Let me be brutally honest: importing DDP (Delivered Duty Paid) sounds like the ultimate "hassle-free" solution. Just pay one price, and your goods magically appear at your door. But when you add "OCS Certified" to the mix, that simple promise becomes a minefield. I've seen too many importers get burned—shipments stuck in customs because the paperwork didn't match the product, or worse, discovering the "certified" goods can't be legally sold because the chain-of-custody was broken in transit. The safety of your DDP shipment isn't about luck; it's about building an unbreakable system of verification that travels with your goods from the factory floor to your warehouse.

Importing OCS-certified garments under DDP terms safely requires treating the certification documentation with the same importance as the physical cargo. Success hinges on three pillars: pre-shipment verification that the goods and papers are flawless, a meticulously prepared commercial and certification dossier, and partnering with a supplier who manages the entire process as a single, accountable system—not just a logistics service. The goal isn't just delivery; it's compliant, claim-ready delivery.

If you're about to place a DDP order for certified organic apparel, this is your essential checklist. We'll move beyond theory and into the exact steps we use at Shanghai Fumao to ensure our clients' shipments clear customs smoothly and their certification remains intact.

Pre-Shipment Verification: Your Last Line of Defense

The most dangerous mistake is assuming everything is fine until customs holds your shipment. At that point, delays cost hundreds per day, and fixing paperwork from overseas is a nightmare. All verification must happen before the container is sealed. This phase is where you, the importer, must be actively involved—even under DDP. Your supplier should facilitate this transparency, not resist it.

Think of this as the final quality check, but for compliance. The garment's stitch quality is checked, and so must be its "paperwork quality."

What must be verified in the final pre-shipment audit?

Your audit checklist must be dual-purpose: Product Compliance and Document Compliance.

Product Compliance:

- Garment vs. Documentation Match: Randomly select cartons. Verify that the style, quantity, and sizes match the packing list. Crucially, check that the composition label on the garment (e.g., "100% Organic Cotton") matches exactly what is declared on the commercial invoice and the OCS certificate.

- Labeling Accuracy: Ensure the OCS label or hangtag is present and correct. Check for any other required labels (country of origin, care instructions).

- Visual Quality Check: Confirm the goods meet the agreed AQL (Acceptable Quality Level) standard. A shipment failing basic quality will also fail at customs if inspected.

Document Compliance (The Critical Part):

- Draft Documents Review: Insist on reviewing draft versions of the Commercial Invoice, Packing List, and Bill of Lading before they are finalized. Check for:

- Value: Correct FOB/DDP value.

- Description: Accurate, detailed product descriptions matching the label.

- Harmonized System (HS) Codes: The correct HS code for the destination country. For example, the HS code for organic cotton garments is often the same as for conventional, but some countries have specific sub-codes. An error here triggers delays.

- OCS Transaction Certificate (TC) Draft: This is non-negotiable. You must see the draft TC and verify:

- Your company's name and address are correct as the "Consignee."

- The product description and quantities match the commercial invoice.

- The percentage of certified organic content is stated correctly.

- It references the correct upstream certificates.

In early 2024, a Canadian importer avoided a major issue because our pre-shipment process flagged a discrepancy: the draft commercial invoice listed "95% Organic Cotton," but the lab test report (which we also provide) confirmed 100%. Fixing this before export prevented a potential customs query for false declaration.

How to ensure the supplier's OCS chain-of-custody is intact?

Ask your supplier for a Documentation Packet that proves the chain. This should include:

- The final OCS TC for your garment shipment.

- The OCS TCs from the fabric supplier to the garment factory.

- The OCS certificate of the fabric mill or spinner.

This packet doesn't need to be submitted to customs initially, but you must have it. It's your proof if authorities question the organic claim. A supplier who hesitates to provide this is a red flag. At Fumao, because we control the fabric production, we compile this "chain-of-custody dossier" for every OCS order as a standard service. It’s part of the delivered value under DDP.

Mastering the Documentation: The Paperwork That Clears Customs

Under DDP, your supplier handles the filing, but you bear the risk of errors. You must understand the documents inside out. Customs authorities, especially in the EU and North America, are increasingly auditing environmental claims. They don't just look at the value; they look at the description and supporting evidence. Inconsistent paperwork is the #1 cause of DDP delivery failures.

The golden rule: Every document must tell the same story. The product description on the invoice, the packing list, the bill of lading, and the OCS TC must be harmonized.

What are the critical data points on the commercial invoice?

The commercial invoice is the king document. Customs uses it to assess duties and verify declarations. For OCS goods, these points are vital:

- Detailed Description: Don't just put "Men's T-Shirts." Use a description that includes material and certification. Example: "Men's Knitted T-Shirts, 100% Organic Cotton, OCS Certified (Certificate Ref: CU123456)."

- Correct Incoterm: Clearly state "DDP [Destination Port/Address]" (e.g., DDP Hamburg Warehouse).

- Accurate Value: The FOB value plus freight and insurance must be declared correctly for customs valuation. Hiding costs is illegal and risky.

- Country of Origin: Must be "China."

- HS Code: The destination country's HS code must be used. Your supplier's forwarder should confirm this. A resource like the World Customs Organization's HS code database can provide context, but the local forwarder's advice is final.

A mismatch between the invoice description ("Organic Cotton") and the product's physical label (missing certification info) is a classic reason for inspection.

How should the OCS TC be formatted and submitted?

The OCS TC is a stand-alone legal document from the certification body (e.g., Control Union, Ecocert). It does not replace the commercial invoice. Best practices for submission:

- Digital is Standard: It is almost always submitted electronically by the freight forwarder or customs broker as part of the entry packet.

- Reference on Invoice: As shown above, include a reference to the OCS TC number on the commercial invoice. This creates the link for customs.

- On-Demand Provision: Customs may not ask for it initially, but they can request it up to several years after import. You (and your supplier) must be able to produce it immediately. We provide our clients with a digital dossier containing all certificates, which they can provide to their broker or authorities in minutes.

The TC must clearly show the importer of record (your company) as the consignee. If your supplier is listed as the consignee, it may raise questions about who is making the organic claim in your market.

Choosing the Right DDP Partner: Beyond Price Per Piece

The cheapest DDP quote is often the most expensive. For certified goods, you need a partner who is an expert in both compliance logistics and certification integrity. Many trading companies offer DDP by simply outsourcing logistics; they become a mere middleman, losing control and visibility. When a problem arises, they point fingers between the factory and the forwarder, leaving you stranded.

Your DDP partner must be the single point of accountability, controlling or deeply managing both the manufacturing and the logistics flow.

What questions should you ask a potential DDP supplier?

Interrogate their process:

- "Can you provide a draft of all shipping and certification documents for our review before shipment?" (A 'no' is unacceptable.)

- "Who is your freight forwarder/customs broker in [Your Country]? Can we have their contact details?" (Reputable partners use reputable forwarders.)

- "What is your procedure if customs in my country questions the OCS certification? Who will resolve it and bear the cost?" (This should be clearly defined in the contract.)

- "Can you show me an example (redacted) of a complete documentation packet from a previous OCS DDP shipment to [Your Region]?"

- "Do you have experience with DDP shipments to my specific country? Are there any specific label or marking requirements?" (E.g., the UK has its own UKCA marking; the EU has specific language requirements for labels.)

Their answers will reveal if they are procedural experts or just order-takers.

Why does vertical integration matter for DDP safety?

Vertical integration (like ours at Shanghai Fumao) is your greatest safety feature. Because we manage the fabric production, weaving, and often the garment manufacturing through controlled partners, we have direct control over the chain-of-custody from the very beginning. This means:

- No Information Gaps: We don't have to ask a fabric mill for certificates; we generate them. This eliminates delays and errors in the documentation chain.

- Single-Point Accountability: When you have a problem, you call us. We don't blame "the factory" because we are the factory for the key certified component. We manage the logistics partner directly.

- Proactive Problem Solving: We understand how the certification data flows into the logistics documents. We can proactively structure the commercial invoice and packing list to align perfectly with the OCS TC, because we created all of them.

A U.S. client in 2023 switched to us for DDP OCS hoodies after their previous supplier's shipment was held at LAX for 18 days. The issue? The supplier's invoice listed an OCS TC number that belonged to a different batch of fabric. The supplier was just a trader who copied an old TC. Our integrated system makes such a error impossible.

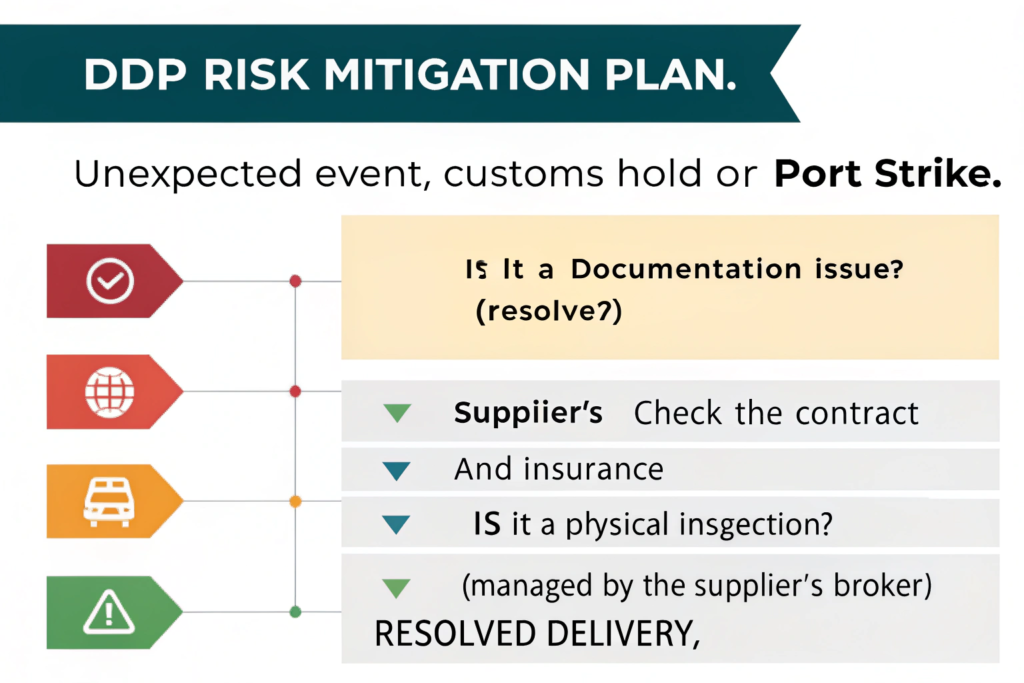

Risk Mitigation & Contingency Planning for the Unthinkable

Even with perfect planning, things can go wrong: strikes at ports, customs system outages, random intensive inspections. Safe DDP importing means having contingency plans for these scenarios. Your contract and understanding with the supplier must clarify where liability lies when forces beyond anyone's control strike.

The core principle: Under DDP, the supplier is responsible for delivering the goods to your named place, paying all duties and taxes. However, the commercial risk of the goods themselves—whether they are sellable, certified, and as ordered—always remains with you, the buyer. You must insure accordingly.

Who bears the cost of customs delays or seizures?

This must be crystal clear in your contract or purchase order terms.

- Delays due to Supplier Documentation Errors: The supplier should bear all resulting costs—demurrage (container detention), storage, and any fines. This is why the pre-shipment document review is your shield.

- Delays due to Random Customs Inspections: Under true DDP terms, the supplier is responsible for getting the goods through customs. A reputable supplier will have a capable local broker who manages this process. The associated costs (examination fees, potential extra handling) should be part of their DDP cost structure. However, the time delay is a risk you bear commercially.

- Seizures due to Non-Compliance: If goods are seized because they are unsafe, counterfeit, or grossly mis-declared, this typically falls back on the supplier's fundamental breach of contract. But the legal battle is costly. Prevention is everything.

Always ensure your supplier has shipped the goods under an appropriate insurance policy (e.g., All Risk marine insurance) that covers the goods for their full DDP value until delivery at your warehouse.

How to verify certification after goods arrive?

Your due diligence doesn't end at delivery. Conduct a post-delivery audit:

- Physical Audit: Spot-check garments against the OCS TC and invoice.

- Database Verification (if available): Some certifiers like Control Union have online databases where you can verify a TC number's authenticity. While not all do, it's a powerful check. You can learn more about how to verify the authenticity of textile sustainability certificates.

- Archive Everything: Store the entire digital documentation packet (invoice, BL, packing list, OCS TC, test reports) in a secure, accessible location. You may need it for a retailer's audit or a consumer inquiry years later.

This final step closes the loop, ensuring the system you paid for delivered exactly what was promised. It also prepares you flawlessly for any downstream customer or auditor.

Conclusion

Importing OCS-certified garments under DDP terms safely is a disciplined exercise in supply chain transparency and document integrity. It requires moving beyond a passive "door-to-door" mindset to an active "document-to-document" partnership. The safety of your shipment, the legitimacy of your certification, and the security of your investment all depend on the meticulous alignment of physical goods with flawless paperwork, managed by a single, accountable, and integrated partner.

The distributors and brands that succeed with DDP for certified goods are those who treat their supplier not as a vendor, but as a logistics and compliance extension of their own team. They verify, they review, and they plan for contingencies.

If you are looking for a DDP partner that combines vertical control over OCS-certified fabric with rigorous logistics management, making the complex simple and safe, let's talk. At Shanghai Fumao, we've built our DDP service precisely for importers who value certainty as much as cost. Contact our Business Director, Elaine, to discuss your next certified shipment: elaine@fumaoclothing.com. Let's deliver more than goods; let's deliver confidence.