You’re planning your next clothing collection, juggling design, budget, and market deadlines. Suddenly, a critical fabric shipment from China is delayed, throwing your entire production schedule into chaos. Missed launch dates, unhappy retailers, and sunk costs become your new reality. This pain is often rooted in a simple oversight: not aligning your sourcing calendar with the rhythmic heartbeat of Chinese manufacturing.

Smart brands don’t just fight these cycles; they master them. Turning seasonal surges and holiday pauses from unpredictable risks into a strategic planning advantage is the key to smoother operations and healthier margins. By syncing your production schedule with China’s manufacturing calendar, you can unlock faster lead times, better pricing, and unprecedented reliability from your supply chain.

This isn’t about working harder; it’s about working smarter. Let’s break down the annual rhythms of Chinese production and provide a clear, actionable blueprint for optimizing your sourcing strategy throughout the year. We’ll move from recognizing the problem to implementing practical solutions that keep your pipeline flowing.

What Are the Key Periods in China's Manufacturing Calendar?

If you think of China’s manufacturing landscape as an ocean, then its calendar defines the tides. Ignoring these tides means sailing against the current—expending more energy for slower progress. The annual cycle is defined by three distinct phases: Peak Production Seasons, Major Holiday Shutdowns, and Strategic Slow Periods. Each phase presents unique challenges and opportunities that directly impact your lead times, costs, and planning complexity.

For over 20 years at Shanghai Fumao, we’ve guided our partners through these waves. One of our long-term clients, a German outerwear brand, learned this the hard way. They consistently missed their Q3 delivery deadlines because their fabric orders for technical shell fabrics always collided with the August-October peak. After we mapped out the cycle for them in 2022, they shifted their development forward by just six weeks. The result? Their 2023 autumn collection arrived at European warehouses three weeks earlier than ever before, allowing for an extended sell-in period with retailers. Understanding these periods isn’t academic; it’s a commercial imperative.

How Do Peak Seasons (Mar-May & Aug-Oct) Impact Your Lead Time?

The spring (March-May) and autumn (August-October) peaks are when Chinese factories operate at full throttle. Demand surges as global brands place orders for the coming seasons. Think of it like the morning rush hour at a major train station—everyone is trying to get on the same trains. For you, this means factory capacity is stretched. Dyeing vats, printing machines, and looms are booked solid. While output is high, the competition for production slots adds a buffer of 1-2 weeks to standard timelines.

This isn't just about waiting longer. The pressure can sometimes affect quality if not managed tightly. Our in-house CNAS-certified lab becomes our clients' greatest asset during these times. We enforce pre-production testing and implement real-time QR code tracking for every batch, so even at peak speed, quality isn't compromised. A practical tip is to book your production slots well in advance during these windows. For instance, if you need fabrics by October for Spring/Summer production, your order should be confirmed with the factory no later than July. This is where partnering with an integrated supplier like Shanghai Fumao pays off. Our control over the weaving, dyeing, and finishing process in Keqiao’s cluster allows us to secure internal capacity for our key clients, bypassing the worst of the external bottleneck. For deeper insights on managing expectations during these crunches, industry platforms like [Apparel Insider often discuss strategies for navigating global production peaks]

Can You Rely on Quoted Lead Times During Holiday Shutdowns?

The simple answer is: you must plan around them, not through them. Chinese New Year (CNY) is the most significant event, causing a 3-4 week nationwide slowdown as workers travel home. National Day Golden Week in early October is a one-week halt. Quoted lead times that ignore these holidays are a fantasy. The savvy approach is to use the pre-holiday period aggressively.

The European fashion brand mentioned earlier exemplifies best practice. They complete all pre-production—including finalizing lab dips, strike-offs, and bulk fabric testing—at least 6 weeks before CNY. This ensures the moment factories reopen, bulk production can start immediately, with no delays for approvals. We facilitated this for a US-based sportswear startup in January 2023. They had their recycled polyester and spandex blend performance fabric samples approved and raw materials prepositioned by mid-December. When our partnered factories resumed work, their order was first in line, achieving a record 5-week turnaround for a complex, functional fabric order. Missing this window can set you back 2 months. Resources like the Fashion Law Blog provide useful annual updates on how to structure contracts around these inevitable shutdowns.

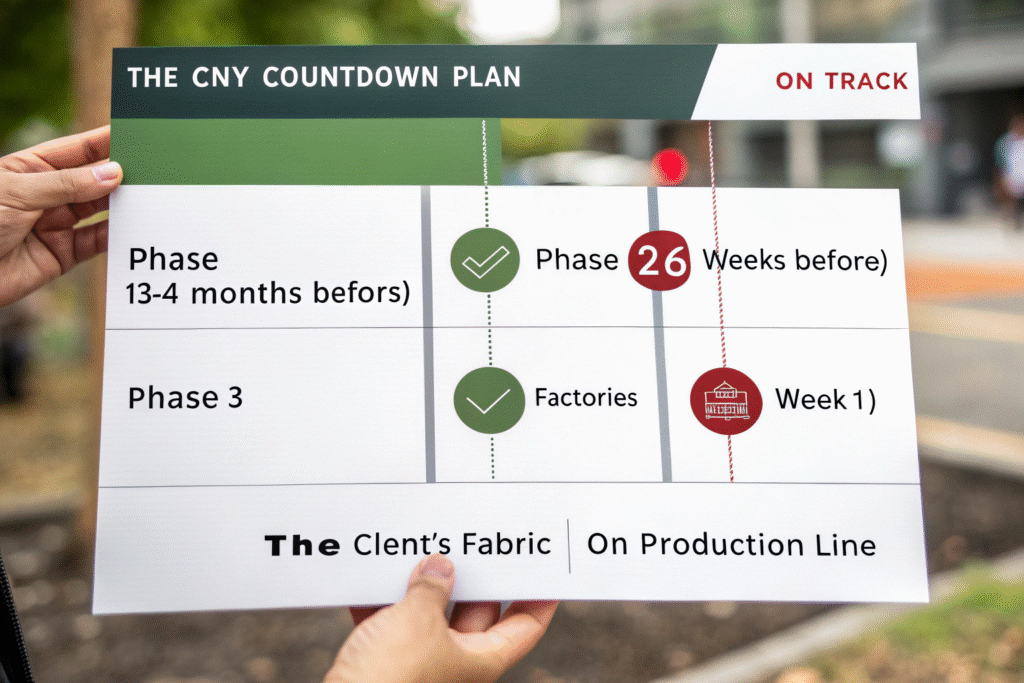

How Can You Plan Ahead for Chinese New Year Shutdowns?

Treating Chinese New Year as a last-minute obstacle is a recipe for failure. Instead, view it as a fixed milestone in your annual timeline—one that requires a proactive, phased approach. Successful planning for CNY isn't a single action; it's a cascade of decisions spanning communication, production, and logistics. The goal is to enter the holiday with all critical work completed, so the shutdown becomes a planned pause rather than a disruptive stop.

I recall a urgent call in late January 2022 from a client in London. They had a brilliant, last-minute idea for a silk-blend jacquard but hadn't accounted for the impending holiday. We had to be frank: weaving and finishing a new jacquard was impossible before the shutdown. We helped them pivot to a stunning but less complex printed velvet from our stock collection, saving their campaign. The lesson was etched deeply. Now, we initiate "CNY Countdown" planning with all clients in Q4. For example, in November 2023, we worked with a Russian boutique brand to accelerate their development of a winter wool coating fabric. By front-loading the fabric development process, we secured their bulk order completion by mid-January 2024, weeks before the festival.

What Steps Should You Take 3-4 Months Before CNY?

This is the strategic foundation phase. Your focus should be on finalizing designs and initiating sampling. All creative debates need resolution here.

- Finalize Tech Packs & Designs: Any ambiguity now will cause exponential delays later. Ensure your tech packs are complete with precise specifications for composition, weight, weave, and finish.

- Initiate and Approve Prototype Samples: This is the time for sampling. Work with your supplier to get first prototypes made. For intricate products like custom jacquard fabrics, this stage can take several iterations. At Shanghai Fumao, our 48-hour rapid sampling service is crucial here, allowing for multiple quick revisions.

- Secure Raw Material Availability: Discuss with your supplier about yarn sourcing. Peak demand before CNY can strain material supply. A good partner will advise on potential shortages and suggest alternatives.

A helpful reference is the annual guide on managing Asian supply chain holidays published by Sourcing Journal, which reinforces the need for this early start.

How to Secure Your Production Slot Before the Holiday Rush?

6-8 weeks before CNY, shift from development to execution. This is the critical window for locking in your place on the production schedule.

- Place Your Deposit and Confirm Order: This formal commitment moves you from a prospective client to a scheduled order on the factory's board.

- Complete Pre-Production Approval (PPA): This is non-negotiable. Approve all lab dips, strike-offs, and pre-production quality testing reports. The PPA is your contract on the fabric's color, hand feel, and performance.

- Pre-position Raw Materials: Integrated suppliers like us will often purchase and store the required yarns or greige fabric in advance. This guarantees that the materials are ready to run the moment production resumes.

We've seen clients who treat this as a "soft" deadline get pushed back by weeks. For example, a client hesitating on a bulk order confirmation for a linen-cotton blend in early December 2022 lost their slot to another brand that confirmed immediately. They had to wait until March for production, missing their early spring launch.

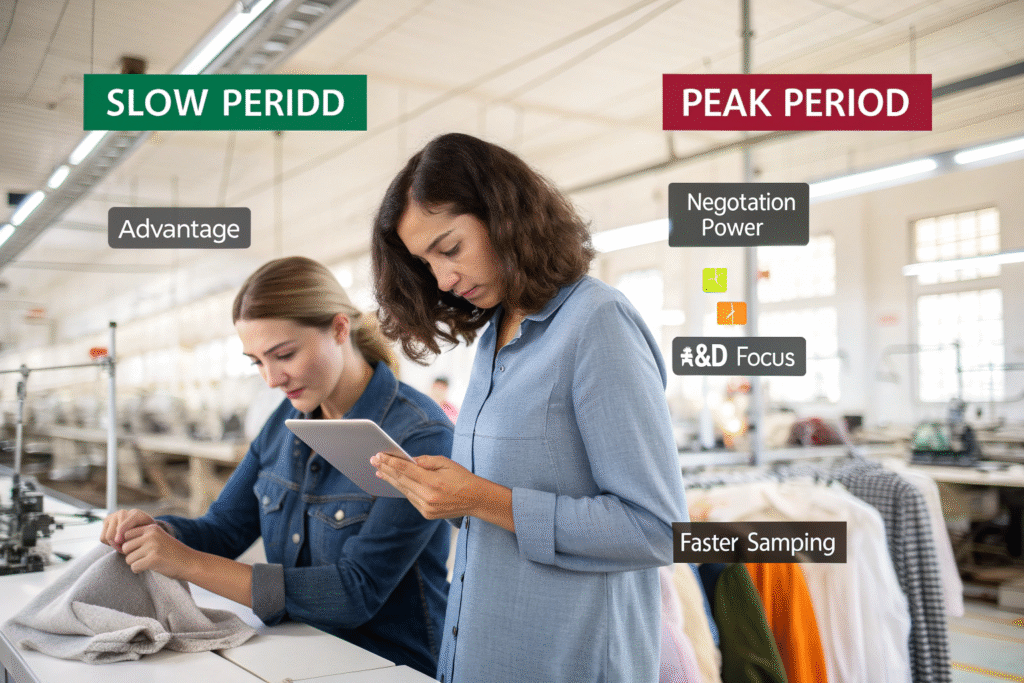

Are Slower Periods (Jun-Jul, Nov-Dec) Better for Sourcing?

Absolutely. If peak seasons are the rush hour, then these slower periods—particularly June-July and late November to December (post-CNY rush, pre-holiday)—are the open road. Factory capacity opens up, and competition for attention fades. This is the strategic window for brands that plan ahead. You gain leverage for better pricing, more flexible Minimum Order Quantities (MOQs), and most importantly, the full attention of your supplier's development and production teams.

The advantages go beyond cost. This is the ideal time for innovation and solving complex problems. In July 2023, a Canadian activewear brand approached us with a challenge: they needed a high-stretch, moisture-wicking fabric that also had a luxurious, brushed texture—a combination that often fails in durability tests. The slower pace allowed our R&D team to experiment with different polyester filament blends and brushing techniques over three weeks without rushing. We finally achieved a fabric that passed 50 wash cycles without pilling, something that would have been rushed or rejected during a peak period. The brand secured an exclusive fabric for their line at a cost 15% lower than if developed during the September peak.

What Cost Advantages Can You Negotiate in Off-Peak Times?

With lower overall demand, factories are more motivated to fill their capacity. This gives you negotiating power you simply don't have during the peaks.

| Negotiation Point | Peak Season Reality | Off-Peak Opportunity |

|---|---|---|

| Price per Meter | Fixed, often at a premium. | Potential for discounts, especially on larger orders. |

| MOQ Flexibility | Strict adherence to high MOQs. | Often possible to negotiate lower MOQs for testing new fabrics. |

| Payment Terms | Standard T/T with large deposit. | Possibility for more favorable milestone-based payment schedules. |

| Development Fees | Often non-negotiable or high. | Can sometimes be waived or reduced with a bulk order commitment. |

This is the perfect time to explore new, sustainable fabric options like our BAMSILK or recycled blends without the pressure of a looming season. Suppliers have more time to source special yarns and run trials. Forums like Texintel often feature discussions on how to leverage seasonal dynamics for cost savings in textile sourcing.

How to Use Quiet Months for Development and Sampling?

This is your R&D goldmine. Use this time for activities that require iteration and deep collaboration.

- Develop Next Season’s Portfolio: Work on fabrics for the cycle after next. If you're in slow June-July, develop fabrics for Fall/Winter of the following year.

- Stress-Test New Concepts: Conduct rigorous testing on new fabric prototypes—abrasion, wash, colorfastness—without time pressure.

- Build Stronger Supplier Relationships: Visit the factory (or have virtual tours). Meet the technical team. This investment in relationship pays dividends year-round.

A client from Australia uses this strategy masterfully. Every November, they work with our design team at Shanghai Fumao to develop 5-10 new fabric concepts for their resortwear line. The relaxed pace allows for creativity and perfectionism, resulting in unique fabrics that become their signature in the market 18 months later.

What Is a Proactive Sourcing Calendar for Fashion Brands?

A proactive sourcing calendar is your master plan—a visual and tactical map that aligns every stage of your product creation with the realities of your manufacturing base. It reverses the traditional, reactive model. Instead of your design dictating an impossible timeline to the factory, the calendar informs your design and development schedule based on manufacturing capacity. It brings predictability to a process often defined by chaos.

Creating one starts with working backward from your must-have in-store or warehouse date. Let’s say you need finished garments in the USA by August 1st for Back-to-School. Factor in 4-5 weeks for shipping and customs, 8 weeks for garment manufacturing and finishing, and suddenly your fabrics need to be delivered to the cut-and-sew factory by early April. Now layer in the Chinese cycles: April is the end of the spring peak. To ensure delivery, your fabric production must start in early February, right after CNY. Therefore, all development and sampling must be locked by the previous November. This backward planning is the core of the proactive calendar.

How to Build Your Own 12-Month Sourcing Timeline?

Start with a simple spreadsheet or calendar tool. Mark the fixed Chinese dates (CNY, Golden Week) first—these are your immovable pillars. Then, block in the peak and slow periods. Now, work backward from your key sales deadlines (e.g., Launch Date 1: March 15 for SS). Here’s a simplified example for a Spring/Summer collection:

- Final In-Store Date: March 15

- Minus 6 weeks: Garments arrive at US warehouse = February 1.

- Minus 8 weeks: Garment production = December 1. FABRIC MUST ARRIVE HERE.

- Minus 6-8 weeks: Fabric production & shipping from China = Start production by October 1.

- Minus 4-6 weeks: Final sampling, approvals, and order placement = August-September.

- Minus 8 weeks: Initial design and fabric sourcing = June-July (SLOW PERIOD - perfect for this work).

This shows how work for a March launch actually begins the previous June. A great resource to understand international logistics legs is Shipping and Freight Resource's guide to trans-Pacific freight times.

What Tools Can Help Synchronize with Your Supplier?

Technology is key to executing this calendar seamlessly.

- Shared Digital Calendars: Use tools like Google Calendar or Asana with shared events for key milestones (PPA deadline, shipment date).

- Real-Time Order Tracking: Insist on a system like our QR code tracking. It’s not just for quality; you can see exactly what stage your order is at—weaving, dyeing, inspecting—in real time.

- Regular Sync Calls: Schedule fixed, brief check-in calls (e.g., every two weeks) during critical phases. This keeps everyone aligned and problems small.

- Cloud-Based Tech Pack Management: Use platforms to ensure everyone from your designer to our factory manager is looking at the exact same, latest version of specifications.

Adopting this disciplined, calendar-driven approach transforms your relationship with your supplier from transactional to strategic partnership. It turns time from your biggest enemy into a managed resource.

Conclusion

Navigating the Chinese manufacturing calendar isn’t about avoiding delays—it’s about orchestrating them. By understanding the natural rhythms of peak production, holiday shutdowns, and strategic slow periods, you transform sourcing from a reactive cost center into a proactive competitive edge. The brands that thrive are those that plan their creative and commercial calendars in harmony with these cycles, using quiet times for innovation and locking in production before the rush. They secure not just better prices and timelines, but also higher quality and stronger supplier partnerships.

Remember, knowledge of these cycles is power, but only if applied. The most elegant sourcing strategy is worthless without a partner on the ground who can execute it within the complex ecosystem of Keqiao’s textile cluster. This is where a partner with integrated control, from yarn to shipment, makes the critical difference.

Ready to make the Chinese manufacturing calendar work for you, not against you? Let’s build your proactive sourcing plan together. Shanghai Fumao is more than a fabric supplier; we are your operational partner in Asia’s textile heartland. Contact our Business Director, Elaine, today to discuss how we can synchronize your next collection with confidence and precision. Reach out to Elaine at strong>elaine@fumaoclothing.com and let’s weave your success into every timeline.