hydrocarbon-based systems may need specialized application equipment to handle higher viscosity formulations. Most importantly, complete production line decontamination is essential to prevent cross-contamination—we've seen many failed transitions due to residual PFAS in equipment. A detailed guide to textile finishing line decontamination provides essential technical guidance for this process.

How to Audit Your Current PFAS Usage and Supply Chain?

Most companies significantly underestimate their PFAS footprint. A comprehensive audit must examine not just obvious applications like DWR, but also hidden sources throughout the supply chain. Many textiles contain PFAS from printing inks, anti-static treatments, seam tapes, and even contamination from manufacturing environments.

Begin with a product-level audit, categorizing items by likely PFAS content. Then conduct chemical testing on representative samples, focusing initially on high-risk products. The supply chain audit should extend to all suppliers of chemicals, fabrics, and components, requiring full chemical disclosure and verification testing. Many brands are surprised to discover PFAS in unexpected places like labels, threads, and even packaging materials.

What Testing Methods Accurately Detect PFAS?

Proper PFAS testing requires sophisticated methodology since these compounds can be present at extremely low concentrations while still triggering regulatory non-compliance. EPA Method 533 and 1633 are becoming standard for textile testing, capable of detecting multiple PFAS compounds at parts-per-trillion levels. We recommend testing for both targeted compounds (specific known PFAS) and total fluorine content, which can indicate the presence of unknown or breakdown products. The table below shows common testing approaches:

| Testing Method | What It Detects | Sensitivity | Best For |

|---|---|---|---|

| Targeted LC-MS/MS | Specific known PFAS compounds | ppt level | Regulatory compliance |

| Total Fluorine | All fluorine-containing compounds | ppm level | Screening for unknown PFAS |

| Extractable Organic Fluorine | Fluorine that can leach out | ppb level | Environmental impact assessment |

| PIGE | Total surface fluorine | na | Rapid screening |

A US apparel brand discovered their "PFAS-free" fabric contained detectable PFAS from contaminated processing water, highlighting the importance of comprehensive testing throughout production.

How Do You Manage Supplier Transparency and Documentation?

Achieving full supply chain transparency requires systematic documentation. Implement a chemical management system that requires suppliers to disclose all chemical components and provide third-party test reports. Many brands are adopting the ZDHC Manufacturing Restricted Substances List (MRSL) framework, which includes PFAS restrictions. We recommend requiring suppliers to sign compliance affidavits and conduct their own supply chain audits. Regular third-party verification testing provides essential backup to supplier declarations. The most successful companies establish clear PFAS elimination timelines with suppliers and conduct joint testing to verify compliance.

What Transition Timeline and Strategy Makes Sense?

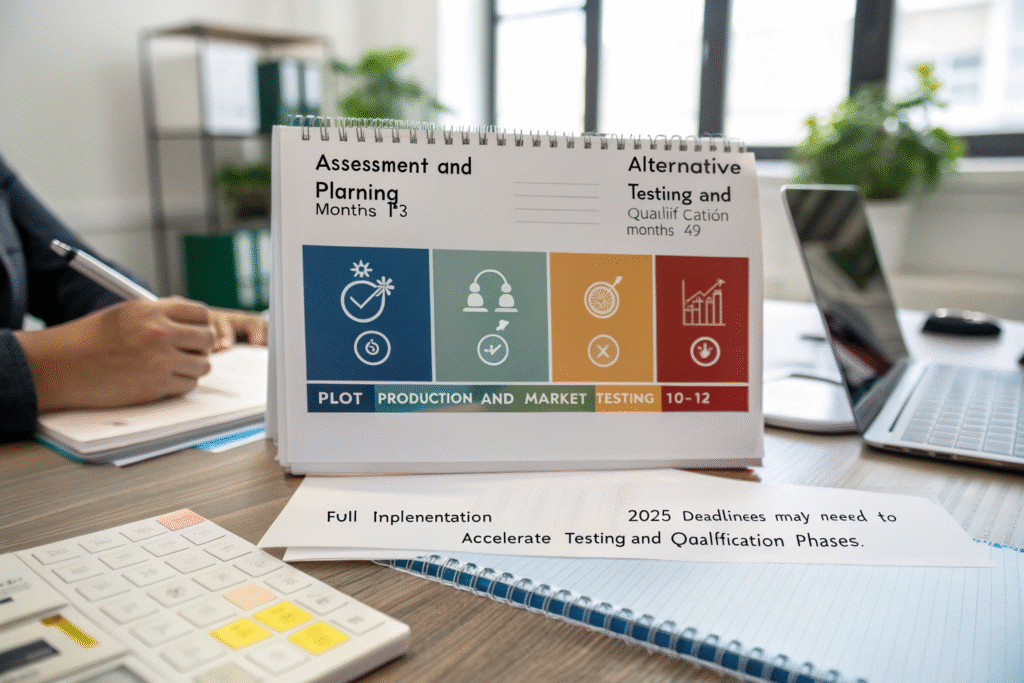

A phased transition approach minimizes business disruption while ensuring regulatory compliance. The optimal timeline depends on your product complexity, supply chain depth, and market requirements. Companies should start with lower-risk products and gradually transition their entire portfolio, allowing time for testing, supplier qualification, and production adjustments.

We recommend a four-phase approach over 12-24 months: assessment and planning (months 1-3), alternative testing and qualification (months 4-9), pilot production and market testing (months 10-12), and full implementation (months 13-24). Companies serving markets with 2025 deadlines need accelerated timelines, potentially compressing testing and qualification phases.

How to Prioritize Which Products to Transition First?

Product transition prioritization should consider regulatory risk, technical feasibility, and business impact. Begin with products sold in regions with nearest compliance deadlines, then address products with the simplest technical requirements. Items with existing PFAS-free alternatives in the market represent lower-risk starting points. We typically recommend this prioritization order:

- Products for California and New York markets

- Products with minimal performance requirements

- High-volume core products

- Technically complex products requiring extensive R&D

A UK fashion retailer successfully transitioned 60% of their collection within 12 months using this prioritization approach, focusing first on their California-bound spring collection before addressing more technically challenging winter performance wear.

What Are the Cost Implications and Budget Requirements?

The PFAS transition involves significant costs across multiple areas. Testing and certification represent initial investments, with comprehensive supply chain testing costing $5,000-$20,000 depending on product range. Alternative DWR chemistries typically cost 20-50% more than traditional PFAS treatments. Production line modifications and decontamination add capital expenses, while reduced durability may increase warranty claims. However, these costs must be balanced against the risk of regulatory penalties, product recalls, and brand reputation damage. Companies should budget for a 5-15% increase in finishing costs during the transition period, with costs decreasing as volumes increase and technologies mature.

How to Communicate Changes to Customers and Stakeholders?

Effective communication about your PFAS transition can become a competitive advantage when handled correctly. Consumers increasingly seek PFAS-free products, but may need education about performance trade-offs. Transparency about the journey—including challenges and limitations—builds credibility and trust.

Marketing claims require careful substantiation to avoid greenwashing allegations. Terms like "PFAS-free," "forever chemical-free," and "non-toxic waterproofing" must be backed by testing and documentation. Many brands are finding success with educational content that explains why they're making the transition and how new technologies work, rather than simply making marketing claims.

What Marketing Claims Are Legally Defensible?

Marketing claims must be accurate, specific, and substantiated. "PFAS-free" is generally acceptable if testing confirms no intentionally added PFAS and total fluorine below established thresholds. "Eco-friendly" or "non-toxic" require broader environmental and toxicological assessments. We recommend third-party certification from organizations like bluesign® or Oeko-Tex Standard 100 to support environmental claims. Performance claims should be qualified—for example, "excellent water repellency with reduced oil resistance compared to previous technology." A Nordic outdoor brand successfully navigated this challenge by using the phrase "Now PFAS-free: Our commitment to cleaner chemistry" while providing detailed performance data on their website.

How Do You Manage Performance Expectations?

Setting realistic performance expectations prevents customer disappointment. Be transparent about any performance differences between PFAS and PFAS-free technologies. Many companies are finding customers accept slightly reduced durability in exchange for environmental benefits, particularly when the trade-offs are clearly communicated. Consider implementing new care instructions optimized for PFAS-free DWR, as proper maintenance can significantly extend performance. Some brands offer complimentary re-treatment services to address durability limitations, turning a potential negative into a customer engagement opportunity. Understanding FTC Green Guides for environmental marketing claims ensures compliance while effectively communicating your transition.

Conclusion

The transition away from PFAS in textiles is inevitable and accelerating. Companies that start preparation now will navigate this shift successfully, while those who delay face significant regulatory and market access risks. The most effective approach combines immediate compliance assessment, systematic testing of alternatives, supply chain transformation, and transparent customer communication.

Success requires treating this as both a technical challenge and a strategic opportunity. The brands that emerge strongest will be those that not only achieve compliance but also leverage their PFAS-free status as a competitive advantage. If you need guidance developing your PFAS transition strategy or identifying the right alternatives for your specific products, our technical team can provide comprehensive support. We've helped numerous brands navigate this complex transition while maintaining performance standards. For personalized advice and technical support, contact our Business Director, Elaine, at elaine@fumaoclothing.com. Let us help you build a PFAS-free future without compromising performance.