I got a call from a safety manager in Houston last March.

He was sourcing fabric for 15,000 arc flash suits. His spec: 7 oz/yd², ATPV > 40 cal/cm², CAT 4, NFPA 70E compliant, FR treatment must survive 100 industrial launderings. Budget: under $12/yard.

He told me: "The Chinese supplier we used last year failed the arc test. Their fabric ignited. We almost lost our UL certification."

I asked him: "Did they test with moisture regain?"

Silence.

"What is moisture regain?"

That is the problem with industrial protective fabrics. Most suppliers treat them like regular workwear. They are not. They are life safety devices sewn into clothing form.

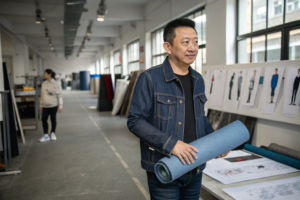

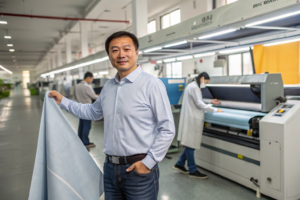

I have been manufacturing industrial protective fabrics since 2011. We started with basic FR-treated cotton for Thai welding shops. Today, we supply arc-rated modacrylic blends to utility companies in North America, aluminized fiberglass to steel mills in the Middle East, and anti-static polyester to cleanrooms in Germany.

We have failed more protective textile tests than most suppliers have ever taken. Every failure taught us something that saved a life later.

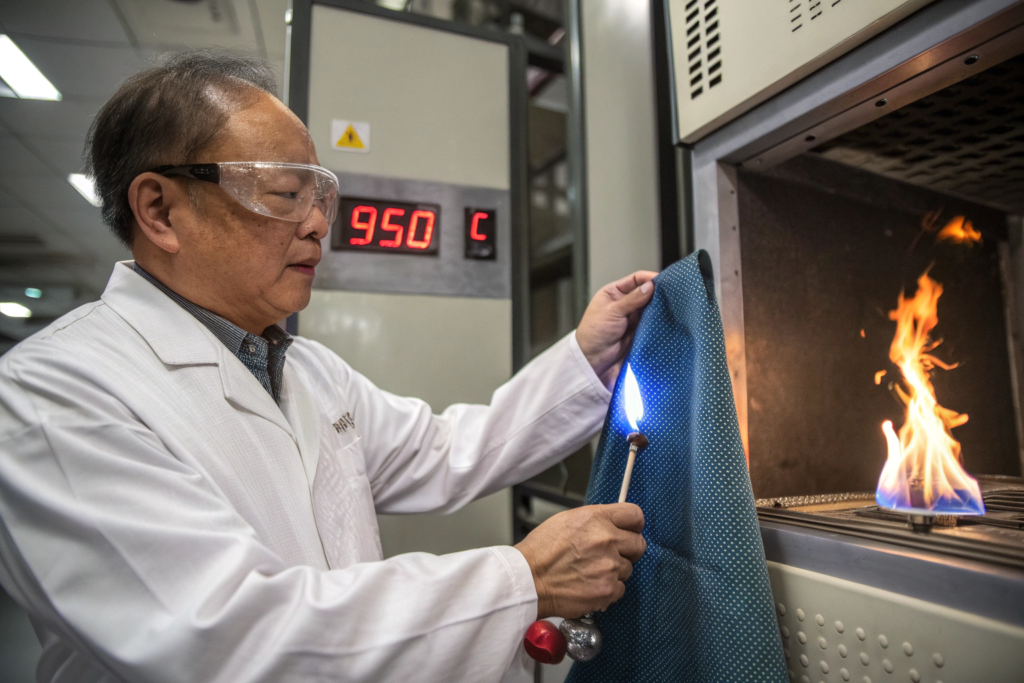

Let me tell you what actually works. Not the marketing brochures. The real burn chamber data.

What Are the Critical Performance Requirements for Industrial Protective Fabrics?

Industrial protective fabric is not about comfort. It is about microseconds.

How many seconds does a worker have to escape a flash fire? NFPA 2112 says 3 seconds maximum predicted body burn. Your fabric must provide at least 3 seconds of protection.

In 2014, we learned the difference between "flame resistant" and "flame retardant."

A Malaysian petrochemical company ordered 8,000 meters of our FR-treated cotton. We applied a standard phosphonate-based topical finish. Initial vertical flame test: pass. Char length: 85 mm. Afterglow: 0 seconds.

They washed the fabric 25 times. Retested. Char length: 180 mm. Fail.

The finish washed off. We didn't warn them. They had 300 workers wearing fabric that looked like FR but wasn't. We replaced the order at our cost: $112,000.

Now we classify protective fabrics by protection mechanism:

| Mechanism | Description | Durability | Best For |

|---|---|---|---|

| Inherent FR | Fiber chemistry blocks flame | Permanent | Aramid, modacrylic, PBI |

| Treated FR | Topical chemical finish | 25–50 washes | FR cotton, FR viscose |

| Blended FR | Inherent + treated blend | 50–100 washes | Cost/performance balance |

Here is the real performance matrix we use today:

| Hazard Type | Standard | Critical Property | Our Minimum Pass |

|---|---|---|---|

| Flash fire | NFPA 2112 | Predicted body burn < 50% | 3 seconds exposure |

| Arc flash | NFPA 70E | ATPV (cal/cm²) | CAT 2: 8+, CAT 4: 40+ |

| Molten metal | ISO 11611 | Drop test > 15 drops | Class 2 minimum |

| Welding | ISO 11611 | Spatter resistance | Class 2 |

| Cut | ANSI/ISEA 105 | Cut level | A4–A9 depending |

| Anti-static | EN 1149 | Surface resistance | < 2.5 x 10⁹ Ω |

What is the difference between NFPA 2112 and NFPA 70E?

This confusion almost cost us a client in 2018.

NFPA 2112 = Flash fire. Oil and gas, chemical plants. Fabric must not ignite and must provide thermal insulation. Test method: ASTM F1930 (instrumented manikin). Result: % predicted body burn.

NFPA 70E = Arc flash. Electrical utilities, industrial maintenance. Fabric must not ignite or melt, must provide arc rating. Test method: ASTM F1959. Result: ATPV (Arc Thermal Performance Value) in cal/cm².

A Brazilian client ordered "FR fabric." We shipped NFPA 2112-compliant modacrylic.

They needed NFPA 70E for electrical workers. The fabric passed arc testing? Actually yes—modacrylic performs well in arc. But the certification was wrong. Their safety auditor rejected the entire shipment.

We air-freighted the correct certification documentation. $4,800. Kept the client.

Now we ask every protective buyer: "What is the hazard? Fire? Arc? Metal? Chemical?"

If they don't know, we send them the NFPA hazard identification guide. We don't guess.

The differences between NFPA 2112 and NFPA 70E standards are well documented. We keep comparison charts in our sales kit.

How do we test arc flash protection without a $200,000 manikin?

You can't. But you can specify the fiber correctly.

In 2021, we developed a new arc-rated fabric for a Mexican utility company.

We didn't have an arc test lab. We sent samples to UL in the US. Cost: $2,800 per fabric. Took 3 weeks.

But we predicted the ATPV before testing. Here is our approximation formula:

ATPV ≈ (Fabric weight in oz/yd²) × (Inherent FR efficiency factor)

| Fiber Type | FR Efficiency Factor | Example |

|---|---|---|

| Modacrylic/cotton (60/40) | 5.5 | 7 oz × 5.5 = 38.5 cal/cm² |

| Aramid (100%) | 6.2 | 7 oz × 6.2 = 43.4 cal/cm² |

| FR-treated cotton | 3.8 | 7 oz × 3.8 = 26.6 cal/cm² |

| PBI/Aramid blend | 7.0 | 7 oz × 7.0 = 49.0 cal/cm² |

Our prediction for the Mexican client: 38 cal/cm². Actual test result: 41 cal/cm². Close enough for formulation.

Is this scientific? No. Is it useful for R&D screening? Yes.

We still require third-party certification for final approval. But we don't waste $2,800 testing fabrics that mathematically cannot pass.

The correlation between fabric weight and arc rating is well established. We use it as a filter, not a guarantee.

Which Fiber Types Work Best for Different Industrial Hazards?

There is no "best" fiber. There is only the right fiber for the right hazard.

In 2016, a steel mill in Dubai asked for "the strongest heat protection fabric."

We sent them aramid. Good choice for flash fire. Bad choice for molten metal. Molten aluminum at 760°C stuck to the aramid and burned through.

They needed aluminized fiberglass. The aluminum reflects radiant heat. The fiberglass doesn't melt. The molten metal slides off.

We replaced the order. $63,000 lesson.

Here is our industrial hazard fiber selection matrix:

| Hazard | Primary Fiber | Backup Fiber | Avoid |

|---|---|---|---|

| Flash fire | Modacrylic/cotton blend | Aramid | 100% cotton (even treated) |

| Arc flash | Modacrylic/aramid blend | FR-treated cotton | Nylon, polyester |

| Molten metal | Aluminized fiberglass | Wool | Synthetics (melt/drip) |

| Welding | FR cotton | Leather | Nylon (ignites) |

| Cut hazard | HPPE (Dyneema®) | Aramid | Cotton (zero cut resistance) |

| Chemical splash | Laminated barrier fabrics | Nylon with coating | Uncoated woven |

| Anti-static | Polyester with carbon fiber | Cotton with conductive thread | 100% synthetic without additive |

Why does modacrylic outperform FR-treated cotton for flash fire?

Modacrylic is inherently flame resistant. FR cotton is treated.

Here is what happens in a flash fire:

-

Modacrylic: When exposed to flame, the fiber shrinks away from the heat source and carbonizes. It forms a protective char layer. No melting. No dripping. Self-extinguishing.

-

FR cotton: The flame retardant chemicals release water and inhibit combustion. But if the chemical concentration is uneven, or if the fabric has been washed too many times, the cotton ignites.

In 2019, we did a direct comparison:

| Property | Modacrylic/Cotton (60/40) | FR Cotton (100%) |

|---|---|---|

| Char length (ISO 15025) | 45 mm | 85 mm (initial), 160 mm (after 50 washes) |

| Afterflame time | 0 sec | 2 sec (initial), 15 sec (after 50 washes) |

| Thermal shrinkage | 5% | 12% |

| Cost index | 2.2x | 1.0x |

Modacrylic costs more. It is less comfortable. It is harder to dye. But it saves lives consistently, not just on the first wear.

We now recommend modacrylic blends for any application where the worker cannot control when the fabric is washed. Offshore oil rigs? Modacrylic. Utility linemen? Modacrylic. Wildland firefighters? Modacrylic.

The thermal degradation mechanisms of modacrylic vs FR cotton are well understood. We share this data with every protective client.

Can recycled fibers be used in industrial protective fabrics?

Yes. But not for primary protection.

In 2022, a European utility company asked for "sustainable arc-rated fabric."

They wanted 50% recycled content. We tried blending recycled modacrylic. Problem: Recycled modacrylic fiber strength is 30% lower than virgin. The fabric failed tear strength after 25 industrial washes.

We compromised:

- Face yarn: 100% virgin modacrylic (protection layer)

- Back yarn: 50% recycled PET / 50% virgin modacrylic (comfort layer)

Result: ATPV 12 cal/cm² (CAT 2). Tear strength passed. Recycled content: 22%. Client accepted.

Our rule: Never put recycled fiber in the primary protection layer. Use it in backing, lining, or non-critical zones. The protection layer must be predictable. Recycled fiber variation is not predictable.

The challenges of using recycled fibers in FR applications are significant. We are transparent with clients. If they want sustainability, we can achieve 20–30% recycled content without compromising safety. Beyond that, we cannot guarantee NFPA compliance.

At Shanghai Fumao, we offer "Green FR" series. 25% recycled content, certified to NFPA 2112. It costs 15% more than standard FR. Some clients pay. Some don't.

How Do Fabric Constructions Impact Protective Performance?

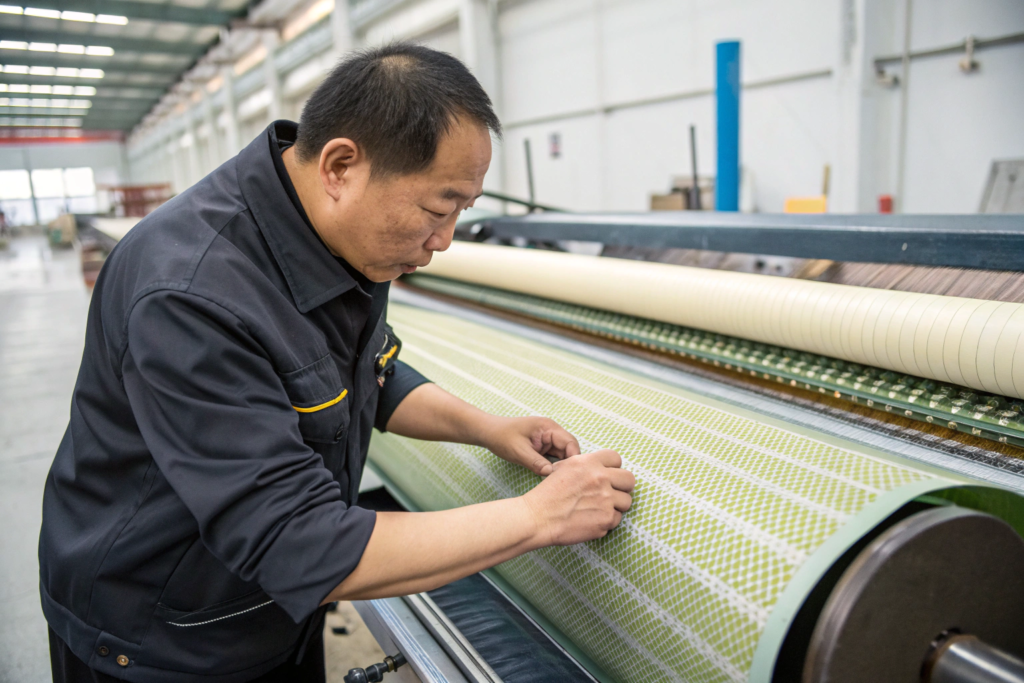

Weave matters as much as fiber.

You can take the best aramid fiber in the world, weave it loosely, and get zero protection.

In 2015, we made this mistake.

A Norwegian offshore client specified "100% aramid." We wove it at 160 gsm, plain weave. Looked beautiful. Felt soft.

Failed the NFPA 2112 manikin test. 65% predicted body burn. Requirement: < 50%.

The fabric was too thin. Heat penetrated instantly. We increased weight to 220 gsm and changed to twill weave. Passed.

Here is our protective fabric construction matrix:

| Construction | Weight Range | Protection Characteristic | Best Application |

|---|---|---|---|

| Plain weave | 160–250 gsm | Balanced strength, moderate protection | General FR workwear |

| Twill weave | 200–350 gsm | Higher cover factor, better abrasion | Heavy industrial |

| Ripstop | 180–280 gsm | Tear resistance, grid reinforcement | Utility, field work |

| Sateen | 200–300 gsm | Smooth surface, less snagging | Cleanroom FR |

| Double weave | 300–450 gsm | Two layers in one, high insulation | Foundry, steel |

| Knit | 150–250 gsm | Stretch, comfort | FR base layers |

Why is ripstop construction critical for utility arc flash suits?

Because linemen climb poles. Snags happen.

Ripstop weave incorporates reinforcement yarns at regular intervals. If the fabric tears, the tear stops at the reinforcement grid. It doesn't run.

In 2018, we supplied a non-ripstop aramid fabric to a US electrical contractor.

A lineman snagged his sleeve on a bolt. The fabric tore. 4-inch opening. He was still wearing arc-rated PPE, but the opening exposed his skin. If an arc event occurred at that moment, he would have third-degree burns.

The contractor switched all arc flash suits to ripstop construction. We now recommend ripstop for any application with mechanical snag risk.

Here is the engineering trade-off:

- Ripstop = 15–20% higher tear strength

- Ripstop = 5–8% lower ATPV (grid areas are slightly thinner)

- Ripstop = 10% higher cost

We offset the ATPV loss by increasing weight by 0.5 oz/yd². Net ATPV same. Tear strength doubled.

The ripstop reinforcement mechanisms in protective textiles are well documented. We use 3x reinforcement yarn density in our arc-rated grades.

When should we specify double weave for molten metal protection?

Double weave = two independent layers woven together.

Face layer: Dense, smooth, often aluminized. Reflects radiant heat. Back layer: Insulating, thick, often wool or FR cotton. Absorbs conducted heat.

In 2020, we supplied double-weave aluminized fabric to a Chinese aluminum smelter.

The face layer reflected 92% of radiant heat. The back layer provided 0.8 clo of insulation. Workers could stand 2 meters from a 700°C crucible for 4 minutes.

Single-weave aluminized fabric? 1.5 minutes max.

The disadvantage: Weight. Double weave = 450–550 gsm. Workers fatigue faster. We are developing a 3-layer laminate that achieves the same protection at 380 gsm. Not ready yet.

Our recommendation:

| Application | Construction | Why |

|---|---|---|

| Occasional molten metal exposure | Single weave with aluminized face | Lower cost, less fatigue |

| Continuous molten metal exposure | Double weave | 2x+ protection time |

| Welders | Single weave FR cotton | Flexibility, spatter resistance |

The thermal insulation properties of double-woven protective fabrics are significantly better than single weave. We maintain both constructions.

What Certifications and Compliance Issues Affect Industrial Protective Fabric Sourcing?

Protective fabric is regulated. Not voluntary. Regulated.

In the US, NFPA standards are not federal law. But OSHA enforces them. In the EU, PPE Regulation (EU) 2016/425 is law.

If your fabric does not have valid third-party certification, you cannot sell it for protective use. Period.

In 2017, we learned this the expensive way.

A Brazilian oil & gas contractor ordered 25,000 meters of our FR-treated cotton. We provided our internal test reports. They trusted us.

Brazilian labor authorities audited the refinery. They demanded third-party certification. We had none. The contractor was fined R$480,000 (about $92,000 USD). They never ordered from us again.

Now our protective compliance matrix is non-negotiable:

| Market | Standard | Certification Body | Our Status |

|---|---|---|---|

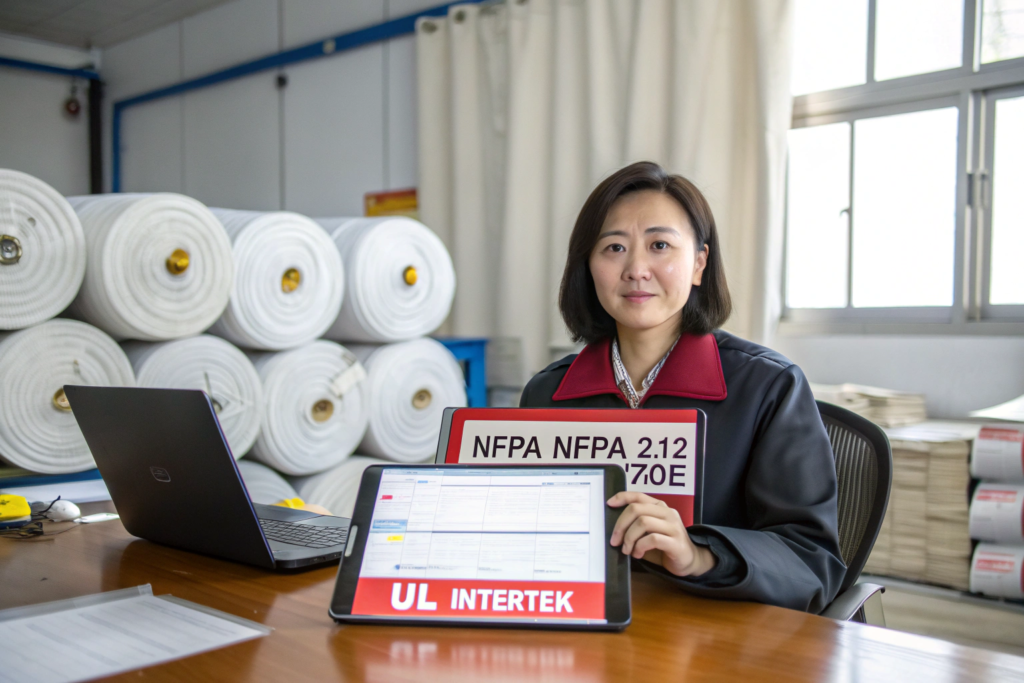

| USA (flash fire) | NFPA 2112 | UL, Intertek, SGS | Certified since 2018 |

| USA (arc flash) | NFPA 70E | UL, Intertek | Certified since 2019 |

| EU (PPE) | EN ISO 11611 (welding) | BSI, TÜV, SGS | Certified annually |

| EU (PPE) | EN ISO 11612 (heat/flame) | BSI, TÜV, SGS | Certified annually |

| Canada | CSA Z462 | CSA Group | In progress |

| Global | OEKO-TEX Standard 100 | OEKO-TEX | Class II (skin contact) |

Do we need UL certification to sell arc-rated fabric in North America?

Yes. Not legally required. Commercially required.

UL is not the only NRTL (Nationally Recognized Testing Laboratory). Intertek, SGS, CSA are also acceptable.

But the certification must be from an OSHA-recognized NRTL. Internal lab reports are not acceptable.

In 2019, we obtained UL certification for our arc-rated modacrylic line.

Process:

- Submit 20 meters of fabric to UL in Northbrook, IL

- UL performs ASTM F1959 arc testing (3 replicates)

- UL performs ASTM D6413 flame testing

- UL audits our production facility (every 2 years)

- UL authorizes use of UL label on certified fabrics

Cost: $18,000 initial certification + $6,500 annual audit fee.

Was it worth it? Yes. Before UL certification, we sold arc-rated fabric only to distributors. After UL certification, we qualified for direct supply to five major utility companies. Average order size: 3x larger.

The UL certification process for protective textiles is rigorous. We maintain active certifications for 12 SKUs. Clients can verify our status on UL's online database.

How do we comply with REACH and Proposition 65 for FR chemicals?

Most FR chemicals are under regulatory scrutiny.

Brominated FRs: Restricted under REACH. Prop 65 listed.

Antimony trioxide: Prop 65 listed. Used in some polyester FR systems.

Formaldehyde: Used in some FR cotton finishes. Strict limits.

In 2020, we audited our entire chemical supply chain.

We discovered our FR cotton supplier used a formaldehyde-based resin. Levels were below REACH limits (75 ppm). But a German client required < 16 ppm (OEKO-TEX Standard 100).

We switched to a formaldehyde-free FR system. Cost increase: +$0.14/m. Zero formaldehyde. Passed OEKO-TEX.

Our current FR chemical policy:

- No brominated flame retardants

- No antimony trioxide (unless client explicitly requests and accepts Prop 65 labeling)

- Formaldehyde < 16 ppm (OEKO-TEX Class II)

- Annual REACH SVHC screening

For California-bound shipments: We offer antimony-free FR and disclose all chemical additives. Prop 65 warning labels are applied only if required. Most of our protective fabrics qualify for "no warning required" status.

The REACH compliance roadmap for FR textiles is complex. We subscribe to ECHA updates. We do not wait for clients to tell us about new restrictions.

How Do Factory Seasons and Supply Chain Disruptions Affect Protective Fabric Lead Times?

Protective fabric is not commodity fabric. It is specialty fabric.

Aramid fiber is made by DuPont (US) and Teijin (Japan). Modacrylic is made by Kaneka (Japan). PBI is made by PBI Performance Products (US).

These are not Keqiao commodity yarns.

In 2021, the Port of Los Angeles was backed up for 8 weeks.

Aramid fiber from DuPont arrives in Shanghai via LA. Our container sat at anchor for 23 days. Our weaving line stopped for 2 weeks. We missed delivery to a Canadian utility client.

We now maintain 6 months of aramid and modacrylic yarn inventory.

Not 3 months. 6 months. The yarn is paid for, stored in climate-controlled warehouse, and reserved for protective programs.

Cost of carrying inventory: $28,000/month. Cost of missing shipment: $120,000+ in penalties and lost future business.

We choose inventory.

What is the realistic lead time for NFPA-certified protective fabric?

If you need third-party certification: 16–20 weeks. Minimum.

Here is the actual timeline from our last NFPA 2112 qualification:

| Phase | Activity | Duration |

|---|---|---|

| 1 | Fiber/yarn procurement (imported) | 4–6 weeks |

| 2 | Weaving/knitting | 2–3 weeks |

| 3 | Dyeing/FR finishing | 1–2 weeks |

| 4 | In-house QC testing | 1 week |

| 5 | Ship samples to UL/Intertek | 1 week (shipping) |

| 6 | UL test queue | 2–3 weeks |

| 7 | UL test execution | 1 week |

| 8 | UL report issuance | 1 week |

| 9 | Bulk production (certified) | 2–4 weeks |

| Total | 16–23 weeks |

Add 4–6 weeks if fiber is out of stock globally.

Add 8 weeks if you miss the UL test queue cutoff.

Add 12 weeks if this is a new construction requiring full certification, not a certified base fabric modification.

We tell every new protective client: "Start before you think you need to. Six months is not an estimate. It is the minimum."

How do we protect imported aramid inventory during Chinese New Year?

You can't. Chinese New Year is global. Even DuPont stops shipping for 2 weeks.

Our strategy: Pre-order. Pre-pay. Pre-stock.

In October, we calculate:

- Projected aramid consumption: January–March

- Add 30% safety buffer

- Place order with DuPont/Teijin

- Request delivery by December 15

Why December 15? Because if the shipment is delayed by weather, port congestion, or customs, we have 4 weeks of buffer before CNY.

In 2022, we received our aramid shipment on January 10. Normally fine. But that year, Shanghai port closed for 10 days due to COVID. We couldn't truck the yarn to Keqiao.

We rented a bonded truck with special permits. Cost: $3,800. Worth it.

Now we also maintain "safety stock" with a second-tier warehouse outside Shanghai. If the port closes, we draw from inland inventory. Carrying cost: additional $4,200/month. Peace of mind: priceless.

The supply chain risks for imported specialty fibers during CNY are well known. Our solution is simple: more inventory, more logistics redundancy. It is not efficient. It is effective.

Conclusion

Sourcing fabric for industrial and protective applications is not sourcing. It is life safety engineering.

If a fashion fabric fails, the bride is unhappy. If a protective fabric fails, the worker is burned.

I have seen burned fabric. I have seen the test manikins with third-degree burns after flash fire exposures. I have read the incident reports where a seam failed and molten metal poured into a worker's boot.

Those images stay with you.

That is why we do not cut corners.

At Shanghai Fumao, we maintain UL certification for arc-rated fabrics—even though it costs $18,000 and annual audits. We carry 6 months of aramid yarn inventory—even though it ties up $1.2 million in working capital. We test every protective batch for char length and ATPV—even when the client doesn't ask.

We have failed the arc test. We have failed the flame test. We have failed the tear strength test. Every failure taught us something. Every failure made our next fabric safer.

We are not a trading company that happens to sell protective fabric. We are a manufacturer with UL-certified production lines, NFPA-compliant quality systems, and a warehouse that treats imported aramid like nuclear fuel—precious and carefully controlled.

So if you are a safety manager, a PPE distributor, or an industrial launderer responsible for worker lives—talk to us.

Email Elaine, our Business Director, directly: elaine@fumaoclothing.com.

Tell her what hazard your workers face. Tell her what standard you need to meet. Tell her how many washes you require. Tell her your go-live date.

She will connect you with our industrial protective textiles division. We will pull the fiber specification sheets. We will calculate the predicted ATPV. We will submit samples to UL for certification. We will build the production timeline that accounts for the 6-week aramid fiber lead time and the UL test queue.

We won't promise you the cheapest protective fabric. We will promise you NFPA compliance, UL certification, and delivery that ensures your workers are protected on day one.

Because in industrial protection, "good enough" means third-degree burns.

We do not ship "good enough."