As a fabric manufacturer and exporter for over two decades, I have witnessed many shifts in sourcing trends. Today, US buyers are rethinking their fabric supply chains due to rising tariffs on Indian textiles. For many, this shift is not about abandoning India’s heritage, but about securing better cost stability, quality control, and logistics efficiency. The US–China textile trade corridor has unique advantages that make it a strategic alternative for bypassing certain tariff impacts.

Yes — moving your sourcing from India to China can reduce tariff burdens, shorten delivery times, and strengthen your competitive edge. With China’s integrated production capabilities, exporters can offer consistent quality, innovative fabrics, and faster responses to market changes. This article explains why more US importers are making the switch, how to do it effectively, and which fabric categories benefit most.

Shifting a supply chain is never a light decision. It involves balancing cost structures, compliance requirements, and buyer expectations. But when tariffs start eroding your margins and delivery schedules become unpredictable, the decision to explore alternatives becomes urgent. China’s textile industry, with its vertically integrated production and mature export infrastructure, offers a practical pathway to regain control over costs and delivery reliability.

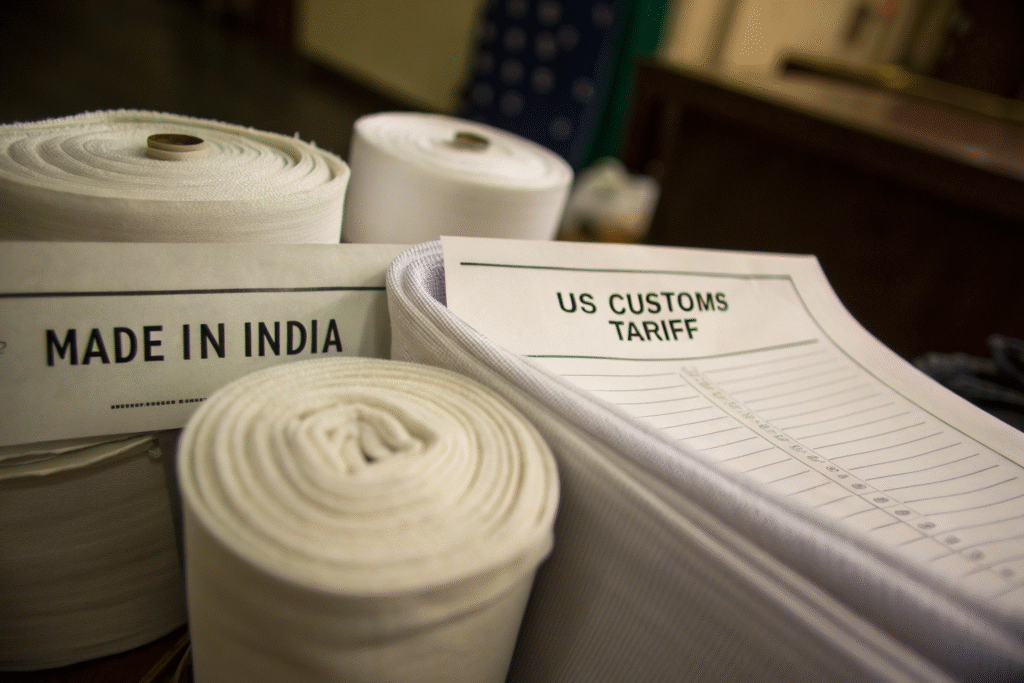

Why Are US Tariffs Hitting Indian Fabric Imports Harder?

Indian fabric exporters face growing tariff challenges, especially in synthetic blends, cotton, and technical fabrics. The US has applied Section 301-related duties and anti-dumping measures that significantly raise costs for US importers. While India remains a respected textile origin, the cost gap between Indian and Chinese sourcing is widening. Many importers also face shipping delays due to congestion at certain Indian ports, further increasing total costs.

China’s supply chain offers faster shipping, better vertical integration, and optimized costs that can offset or avoid certain tariff-related expenses. Even with higher operational costs in some Chinese regions, the efficiency and scale of production make the final price more attractive. Chinese ports like Ningbo and Shanghai handle massive textile export volumes with shorter turnaround times.

The tariff differential is not just about numbers on a customs declaration — it is about how those numbers translate into operational strain for US importers. Once higher duties are combined with added inland transport fees, port delays, and insurance premiums, the gap between Indian and Chinese sourcing can widen further, making China the more predictable choice.

What Specific Tariffs Are Affecting Indian Fabrics?

Recent US trade measures have increased tariffs on specific HS codes related to fabrics from India. According to the USITC database, some polyester-cotton blends now face duties above 20%. For importers using HTS search tools, the complexity of compliance makes cost prediction difficult. Products such as certain dyed cotton fabrics and synthetic blends are especially affected, and importers have reported unexpected cost spikes after customs reclassification.

Some US retailers have already scaled back on Indian-sourced polyester blends due to unpredictable customs duties, replacing them with Chinese alternatives that qualify for lower effective rates. This shift is not always about cost alone — it also improves supply predictability.

How Do Tariffs Translate into Price Disadvantages?

Indian FOB prices may appear competitive, but after factoring in tariffs, inland transport, and port congestion, the total landed cost can be 10–25% higher than Chinese alternatives. Reports from Trade Map show China’s scale and logistics efficiencies consistently keep prices lower for similar quality levels. The predictability of Chinese export operations also means fewer unexpected costs from demurrage or customs delays, which can erode margins even further.

For brands running tight seasonal launches, a delay of even two weeks due to customs issues in India can mean lost shelf space in US retail. This hidden cost is often more damaging than the tariff itself.

What Makes China’s Fabric Supply Chain More Resilient?

China’s textile hubs like Keqiao are built for resilience. Every step — from yarn preparation to final inspection — can be managed within a single industrial cluster. This reduces lead times, avoids middleman costs, and supports just-in-time production for US buyers. The result is a supply chain that can adapt quickly to demand changes, seasonal trends, and urgent re-orders.

The advantage lies in combining cutting-edge manufacturing technology with an established global shipping network. This creates a stable, scalable sourcing base for both small-batch custom orders and high-volume contracts. Even during global shipping disruptions, Chinese suppliers often secure priority loading slots at major ports, keeping delivery timelines intact.

Keqiao’s competitive edge is not only its manufacturing scale but also the ecosystem of complementary services. From dyeing plants to design studios and testing labs, everything is within logistical reach, creating a fluid, responsive environment for textile production.

How Does Vertical Integration Reduce Costs?

Keqiao’s supply chain integrates weaving, dyeing, printing, embroidery, coating, and packaging in one area. This allows suppliers like Fumao Fabric to cut lead times by up to 40%. Unlike fragmented supply chains, these clusters reduce handling fees and improve consistency. Buyers benefit from reduced freight between process stages, fewer quality disputes, and faster sample development, enabling brands to respond rapidly to consumer trends.

For example, a US sportswear brand that moved production from a multi-location Indian supply chain to a Keqiao-based network reduced average delivery time from 90 days to 52 days without sacrificing fabric quality.

What Role Does Technology Play in Quality and Speed?

Automation, AI trend analysis, and CNAS-certified testing labs allow Chinese mills to guarantee quality. Similar to SGS protocols, buyers can track shrinkage, colorfastness, and safety compliance through QR code data attached to each fabric roll. This digital transparency not only speeds up approvals but also builds trust between buyers and suppliers, reducing the need for costly rework or returns.

Some advanced mills have integrated real-time defect detection systems into their weaving machines, ensuring quality is verified at the point of production rather than at the end of the process.

How to Transition Your Fabric Sourcing from India to China?

Switching sourcing countries can be smooth if planned properly. The key is to match your fabric specifications while improving cost and lead time advantages. It is not enough to simply replace one supplier with another — the transition must be strategic to avoid production gaps and quality mismatches.

Preparation, supplier verification, and logistics alignment are critical to a successful transition. Importers must start with a thorough vetting process, confirm sample quality, and synchronize production schedules with retail timelines. Building clear communication channels with your new supplier is essential during the first orders.

A phased approach works best. Start with a trial order to assess fabric performance, communication responsiveness, and shipping accuracy before shifting the majority of your volume. Some US importers also keep a dual-supplier model for the first six months to minimize risk.

What Are the First Steps in Supplier Verification?

Request certifications like OEKO-TEX®, GRS, and ISO9001. Use sourcing platforms such as Alibaba or Global Sources to shortlist vendors, and then confirm quality through recent lab test reports and factory videos. A site visit or third-party audit can further validate claims about production capacity and compliance.

For higher assurance, ask for references from existing clients in the US market and verify them through independent channels.

How Do You Ensure Consistency During the Switch?

Run sample trials for comparison before committing to bulk orders. Engage inspection firms like QIMA to ensure your orders meet your brand’s standards before shipment. Establish a QC checklist that matches your current specifications, and require your supplier to follow it strictly for each batch.

In addition, create a clear fabric library with labeled swatches for reference, ensuring future orders match the agreed standards without variation.

Which Fabrics Benefit Most from a China Supply Chain Shift?

Not all fabrics offer equal savings when shifting to China. High-performance textiles, eco-friendly blends, and polyester-based fabrics often yield the most significant benefits. This is due to China’s large-scale specialization in these categories, which lowers production costs and ensures consistent quality.

These categories see both cost savings and quality enhancements when produced in China’s specialized facilities. US buyers looking for sustainability credentials also benefit from China’s rapid adoption of eco-certifications.

Chinese suppliers are increasingly investing in R&D for functional textiles. This includes moisture-wicking sportswear, UV-protection garments, and antibacterial uniforms, which are in high demand in the US retail and corporate sectors.

Are Performance Fabrics Cheaper from China?

Chinese mills produce large volumes of UV-resistant, moisture-wicking, and antibacterial fabrics, often at 15–30% lower landed cost than Indian sources. Factories certified by bluesign® or BSCI meet Western compliance standards. Their large production capacity also means they can handle both small runs for boutique brands and massive orders for global retailers.

One US outdoor apparel company reduced fabric procurement costs by 18% after switching its performance fleece sourcing to a Chinese mill that specialized in warp-knit technology.

How About Eco-Friendly Fabrics?

With strong investments in rPET, Tencel™, and organic cotton, China offers competitive pricing for sustainable textiles. Suppliers certified by Textile Exchange deliver short lead times and maintain EU/US compliance. This is especially valuable for brands seeking to align with consumer demand for sustainable fashion without compromising profitability.

In fact, some Chinese suppliers are now offering biodegradable fabric options, positioning themselves ahead of upcoming environmental regulations in Western markets.

How Do Chinese Suppliers Help with Tariff-Free Routes?

Some orders can qualify for reduced or zero tariffs by using Free Trade Zones (FTZs) or bonded warehouse re-exports. These strategies require precise documentation and compliance with both Chinese and US trade laws.

When properly documented, these routes help US buyers cut duty costs without breaching customs laws. They also offer flexibility in shipment consolidation, allowing importers to manage inventory more effectively.

While not every order qualifies for tariff reduction, strategic planning can maximize the number of shipments that do. Partnering with experienced logistics providers is crucial for executing this correctly.

What Is FTZ Processing and How Does It Work?

FTZs allow processing and re-export without paying certain duties in China. If goods meet US origin rules, they may enter with reduced tariffs. See US CBP guidelines for exact requirements. Many FTZ facilities also provide value-added services such as labeling, packaging, and quality inspection.

For some US buyers, this allows pre-shipment customization without triggering additional duties.

Are There Risks in Using Transshipment Routes?

Compliance is essential. Work with reputable forwarders like Flexport to ensure proper routing and documentation. Misclassification or incomplete paperwork can result in penalties, shipment delays, or seizure.

To avoid risk, always verify that your freight forwarder has experience with textile shipments under US trade law.

How to Secure Long-Term Cost Stability?

For many buyers, stability is as important as immediate savings. Locking in pricing and securing consistent quality reduces future risks. Long-term partnerships also create better negotiation leverage during raw material cost fluctuations.

Long-term contracts and currency management tools can safeguard margins. This is especially important for importers with annual purchasing cycles tied to retail seasons.

Well-structured agreements protect both parties, ensuring supply reliability for buyers and order security for manufacturers. Trust built over time also fosters better collaboration on new product development.

Can Contracts Protect Against Price Volatility?

Yes, fixed-price agreements for 6–12 months can shield buyers from raw material price spikes. Organizations like CCCT connect buyers with reliable mills. Price locks combined with agreed delivery schedules help avoid last-minute price hikes during high-demand seasons.

Some importers even negotiate tiered pricing structures to accommodate different order volumes without losing cost stability.

How Does Currency Hedging Help?

Using services like OFX lets importers lock exchange rates, ensuring predictable landed costs over multiple shipments. This is particularly beneficial for companies paying in RMB but selling in USD, as it prevents sudden cost increases caused by currency fluctuations.

Hedging tools can be integrated into supplier contracts, aligning financial and operational planning.

Conclusion

By shifting fabric sourcing from India to China, US buyers can bypass certain tariff impacts, cut lead times, and maintain or improve product quality. The key is careful supplier selection, transparent quality control, and leveraging China’s integrated supply chain advantages. From performance and sustainable fabrics to tariff-free routing strategies, China offers a competitive edge in today’s complex trade environment.

If you’re ready to explore this opportunity, our team at Shanghai Fumao can guide you through every step — from sample development to final shipment. Contact our Business Director Elaine at elaine@fumaoclothing.com to discuss your next fabric order.