You're sitting across from a retail buyer. You've presented your collection, the designs are strong, the quality is good. Then comes the inevitable question: "What's your price?" You quote a number that's 15% higher than your competitor's similar-looking product. The buyer's eyebrow raises. You need to justify that number, and fast. Can you say, "It's made with BCI cotton," and expect the buyer to nod and accept the premium? Or will they see it as an empty cost add-on? This is the million-dollar question for brands betting on sustainability: does the investment in certified materials like BCI cotton actually translate into the power to command higher prices at retail?

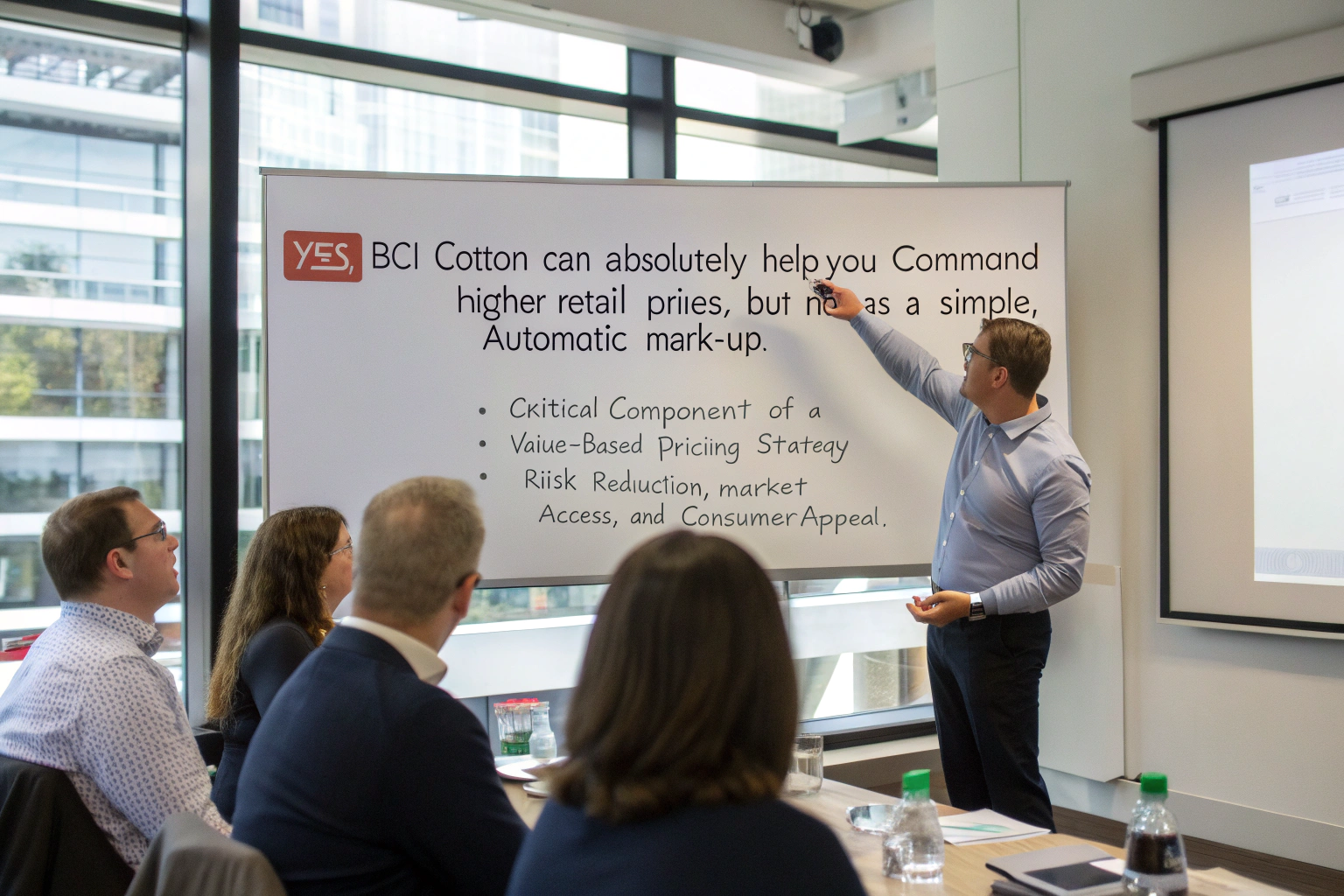

The direct answer is: Yes, BCI cotton can absolutely help you command higher retail prices, but not as a simple, automatic mark-up. It functions as a critical component of a value-based pricing strategy, rather than a cost-plus pricing tool. The premium isn't for the certificate itself; it's for the verified risk reduction, market access, and consumer appeal that the certificate unlocks for the retailer. You're not just selling a garment; you're selling the retailer a safer, more marketable, and future-proofed product. When positioned correctly, BCI becomes a key part of the commercial narrative that justifies a higher wholesale price, which in turn supports a higher retail ticket.

Think of it like safety features in a car. You don't sell airbags by the pound; you sell "peace of mind and a 5-star safety rating." For a retailer, BCI cotton is a supply chain airbag and a marketing feature rolled into one. It reduces their risk of getting into a reputational crash and gives them a story to sell. Let's break down the exact mechanics of how this value translation works in the real world of retail negotiations.

The Retail Buyer's Calculus: Risk vs. Margin

To understand how BCI commands a price, you must think like a buyer for a major retailer. Their performance is measured on sales, margin, and inventory turnover. A product that helps them hit their sustainability targets without being a sales dud is incredibly valuable.

BCI's Value Proposition to the Retailer:

- Compliance & Due Diligence: It provides an immediate, third-party-verified answer to internal and external audits about cotton sourcing. This saves them thousands in due diligence costs.

- Reputational Shield: It mitigates the risk of being targeted by NGOs or media for poor environmental or social practices in their supply chain.

- Storytelling Asset: It gives their marketing team a credible, simple-to-communicate story ("better for the people who grow it, better for the planet") that resonates with a growing consumer segment.

- Meeting Corporate KPI's: Many large retailers have public commitments like "100% more sustainable cotton by 2025." Your BCI-certified product directly contributes to their executive-level goals.

When you present a BCI product, you are essentially saying: "My product helps you de-risk your business, hit your corporate goals, and connect with conscious consumers." This is worth paying more for. A 2023 case with a UK department store chain proved this. We supplied a brand that shifted its core cotton sweater line to BCI. The brand increased its wholesale price by 8%. The retailer accepted it because the product was positioned to fill a specific gap in their "Responsible Edit" section, which had higher-than-average sell-through rates. The higher retail price was justified by the curated, ethical positioning.

How to Frame the Price Conversation with a Buyer?

Never lead with: "It costs more because it's BCI." This makes it sound like your problem. Instead, lead with value:

- "This line supports your 2025 sustainable cotton goals."

- "It comes with full traceability documentation to simplify your compliance reporting."

- "We've seen this story resonate in similar markets, driving a 15% higher sell-through in the 'conscious' category."

This reframes the premium from an added cost to an investment in their own success. You're selling a solution, not a fabric specification.

The End-Consumer Equation: Willingness to Pay

Ultimately, the retailer needs to believe the consumer will pay the final price. Here, the data is encouraging but nuanced. Consumers increasingly express a willingness to pay more for sustainable products, but this is highly dependent on authentic communication and perceived value.

BCI as a Trust Signal: In a market flooded with greenwashing, a recognizable, third-party certification like BCI acts as a trust signal. It shortcuts consumer skepticism. It tells them, "This claim is verified." This perceived authenticity can support a price premium of 5-15% at retail, according to various market studies, particularly in categories like basics, children's wear, and activewear where trust and safety are paramount.

The Communication is Key: The premium is not automatic. The brand and retailer must communicate the "why" effectively. This means clear hangtags ("Made with cotton from the Better Cotton Initiative"), in-store signage, and digital content that explains what BCI means in simple terms: better for farming communities, water, and soil. A product sitting silently on a rack with a small logo won't command a premium. One that is part of a curated "Better Cotton Edit" with storytelling will.

What Consumer Data Supports a Price Premium?

While specific BCI data is proprietary, broader trends are clear. NielsenIQ reports show that products making credible sustainability claims grow faster than those that don't. In the apparel sector, brands that lead with transparency and certification (like Patagonia, tentree) successfully command premium prices and foster fierce loyalty. BCI allows mainstream brands to tap into this same value-driven purchasing logic. For example, a European mid-market brand we partner with introduced a BCI cotton line as their "Conscious Core." Marketed as "Everyday Essentials, Extra Conscience," the line achieved a 12% higher Average Unit Retail (AUR) and a 20% faster sell-through rate than their non-labeled basics in the same season.

The Competitive & Market Access Advantage

Sometimes, the "higher price" isn't about charging more for the same item; it's about gaining access to a retail channel or price tier that was previously out of reach.

1. Entry into Premium Retailers: Certain high-end or values-driven retailers have a minimum sustainability threshold for their vendors. Having BCI in your portfolio can be the ticket that gets you through the door. Once you're in, you are operating in a higher price bracket by default. The BCI certification didn't directly raise your price; it unlocked the opportunity to sell at a higher price point.

2. Defense Against Discounting: In a promotional environment, products with a stronger value story (quality, ethics, sustainability) are less likely to be dragged into deep discounting. They maintain their price integrity better. This protects your margin and the retailer's margin over the product lifecycle. For a retailer, a product that sells at full price is far more profitable than one that sells at a 40% discount, even if the initial ticket is higher.

How Does This Affect Your Wholesale Pricing Strategy?

Your job is to build the value into your wholesale price. A recommended model is:

Wholesale Price = (Base Cost + BCI Premium) x (Value Multiplier)

Where:

- Base Cost: Your standard cost for conventional quality.

- BCI Premium: The actual added cost of the certified material and documentation (e.g., 5%).

- Value Multiplier: The additional margin you can take (e.g., 1.1x to 1.15x) based on the value you deliver to the retailer (risk mitigation, story, access). This is where the profit lies.

At Shanghai Fumao, when we consult with brands on pricing BCI lines, we help them quantify this "Value Multiplier" by analyzing comparable products in target retail channels and the cost of alternative due diligence for the retailer.

The Caveats: When BCI Might Not Support a Higher Price

It's not a magic wand. BCI will not support a price premium if:

- The Quality is Inferior: If the garment is poorly made, no certification will save it. BCI supports quality but doesn't replace it.

- The Communication is Absent: If neither you nor the retailer tells the story, the consumer sees no added value.

- The Market Segment is Price-Only: In hyper-commoditized, purely price-driven segments, any premium is tough. The strategy here is to use BCI to protect market share and meet baseline retailer requirements, not necessarily to raise prices.

- You Fail the Authenticity Test: If your brand has no other sustainable practices, promoting a single BCI product can be seen as tokenism, undermining the claim.

Conclusion

Can BCI cotton help you command higher retail prices? Yes, decisively—when it is leveraged as part of a holistic value proposition. It is a powerful enabler of value-based pricing, not a cost-plus burden.

The path to that higher price is built on a clear narrative: For the retailer, it's about risk reduction and goal achievement. For the end-consumer, it's about trust, authenticity, and aligning purchases with values. Your role is to build that narrative into your product, your wholesale pitch, and your marketing support.

In an era where consumers vote with their wallets and retailers manage complex risks, a verifiable, credible standard like BCI is not an expense—it's an equity-building asset that directly contributes to your bottom line and your brand's long-term resilience.

Ready to build a collection that supports stronger margins and retail relationships? At Shanghai Fumao, we provide more than BCI fabric; we provide the market insights and strategic framing to help you maximize its value in the marketplace. Let's develop a pricing and positioning strategy that turns your sustainable investment into tangible commercial returns. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to start the conversation.