If you're importing fabrics and feeling the squeeze from tariffs, you know every percentage point saved on duties goes straight to your bottom line. The landscape of global trade agreements can seem like a maze of legal jargon, but there's one powerful tool that's actively reshaping sourcing in Asia: the Regional Comprehensive Economic Partnership (RCEP). Ignoring it means you might be leaving significant cost savings on the table and losing a competitive edge. Let's demystify how you can leverage RCEP for tangible tariff advantages on your fabric imports.

The RCEP is a free trade agreement among 15 Asia-Pacific nations that creates a unified market with progressive tariff elimination. To source fabric for tariff advantages under RCEP, you must ensure your goods qualify for "originating status" by meeting the agreement's specific Rules of Origin (ROO). This typically requires that the fabric is either wholly produced or has undergone sufficient working or processing within an RCEP member country. By structuring your supply chain to comply and obtaining a Certificate of Origin (RCEP COO), you can access preferential tariff rates, often reducing duties to 0% over time.

However, simply buying from an RCEP country doesn't guarantee the benefit. The real work lies in understanding which products get the best cuts, navigating the complex rules of cumulation (which allow inputs from multiple RCEP members to count toward origin), and managing the documentation with your suppliers. As a supplier based in China, a key RCEP member, we help clients navigate these rules daily to optimize their landed costs.

What is RCEP and How Does It Specifically Benefit Fabric Importers?

Forget the political headlines; think of RCEP as a bulk discount card for trading across the most dynamic manufacturing region in the world. For fabric importers, its value isn't just theoretical—it translates into direct, year-on-year cost reductions on duties for qualifying goods, making your sourcing more predictable and competitive.

The RCEP is the world's largest free trade agreement by GDP, grouping 15 countries: China, Japan, South Korea, Australia, New Zealand, and the 10 ASEAN nations. For fabric importers, the core benefit is the tariff concession schedules each member offers to others. Under most-favored-nation (MFN) rates, you might pay 8-12% duty on imported fabrics. Under RCEP, these rates are often reduced immediately to 5-8% upon implementation, and scheduled to phase down to 0% over 10-20 years. Crucially, RCEP introduces regional cumulation rules. This means that if you source yarn from Japan, weave and dye it in Vietnam (both RCEP members), the final fabric can qualify as "Vietnamese originating" and get preferential access to, say, the Chinese or Korean market. This fosters integrated, multi-country supply chains. A resource like the International Trade Centre's RCEP Rules of Origin Guide provides an excellent starting point for understanding product-specific rules.

Which fabric categories see the most immediate tariff cuts under RCEP?

The benefits aren't uniform; you need to check the specific schedule for your Harmonized System (HS) code. Generally, textiles and apparel are high-priority sectors. For example:

- Cotton Fabrics (HS 52): Many RCEP members have committed to steep reductions. For instance, China's tariffs on certain cotton fabrics from ASEAN members were cut to 0% immediately upon RCEP's entry into force.

- Synthetic Filament & Staple Fabrics (HS 54 & 55): These often see a linear annual reduction. A 10% MFN rate might drop by 0.5% each year.

- Specialty Fabrics: Technical fabrics (e.g., coated, laminated) and man-made filament fabrics can see significant immediate cuts.

You must check the schedule for your importing country and your fabric's exact 8-10 digit HS code. The key is to work with a supplier who understands this. In early 2023, we helped an Australian workwear brand source a specific 65/35 polyester-cotton twill (HS 5513.49) from our mills. By verifying the RCEP schedule, we confirmed Australia's import duty on this from China dropped from 5% to 0% immediately, saving them over $15,000 on their first container. Tools like global tariff lookup databases for textile HS codes are indispensable for this research.

How does RCEP's "regional cumulation" change my sourcing strategy?

It encourages you to think of the RCEP bloc as a single production base. Previously, under bilateral FTAs, you might need fabric to be wholly made in one country (e.g., Vietnam) to get tariff-free access to another (e.g., Japan). With RCEP's cumulation, Japanese polyester yarn shipped to Vietnam to be woven into fabric can count as Vietnamese content when that fabric is exported to Korea. This allows you to:

- Optimize Cost and Quality: Source high-tech yarns from Japan or Korea, manufacture in lower-cost ASEAN countries, and enjoy preferential tariffs when exporting the final fabric to any RCEP market.

- Mitigate Single-Country Risk: Diversify your supply chain across multiple RCEP members while maintaining tariff benefits.

Your sourcing strategy should now include asking potential suppliers about their own input sources. A question like, "Can you provide documentation proving the origin of your yarns to support an RCEP COO?" becomes critical. For a deeper strategic view, reading analyses on building resilient pan-Asian textile supply chains under RCEP from industry think tanks can be highly valuable.

What Are the Concrete Steps to Qualify for RCEP Tariff Rates?

Qualifying isn't automatic; it's a procedural hurdle you must clear with documentation. The process centers on proving your fabric's "economic nationality" according to RCEP's rulebook. Missing a step means you pay the full MFN rate.

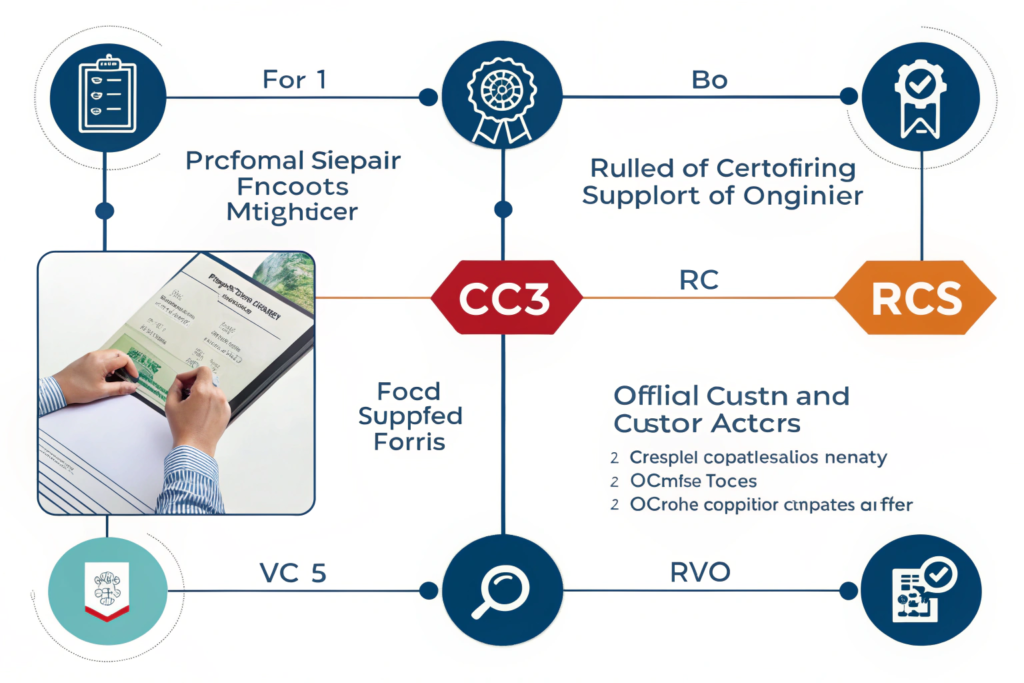

The concrete steps are sequential and demand attention to detail from both you and your supplier:

- Classify Your Fabric: Determine the precise HS Code (usually 8-10 digits) in both the exporting and importing countries.

- Determine the Applicable Rule of Origin (ROO): For textiles, the common rule is "Change in Tariff Classification (CTC)" – often requiring that the non-originating materials used undergo a change in HS chapter heading (e.g., from yarn (Chapter 54) to fabric (Chapter 55)). Some rules may also include a Regional Value Content (RVC) requirement (e.g., value added within RCEP must be ≥ 40%).

- Collect Supplier Declarations: Your supplier must provide a detailed declaration listing all inputs (yarns, chemicals) and their origins, along with cost breakdowns.

- Obtain the Certificate of Origin (COO): The exporter (or their authorized body, like a Chamber of Commerce) in the originating country must issue the official RCEP COO. This is your golden ticket.

- Submit at Customs: Present the commercial invoice, packing list, bill of lading, and the RCEP COO to the customs authority of your importing country to claim the preferential rate.

How do I work with my supplier to gather the necessary proof of origin?

This is a collaborative, transparent process. You cannot do it alone. Start the conversation early—during the sourcing inquiry, not after the order is shipped. Your supplier should be your guide. A competent supplier will:

- Maintain Traceable Records: They should have purchase documents (invoices) for their yarns and other materials, proving where they were sourced.

- Understand the ROO for Their Products: They should know if their manufacturing process (e.g., weaving + dyeing) satisfies the CTC rule for their fabric type.

- Be Willing to Complete the Supplier's Declaration: This is a formal document they sign, attesting to the origin of inputs and the manufacturing process.

For instance, when a New Zealand home textiles brand approached us last year to source linen blends, our first step was to audit our linen yarn supply from our partner mill. We confirmed the flax origin and processing were within the RCEP region (China), allowing the final fabric to qualify. We then prepared a full dossier for them, which they used to apply for the COO through their agent. If a supplier is hesitant or unable to provide this information, it's a major red flag. Resources like templates for supplier origin declaration forms can help standardize this request.

What are the common pitfalls in the RCEP certification process?

The pitfalls are often in the details:

- Incorrect HS Code Classification: A mistake in the 6-digit level can void the entire claim. Always double-check with a customs broker.

- Insufficient Working/Processing: Simple cutting, packaging, or dilution does not confer origin. The transformation (e.g., spinning, weaving, knitting) must be substantial.

- Documentation Inconsistencies: Discrepancies between the COO, commercial invoice (e.g., weight, value), and bill of lading will cause rejection.

- Direct Consignment Rule: The goods must be shipped directly from the exporting to the importing RCEP country, or if transshipped, they must remain under customs control in a non-party country.

The most costly pitfall is assuming your supplier will handle everything. You must be the project manager. In one case, a client assumed their Vietnamese factory would handle the RCEP COO, but the factory used Chinese yarns without proper documentation. The shipment arrived in Korea and was hit with the full 8% duty. This underscores the need for due diligence. Consulting a checklist for verifying RCEP compliance before shipment is a prudent risk management step.

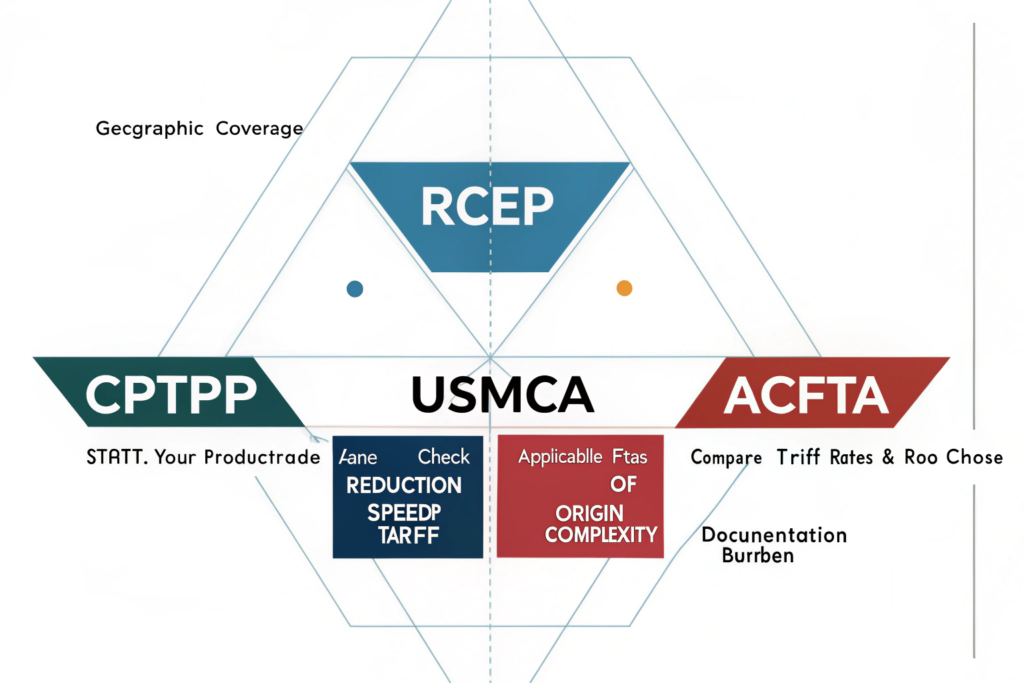

How Do RCEP Advantages Compare to Other Trade Agreements?

RCEP isn't the only game in town. You might already be using the USMCA, ASEAN-China FTA, or CPTPP. The smart importer compares and chooses the agreement that delivers the lowest duty for their specific product and trade flow. Sometimes, an older bilateral FTA offers a better rate than RCEP.

RCEP's main advantage is its breadth and simplicity. It consolidates multiple overlapping "noodle bowl" agreements in Asia into one with common rules. However, for specific country pairs, older bilateral FTAs might have more aggressive tariff elimination schedules. For example:

- For Vietnam-sourced goods to the EU: The EU-Vietnam Free Trade Agreement (EVFTA) offers faster and deeper cuts than RCEP (which the EU is not part of).

- For ASEAN goods to China: The ASEAN-China Free Trade Area (ACFTA) might already have zero tariffs, making RCEP a parallel option.

- For high-standard goods to CPTPP members: The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has stricter labor/environmental rules but can offer comparable or better access for members like Japan, Canada, and Mexico.

You must run a comparative tariff analysis for your specific HS code. The "best" agreement is the one that provides the lowest applicable duty at the time of import. Your customs broker or a savvy supplier can assist. For instance, for a Canadian client importing performance knits, we analyzed both RCEP (as China is a member) and CPTPP rules. For their product, the rules of origin under CPTPP were slightly easier to meet, granting them immediate duty-free access. Staying informed through updates on preferential tariff rates under major trade agreements is crucial for ongoing optimization.

When should I choose RCEP over a bilateral agreement like the ASEAN-China FTA?

Choose RCEP when it offers a lower tariff rate or when its more flexible cumulation rules make it easier for your product to qualify. While the ASEAN-China FTA may already have zero tariffs on many finished textiles, RCEP's regional cumulation is a game-changer for products using inputs from non-ASEAN RCEP members like Japan or Korea. For example, if you are sourcing a fabric from Thailand that uses Japanese synthetic yarns, it might not qualify under ASEAN-China FTA (as Japan is not a member), but it can qualify under RCEP because both Japan and Thailand are members, and the yarn can be cumulated. Therefore, RCEP provides a new pathway to preferential treatment for more complex, multi-country supply chains.

How does RCEP interact with "Bonded Zones" in China and ASEAN?

This is an advanced but powerful strategy. Bonded zones (or Free Trade Zones) are areas considered outside a country's customs territory. Processing done here can be strategic for meeting ROO. For example, you could import Australian wool tops into a bonded zone in Vietnam. There, they are spun into yarn and woven into fabric. Because the processing (spinning and weaving) that confers origin occurs within Vietnam (an RCEP member), the resulting fabric can qualify as Vietnamese originating, even though the raw material entered duty-free. Working with suppliers who have access to or operate within such zones can provide significant flexibility and cost savings. Understanding the operational benefits of manufacturing in Asian free trade zones is key for sophisticated sourcing strategies.

How to Find and Vet RCEP-Compliant Fabric Suppliers?

Finding a supplier is easy; finding one that is both capable and compliant is the challenge. Your goal is to identify partners who view RCEP not as a bureaucratic burden, but as a value-added service they provide to clients.

Start your search with a clear filter: RCEP readiness. On platforms like Alibaba or Global Sources, use keywords like "RCEP supplier," "preferential origin," or "FTA compliant." During initial inquiries, ask direct questions: "Do you have experience issuing RCEP Certificates of Origin?" and "Can you provide a sample COO for a similar fabric?" Attend trade shows in RCEP member countries—suppliers there are often more export-savvy. However, the most reliable method is often through referrals or working with large, established trading companies or manufacturers with dedicated compliance departments, like Shanghai Fumao, which have the scale and systems to manage this complexity.

What questions should I ask a potential supplier about RCEP compliance?

Go beyond "Can you do it?" Ask how they do it. Your questionnaire should include:

- Process Understanding: "What is the specific Rule of Origin (CTC or RVC?) for this fabric in your production?"

- Documentation Capability: "What is your process for collecting and verifying origin documents from your own material suppliers?"

- Track Record: "Can you share a redacted copy of a previous RCEP COO you've issued for a similar product?"

- Cost and Responsibility: "Who handles the COO application and associated costs—you, us, or a third party?"

- Contingency: "If the goods are found non-compliant at my customs, what is the process for resolving it?"

A supplier's ability to answer these clearly is a strong indicator of reliability. In our practice at Shanghai Fumao, we maintain a digital dossier for key products, pre-calculating RVC and documenting the supply chain, so we can answer these questions instantly for clients.

What red flags indicate a supplier isn't truly RCEP-ready?

Be wary of these signs:

- Vague or Evasive Answers: "Don't worry, we handle all documents" without specifics.

- Inability to Provide a Sample COO: This suggests no prior experience.

- Unwillingness to Share Input Source Information: Citing "trade secrets" for yarn origin is a major red flag for origin tracing.

- Promising 0% Duty Unconditionally: The benefit depends on your importing country's schedule and correct classification.

- No Mention of Internal Compliance Systems: They should have someone trained on trade agreement rules.

A supplier who is not RCEP-ready can cost you time and money. It's better to identify this early. Leveraging resources like industry forums discussing experiences with Asian fabric suppliers on FTA compliance can provide real-world insights and warnings.

Conclusion

Sourcing fabric under the RCEP agreement is a strategic move that goes beyond finding a cheaper supplier—it's about intelligently restructuring your supply chain to leverage progressive tariff elimination and flexible rules of origin. The benefits are real and quantifiable: reduced landed costs, enhanced competitiveness, and the opportunity to build a more resilient, pan-Asian supply network. The path to these advantages requires diligence—meticulous attention to HS codes, a deep understanding of product-specific rules, and, most importantly, a partnership with a transparent and competent supplier who can navigate the certification process seamlessly.

The complexity of trade agreements need not be a barrier. It can be your competitive moat. By investing the time to understand RCEP and aligning with suppliers who share this expertise, you turn a regulatory framework into a powerful tool for cost savings and market agility. If you're ready to explore how RCEP can optimize your fabric sourcing and you need a partner with the technical knowledge and supply chain integrity to make it happen, let's connect. At Shanghai Fumao, we help our clients not just source fabric, but build tariff-advantaged supply chains. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to start a conversation about qualifying your next order under RCEP.