As a fabric manufacturer who has shipped over 5,000 containers internationally, I've learned that accurate landed cost calculation isn't just accounting—it's strategic planning that determines your profit margins. Many importers focus only on the FOB price and get shocked when additional costs wipe out their projected profits. The landed cost is the total expense to get fabrics from your supplier's factory to your warehouse, including all hidden fees that often get overlooked until it's too late.

Landed cost encompasses four main components: FOB price, ocean freight charges, import duties, and brokerage fees. But within these categories lie numerous sub-costs that can surprise unprepared importers. I've seen companies lose money on orders because they didn't account for everything from peak season surcharges to harbor maintenance fees. Understanding and accurately calculating these costs upfront is what separates successful importers from those who struggle with unpredictable profitability.

Let me break down each component with real examples from our clients' experiences to help you master landed cost calculation.

What exactly is included in FOB pricing?

FOB (Free On Board) price forms the foundation of your cost calculation, but many importers don't fully understand what's included—and more importantly, what's not. FOB means the seller covers all costs until the goods are loaded onto the vessel at the origin port, after which responsibility transfers to the buyer.

The FOB price typically includes: fabric cost, domestic transportation to the Chinese port, origin port charges, export documentation fees, and loading onto the vessel. However, it excludes: ocean freight, insurance, destination port charges, customs duties, and domestic transportation from the destination port to your warehouse. We recently worked with a startup that budgeted based solely on FOB price and discovered their actual costs were 38% higher—nearly putting them out of business after their first container.

How do fabric quality and quantity affect FOB price?

Fabric quality directly impacts FOB price through raw material costs, production complexity, and quality control requirements. Similarly, order quantity affects price through economies of scale—larger orders typically have lower per-meter costs due to fixed cost absorption.

Here's how different factors influence FOB pricing:

| Factor | Impact on FOB Price | Example from Our Experience |

|---|---|---|

| Fiber Content | Premium fibers cost more | Organic cotton costs 25-40% more than conventional |

| Construction Complexity | Complex weaves/knits increase price | Jacquard fabrics cost 15-30% more than basic weaves |

| Order Quantity | Larger quantities reduce unit cost | Orders over 10,000 meters get 8-12% quantity discount |

| Finish Requirements | Special finishes add cost | Moisture-wicking treatment adds $0.35-0.75/meter |

Understanding these variables helps you make informed sourcing decisions. A client recently switched from 100% cotton to a cotton-polyester blend for their basic twill, reducing their FOB cost by 18% while maintaining performance. Resources like the comprehensive guide to textile costing variables provide deeper insights into these calculations.

What hidden costs often surprise first-time importers?

The most commonly overlooked FOB-related costs include: banking fees for international transfers, inspection costs if you hire third-party quality control, sample development fees, and costs for special packaging requirements. These can add 3-8% to your expected FOB costs.

We've seen clients forget to account for: LC (Letter of Credit) charges (0.5-1.5% of invoice value), testing and certification costs ($300-800 per fabric type), and specialized packaging for delicate fabrics (adding 2-4% to cost). One importer learned this lesson when their delicate velvet shipment required custom plastic cores and protective wrapping, adding $1,200 to a $25,000 order. Now we provide clients with a complete checklist of hidden FOB-related costs to prevent such surprises.

How do you accurately estimate ocean freight costs?

Ocean freight is often the most volatile component of landed cost, fluctuating based on season, fuel prices, port congestion, and global demand. Understanding the structure of freight charges helps you budget more accurately and identify potential savings opportunities.

Ocean freight consists of base ocean rates plus numerous surcharges and fees. The base rate covers transportation from port to port, while additional charges cover fuel (Bunker Adjustment Factor), currency adjustments, terminal handling, and peak season demands. During the pandemic, we saw freight costs increase by over 400% for some routes, devastating importers who hadn't built flexibility into their costing models.

What factors cause ocean freight rate fluctuations?

Ocean freight rates fluctuate based on supply and demand dynamics, fuel costs, seasonal patterns, and geopolitical factors. Understanding these drivers helps you time your shipments and negotiate better rates.

Key factors include: seasonal demand (pre-holiday shipments cost more), fuel price changes (impacting BAF charges), port congestion (adding congestion surcharges), and carrier capacity management. We help clients navigate these fluctuations by maintaining relationships with multiple carriers and providing rate tracking. Last year, we advised a client to shift their shipment schedule by three weeks to avoid peak season surcharges, saving them $4,200 on a single container. Industry resources like the Drewry World Container Index provide valuable market intelligence for freight cost forecasting.

How do container types and routing affect costs?

Container selection and routing significantly impact freight costs. Standard 40-foot containers are most cost-effective for fabric shipments, but high-volume or delicate fabrics may require specialized equipment. Routing decisions balance speed against cost, with direct routes costing more than transshipment options.

We typically recommend: 40-foot containers for most fabric shipments (optimizing cost per meter), proper container loading to maximize capacity, and balanced routing that considers both cost and transit time. For a client shipping heavy denim, we optimized container loading to fit 12% more fabric per container, effectively reducing their freight cost per meter by 9%. Understanding container optimization strategies for textile shipments can yield significant savings for volume importers.

How are import duties and taxes calculated?

Import duties represent a significant, often misunderstood component of landed cost. Duty rates vary based on fabric composition, construction, value, and country of origin. Misclassification can lead to either overpayment or penalties for underpayment.

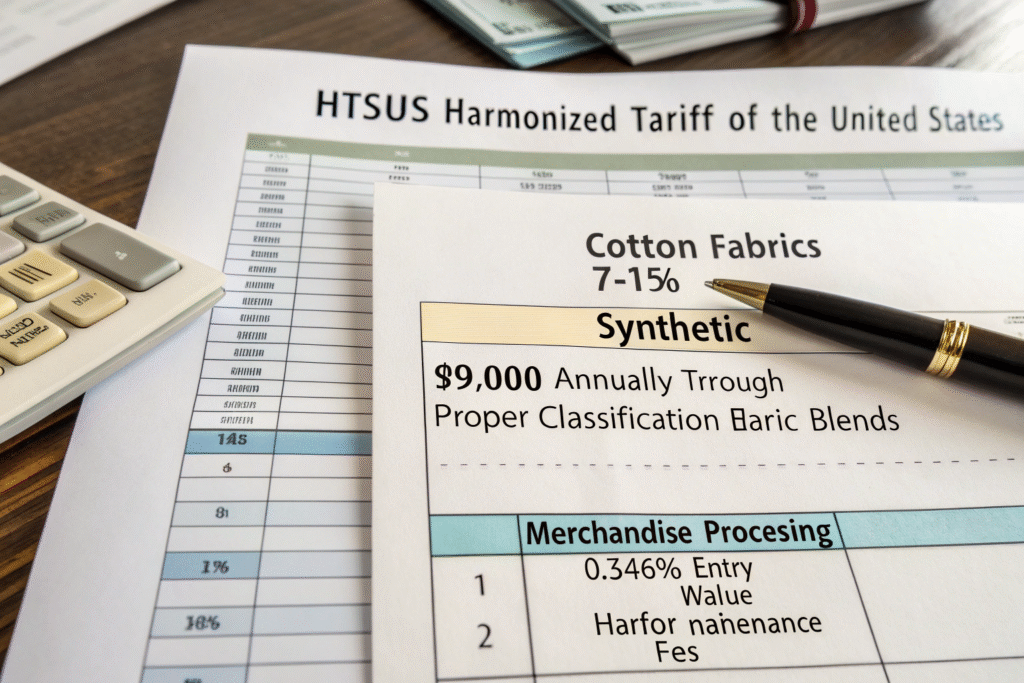

The duty calculation starts with proper HTSUS (Harmonized Tariff Schedule of the United States) classification. Textile rates vary widely—for example, cotton fabrics typically face 7-15% duty rates, while synthetic fabrics might be 10-20%. Additionally, you must consider merchandise processing fees (0.3464% of entry value, minimum $27.23) and harbor maintenance fees (0.125% of value). We saved a client approximately $9,000 annually by properly classifying their fabric blends to qualify for lower duty rates.

What HTSUS codes apply to different fabric types?

HTSUS codes are specific to fabric composition, construction, and sometimes finishing treatments. Correct classification is essential for accurate duty calculation and compliance.

Common textile categories include:

- Cotton fabrics: Chapters 52, HTSUS codes like 5208.11-5208.59

- Synthetic fabrics: Chapters 54-55, with specific codes for polyester, nylon, etc.

- Woven vs. knit: Different chapters based on construction

- Special finishes: Additional codes for coated, laminated, or otherwise treated fabrics

We maintain a database of HTSUS classifications for all our fabrics and review it quarterly for changes. When a client was incorrectly classifying their polyester-cotton blends as 100% cotton, we helped them correct the classification, reducing their duty rate from 14.9% to 8.5%. The U.S. International Trade Commission's HTS database is the official resource for current classifications.

How do trade agreements affect duty calculations?

Trade agreements can significantly reduce or eliminate duties for qualifying goods. Understanding and documenting eligibility for these programs can dramatically impact your landed costs.

Key programs include: USMCA (United States-Mexico-Canada Agreement), CBTPA (Caribbean Basin Trade Partnership Act), and AGOA (African Growth and Opportunity Act). Each has specific rules of origin and documentation requirements. We helped a client establish USMCA eligibility for fabrics woven and finished in our facilities, reducing their duties to zero and saving approximately $18,000 per container. Proper documentation for preferential trade agreement claims is essential for claiming these benefits.

What brokerage and destination charges should you expect?

Brokerage fees and destination charges encompass all costs from vessel arrival to warehouse delivery. These are often the most variable and least understood components of landed cost, with fees that can surprise unprepared importers.

Brokerage services typically cost $150-500 per entry, depending on complexity. Destination charges include: terminal handling charges ($200-600), pier passes ($40-125), customs examination fees (if applicable, $250-750), ISF filing fees ($25-75), and demurrage/detention charges if containers aren't moved promptly. We've seen clients incur thousands in demurrage fees due to documentation delays—one faced $3,200 in charges because their paperwork wasn't ready when the vessel arrived.

How do you choose between broker options?

Choosing a customs broker involves balancing cost against service quality, expertise, and reliability. The cheapest option often becomes expensive when errors cause delays or penalties.

We recommend selecting brokers based on: textile-specific experience, communication responsiveness, technology capabilities, and fee transparency. A good broker should provide a detailed breakdown of all expected charges upfront. We partner with several reputable brokers and can make recommendations based on your specific needs. One client switched to our recommended broker and reduced their average clearance time from 8 days to 3 days while saving 15% on brokerage fees through more efficient processing. Resources like the National Customs Brokers & Forwarders Association of America can help identify qualified providers.

What domestic transportation factors affect final costs?

Domestic transportation from the destination port to your warehouse involves multiple cost variables including distance, equipment requirements, fuel surcharges, and accessibility.

Key considerations include: trucking vs. rail options (rail is cheaper but slower), specialized equipment needs for temperature-sensitive fabrics, and warehouse receiving capabilities. For a client with limited dock space, we arranged for tailgate liftgate service, adding $150 per container but preventing much more expensive alternative handling costs. Understanding domestic drayage cost factors for textile imports helps budget this final cost component accurately.

Conclusion

Accurate landed cost calculation requires meticulous attention to each component: FOB price with all its variables, volatile ocean freight costs, complex duty calculations, and often-overlooked brokerage and destination charges. By understanding and accurately estimating each element, you can make informed sourcing decisions, maintain predictable profit margins, and avoid costly surprises.

Mastering landed cost calculation transforms importing from a gamble into a strategic business activity. If you need help calculating landed costs for your specific fabric requirements, contact our Business Director Elaine at elaine@fumaoclothing.com. We'll provide detailed cost breakdowns and help you optimize each component for maximum value.