If you're sourcing fabrics from China, you’re probably battling that nagging feeling: am I missing the next big thing? While you're finalizing one season's order, the trend cycle in fashion and textiles has already spun twice. The disconnect is real, especially when you're thousands of miles away. But what if your geographical distance from the epicenter of global textile manufacturing—China's Keqiao district—could become your biggest advantage instead of a liability?

Staying ahead of global fabric trends isn't about having a crystal ball; it's about having the right antennae planted directly in the soil where trends are woven, dyed, and finished. For over 20 years at the heart of Keqiao, we've seen countless international brands transform from trend-followers to trend-setters by mastering a few key channels. The secret lies in building a proactive, intelligence-driven sourcing strategy that taps into China's dynamic manufacturing ecosystem in real-time.

This guide will unpack the practical, actionable methods that successful brands use to not just keep up, but lead. From leveraging digital showrooms to decoding pre-production signals from major manufacturers, you'll learn how to build a reliable trend radar. Let's dive into how you can turn insights from the world's textile capital into your next bestselling collection.

How to Use Chinese B2B Platforms for Trend Forecasting?

You might think of Alibaba as just a marketplace for transactions. But for the savvy buyer, it's a live, global feed of what's coming next in fabrics. The key is shifting from a search-and-buy mindset to a research-and-analyze one. The volume and velocity of new product listings and supplier activities on these platforms create a powerful dataset for predicting shifts in color, texture, and fiber popularity months before they hit mainstream retail.

At Shanghai Fumao, our team dedicates hours each week not just to managing our own storefront on Alibaba and Made-in-China.com, but to studying our competitors and the wider platform. We monitor which new fabric listings from major mills are getting the most inquiries and sample requests. This "digital heatmap" often reveals emerging trends. For instance, in early 2023, we noticed a 300% spike in sample requests for GOTS certified organic cotton blends with recycled polyester on these platforms. This wasn't just a blip; it was a signal. We immediately ramped up our stock and development for such blends, positioning us perfectly when a major European sportswear brand came looking for exactly that specification by Q3.

What Are the Key Signals to Monitor on Supplier Pages?

Don't just look at the product images. Dig deeper. First, check the "New Arrivals" or "Hot Products" section of your trusted suppliers frequently. The types of fabrics featured here indicate what the factory is betting on. Second, monitor changes in their "Capability" or "R&D" descriptions. When a supplier suddenly highlights new moisture-wicking finishing technology or a jacquard loom upgrade, it's a clue about where industry investment is flowing. Third, and most crucially, read the reviews and Q&A sections. The questions buyers are asking—about a fabric's sustainability certification, weight, or stretch recovery—reveal the market's evolving priorities. A great resource to understand how to interpret these signals is this guide on how to decode supplier communications on global B2B platforms.

How Can You Leverage Platform Analytics Tools?

Most premium B2B platform accounts offer basic analytics. Use them. Look at the "Keywords Buyers Use" report to see what search terms are trending upward. A sudden rise in searches for "biodegradable spandex" or "zero-carbon discharge dyeing" is a powerful trend indicator. Additionally, use the platform's RFQ (Request for Quotation) feed. Analyzing the detailed specifications in public RFQs shows you what exact products buyers are actively seeking, often 6-8 months before their selling season. For a deeper dive into using data for sourcing, industry forums like Sourcing Journal often publish analyses on sourcing data trends that can validate your findings.

Why Are Virtual Showrooms and Digital Swatch Services Game-Changers?

The old model of waiting for physical swatch books to arrive by courier is dead. It was slow, expensive, and environmentally wasteful. Today, the brands that move fastest are those using virtual showrooms and digital swatch services offered by forward-thinking suppliers. These tools provide instant, visual access to a supplier's latest developments, allowing for rapid ideation and sampling without shipping delays.

We invested in our 3D digital showroom not just as a marketing tool, but as a trend dissemination channel. When our R&D team develops a new fabric—like our BAMSILK bamboo silk blend with a patented soft-touch finish—it's photographed, scanned, and uploaded to the digital library within 48 hours. Our buyers in New York or Milan can see its drape, color, and spec sheet instantly. In February 2024, a fast-fashion buyer in Spain used our virtual showroom to shortlist 15 new eco-jacquards for their holiday collection. We sent physical confirmatory samples only for their top 5 choices, cutting their decision time from 3 weeks to 4 days and saving over 80% in sample shipping costs. That's the power of digital.

How Do Digital Tools Accelerate the Design-to-Sample Cycle?

The acceleration happens in three phases. First, in the ideation phase, designers can browse thousands of digital swatches, applying colors and patterns to basic garment renders in real-time. Second, in the selection phase, they can request "lab-dip" equivalents—where we produce and ship a single, small physical swatch of the exact digital selection for touch and quality verification. Third, in the pre-production phase, digital fabric specs integrate directly into their CAD and PLM systems, minimizing data entry errors. This compressed cycle is critical for capitalizing on fast-moving trends. For insights into integrating digital fabrics into design workflows, check out this discussion on best practices for implementing digital textile libraries.

What Should You Look for in a Supplier's Digital Offering?

Not all digital showrooms are created equal. Look for these features: 1) High-Resolution & Accurate Color: The digital swatch must be a true color representation, ideally with Pantone cross-references. 2) Technical Data Integration: The page should seamlessly show weight, composition, stretch, and care instructions. 3) "Request Physical Sample" Button: One-click sampling is a must for efficient workflow. 4) New Arrivals Tagging: A clearly marked section for recently added fabrics helps you spot what's fresh immediately. Suppliers who are serious about this will often discuss their digital investments; reading about the future of digital sourcing for apparel brands can help you ask the right questions.

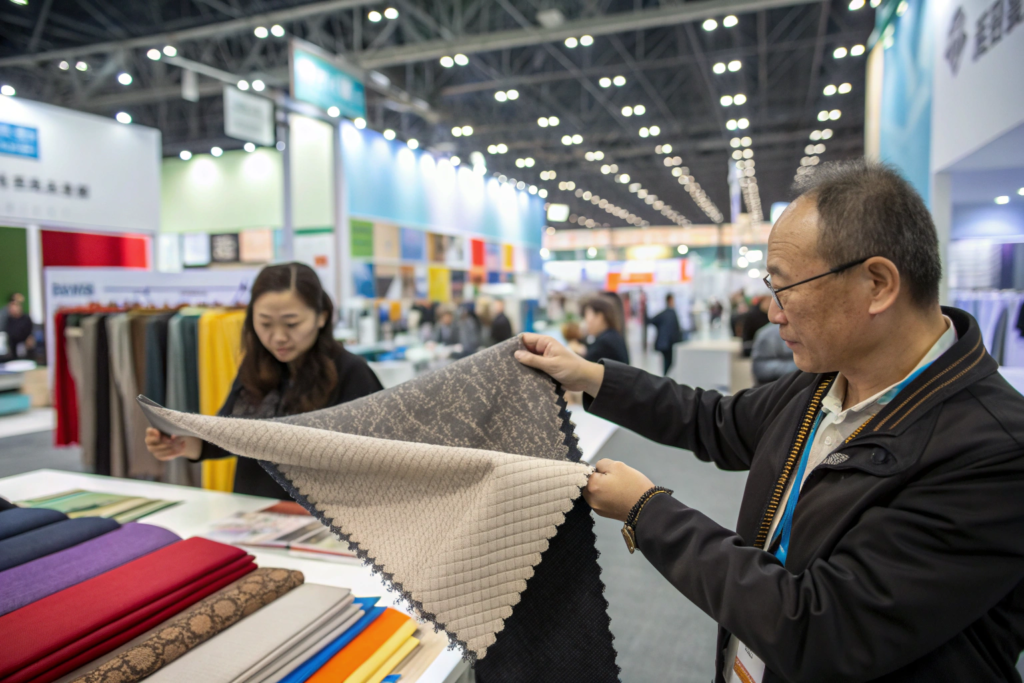

How to Decode Trends from Chinese Fabric Exhibitions (Like Intertextile Shanghai)?

You can't always be in Shanghai, but you can still harvest the intelligence from its massive exhibitions. Intertextile Shanghai Apparel Fabrics is the industry's barometer. The goal is to gather actionable insights without physically attending. This requires building a strategic partnership with a local agent or supplier who acts as your eyes and ears on the ground.

Our role for many clients during major fairs is exactly that. For example, during the Spring 2023 Intertextile, a U.S.-based outdoor apparel brand couldn't send their team due to travel constraints. They tasked us with a specific mission: report on functional fabric innovations for extreme cold weather. We didn't just send them a list; we provided a curated report with videos of fabric demonstrations, close-up photos of new bonding techniques for waterproof breathable membranes, and interviews we conducted with 3 leading technical fabric mills on their R&D roadmaps. We even secured exclusive early-access sample cards for them. Based on our report, they pivoted their Winter 2024 line to incorporate a new lightweight, high-loft insulation fabric they discovered through us, which their competitors had missed entirely.

What Specific Trends Emerge from Exhibition Floor Analysis?

| Focus goes beyond "what's pretty." Analysts look for: | Trend Category | What to Look For at Exhibitions | Real-World Example (2023) |

|---|---|---|---|

| Material Innovation | New fiber blends, recycled content percentages, traceability tech. | Surge in post-consumer recycled nylon derived from fishing nets, with blockchain traceability. | |

| Finish & Function | Novel coatings, dyes, and mechanical finishes. | Growth in non-PFC durable water repellent (DWR) finishes across price points. | |

| Pattern & Color | Direction from major yarn suppliers' forecast stands. | Dominance of "digital nature" prints—hyper-realistic botanicals created via AI-assisted design. | |

| Supply Chain Shifts | Which regions (e.g., Vietnam, Bangladesh) have larger pavilions? | Increased presence of Chinese-owned mills based in Southeast Asia, signaling shifting production hubs. |

How to Build a Post-Exhibition Action Plan?

The information is useless without action. Within one week of the exhibition closing, you should: 1) Review Sample Cards: Organize physical/digital samples by your product categories. 2) Request Costing: Send your top 5-10 fabric findings to your agent or Shanghai Fumao for preliminary bulk pricing and MOQ checks. 3) Initiate Testing: For serious contenders, immediately order sample yardage for your standard fabric performance testing protocols. Delaying this by even a month can put you behind. A good resource for building a post-trade show strategy is this article on maximizing ROI from international trade shows.

Why is Building a Direct Relationship with a Keqiao-Based Partner Crucial?

All the digital tools and reports in the world can't replace the value of a trusted, on-the-ground partner embedded in the ecosystem. Keqiao isn't just a cluster of factories; it's a living, breathing network where information flows informally through dye-house managers, loom technicians, and yarn salesmen over tea. A local partner taps into this "grapevine," giving you early warnings on everything from raw material price fluctuations to which weave structure a major fast-fashion brand just ordered 500,000 meters of.

This is our home turf. In late 2022, through our dyeing factory contacts, we learned about a potential tightness in the supply of a specific reactive dye pigment due to an environmental audit upstream. We immediately advised our clients using fabrics in that color family to approve their lab dips and lock in orders 2 weeks earlier than planned. Clients who heeded our advice avoided a 4-week production delay that impacted many in the market. This kind of insight doesn't appear on any B2B platform or exhibition report; it comes from deep, long-term relationships. (Here I have to interject—this is where our 20 years in Keqiao really pays off for our partners).

How Does a Local Partner Navigate Seasonal Production Peaks?

China's manufacturing calendar is not linear. As mentioned, peak periods (Mar-May, Aug-Oct) add 1-2 weeks to timelines, and holiday shutdowns like Chinese NewYear halt everything. A local partner doesn't just warn you about these dates; they actively strategize with you. For instance, a savvy partner will advise you to develop and confirm your autumn/winter fabrics during the slower June-July period, so your order is queued and ready to hit the loom the day the August peak period begins. They manage the factory relationship, ensuring your order gets a priority slot even during the crunch. For a comprehensive look at planning around these cycles, forums like The Fashion Network have threads dedicated to seasonal sourcing planning.

What Operational Advantages Does a Partner in the Cluster Provide?

The advantages are tangible and impact your bottom line:

- Faster Problem-Solving: A fabric batch fails inspection? Your local partner is at the factory within the hour to see the issue firsthand—whether it's a color deviation in yarn-dyed stripes or a pilling issue—and negotiate a re-make or discount on the spot.

- Consolidated Quality Control: Instead of managing multiple QC agents for weaving, dyeing, and finishing, your single partner oversees the entire pipeline with a unified standard. At Shanghai Fumao, our QC team conducts inspections at each of our cooperative factories, which is how we maintain a 98% client pass rate.

- Logistical Synergy: They can consolidate fabric from multiple specialized mills into a single container, handle packaging, and manage customs clearance through established local forwarders, simplifying your logistics. Understanding the full scope of these advantages is key, and resources on managing offshore textile production and quality control can provide additional context.

Conclusion

Staying updated on global fabric trends from China is less about frantic chasing and more about building a smart, connected system. It combines the wide-lens scanning of digital platforms and exhibitions with the high-resolution, ground-level intelligence only a trusted local partner can provide. The brands that thrive are those that view their Chinese suppliers not as mere order-takers, but as integral extensions of their own product development and trend intelligence teams.

The cycle never stops, and neither should your flow of information. By implementing these strategies—leveraging B2B data, embracing digital tools, decoding exhibitions, and forging a deep partnership in Keqiao—you transform your supply chain from a cost center into a competitive intelligence engine. You stop reacting to trends and start influencing them.

Ready to build a sourcing strategy that keeps you ahead of the curve? Let's co-create your next collection with the speed and insight that only comes from the heart of the global textile industry. Contact our Business Director, Elaine, today at elaine@fumaoclothing.com to discuss how Shanghai Fumao can become your eyes, ears, and manufacturing partner in China.