If your business depends on a steady flow of fabrics from overseas, a single factory shutdown, a sudden port congestion, or an unexpected tariff change can bring your entire operation to a grinding halt. You know the risk is real, but building a contingency plan feels overwhelming—where do you even start? Let’s break it down into actionable steps you can implement today.

A robust contingency plan for your fabric supply chain is a proactive strategy that identifies key risks, establishes clear alternative actions, and maintains business continuity during disruptions. It’s not about having a spare supplier for every item; it’s about intelligent redundancy, strategic inventory buffers, and documented procedures that your team can execute under pressure. As a supplier managing complex logistics for over 100 countries, we’ve seen that brands with even a basic plan recover 3-4 times faster from supply chain shocks.

The difference between scrambling and responding strategically lies in preparation. This guide will walk you through the four pillars of a practical contingency plan: mapping your critical vulnerabilities, developing real supplier alternatives, creating smart inventory buffers, and establishing a clear communication protocol. By the end, you'll have a framework to protect your business from the unpredictable nature of global sourcing.

What Are the Most Common Disruptions in Fabric Sourcing?

You can’t plan for everything, but you absolutely must plan for the predictable. The most frequent disruptions aren't black swan events; they are seasonal, regulatory, or logistical patterns that catch unprepared importers off guard. Acknowledging these patterns is the first step to building resilience.

The top disruptions stem from predictable cycles, geopolitical policies, and infrastructure limitations. Seasonally, Chinese New Year and Golden Week shutdowns are the most significant, halting production for weeks. Production capacity crunches during peak seasons (March-May, August-October) routinely add 1-2 weeks to lead times. Logistically, port congestions at key hubs like Los Angeles or Rotterdam, and fluctuating shipping container availability and freight costs, cause consistent delays. Politically, sudden changes in trade agreements or tariffs, like the U.S. reviews on Section 301, can alter cost structures overnight. Finally, quality failures from a single-source supplier can stop production lines dead.

How do seasonal factory closures in Asia impact my timeline?

The impact is absolute and predictable: production stops. The biggest mistake is assuming the holiday only affects the week factories are officially closed. The real disruption window is much wider. For Chinese New Year (CNY), a 3-4 week official closure typically creates a 6-8 week total disruption period. Production slows for 2 weeks pre-CNY as workers leave, and ramps up slowly for 2 weeks post-CNY. Your plan must account for this. For example, a European client in 2023 needed a quick-turnaround order of recycled polyester fleece in February. Because they hadn't planned for CNY, they faced a 9-week delay. We now advise all clients to use the post-holiday production restart checklist for Asian suppliers, ensuring all materials and approvals are locked before the shutdown to hit the ground running. A good practice is to finalize all tech packs and place orders at least 6 weeks before CNY to secure a slot in the first production batch after the holiday.

What logistical bottlenecks should I anticipate?

Bottlenecks are the constant friction in global trade. The key ones are: 1) Pre-shipment: Delays at origin ports due to vessel space, especially during peak season (Aug-Oct). Booking shipments 3-4 weeks in advance is crucial. 2) In-transit: Canal delays or rerouting (like the Red Sea issues) adding 2-3 weeks. 3) Destination: Port congestion and slow customs clearance, particularly for fabrics subject to specific HTS code inspections for textile imports. Your contingency plan should include diversified routing options (e.g., air freight for critical small batches, alternative ports like East Coast vs. West Coast). Partnering with a supplier like Shanghai Fumao that has in-house logistics coordination is a huge advantage, as we can pivot based on real-time capacity.

How to Develop Real Supplier Redundancy Without Doubling Costs?

The goal is “smart redundancy,” not duplicate spending. It means having vetted, ready-to-activate backup options for your most critical fabrics, not for every single SKU. This approach minimizes risk without exploding your procurement complexity or costs.

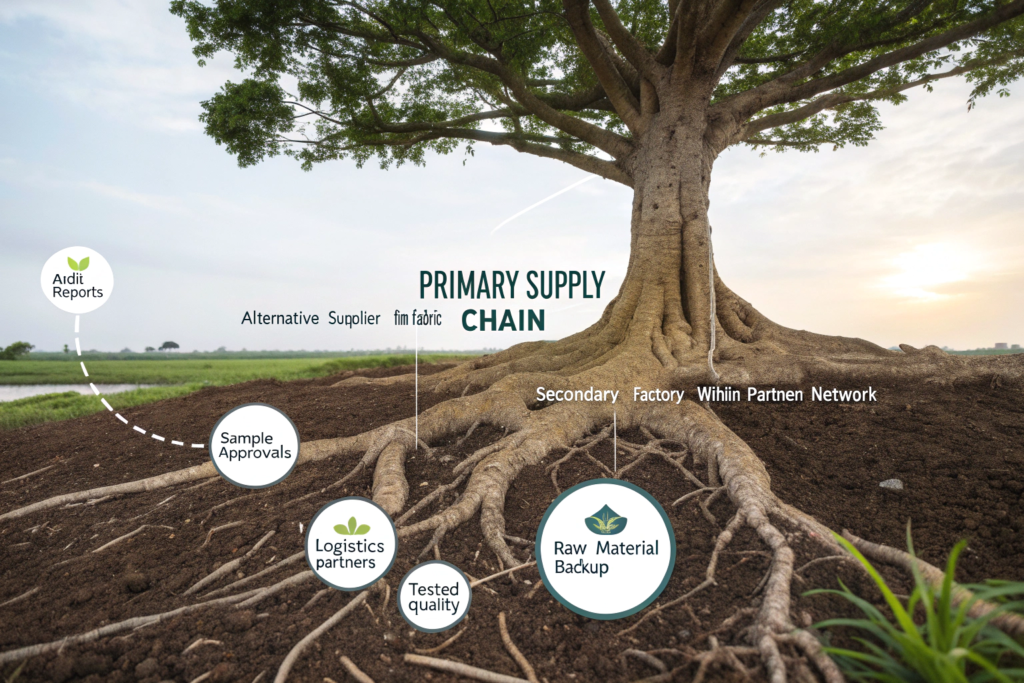

True redundancy is built on relationships and verified capabilities, not just contact lists. Start by categorizing your fabrics: which are “mission-critical” (unique, high-volume, long lead time)? For these, you need an alternative source. This doesn’t mean developing the same fabric twice from scratch. It can mean identifying a supplier who produces a comparable fabric with similar performance, or a partner like us who can produce the same fabric across multiple certified cooperative factories within our network. This way, if one factory has an issue, production can be shifted internally without you needing to requalify a whole new vendor.

How do I qualify a backup fabric supplier effectively?

Qualification is a process, not an event. Don't wait for a crisis to test a new supplier. Your backup should be partially "onboarded" during normal operations. Key steps include:

- Technical Auditing: Request and review their factory audit reports and quality management certifications well in advance. Do they have ISO 9001 or similar?

- Sample Validation: Order development samples for your key fabrics during your regular R&D cycle. Test them for colorfastness, shrinkage, and composition in a third-party lab.

- Trial Run: Place a small but real production order (even for future seasons) to assess their communication, adherence to timeline, and bulk quality consistency. A US activewear brand we worked with in 2024 used this strategy. They had us as their primary for compression fabrics, but they annually placed a 5,000-meter order for their core polyester spandex jersey with a second supplier. This kept the relationship warm and the quality verified, costing less than 2% of their total spend for immense peace of mind.

Can a single supplier like Fumao provide internal redundancy?

Yes, and this is often the most efficient model. A vertically integrated or deeply networked supplier acts as your risk mitigation partner. For instance, at Shanghai Fumao, our contingency is built into our structure. We have our own weaving factory but also maintain partnerships with several other high-quality weaving mills. For dyeing and printing, we work with two or more certified partner factories. If a quality issue arises at one or if capacity is maxed out, our QC and management team can seamlessly shift the order to another facility using the same approved yarns and tech packs. You deal with one point of contact while we manage the internal redundancy. This is far simpler than you managing multiple external suppliers. It's crucial to ask potential suppliers about their internal capacity and partnership network for production flexibility during your initial due diligence.

What is Strategic Inventory and How Much Should I Hold?

Strategic inventory is a calculated buffer of key materials designed to keep your production running during a supply disruption. It’s not hoarding; it’s a financial tool to ensure revenue continuity. The “right” amount is a balance between the cost of holding stock and the cost of a stock-out.

The amount to hold depends on your “risk exposure window”—the time it would take to restore supply from an alternative source. A common formula is: Buffer Stock = (Average Weekly Usage) x (Lead Time of Backup Source in Weeks). For example, if you use 1,000 meters of a specific cotton twill per week and your backup supplier’s lead time is 8 weeks, a strategic buffer of 8,000 meters would cover you while switching sources. For fabrics with very long development times (like complex jacquards), the buffer might need to be larger. The key is to only do this for your top 5-10% of SKUs that generate the majority of your revenue. Financing this inventory is part of the cost of resilience.

How do I finance and store strategic fabric inventory?

Financing and storage are the two practical hurdles. Solutions include:

- Supplier-Managed Inventory (SMI): Some suppliers, especially those with overseas warehouses, will hold committed stock for you, often with staggered payment terms. We offer this for key clients, holding 2-4 weeks of fabric in our bonded warehouse.

- Third-Party Logistics (3PL) Warehousing: Use a 3PL near your manufacturing unit. They can provide just-in-time delivery to your factory, reducing your capital tie-up.

- Pre-paid Production: Work with your supplier to produce and pay for a bulk order during their off-peak season (e.g., June-July), when prices may be lower. The fabric can be stored at their facility or in transit, acting as both a buffer and a cost-saving measure. For insights on setting up such agreements, this guide to negotiating supplier-managed inventory programs on industry forums like Supply Chain Dive can be very useful.

What are the risks of holding too much inventory?

The risks are financial and qualitative. Financially, you tie up working capital and incur storage, insurance, and potential obsolescence costs. Qualitatively, fabrics can degrade over time, especially natural fibers susceptible to moisture or pests. Color standards can shift, and fashion trends can change, leaving you with dead stock. The contingency plan must include regular rotation of the buffer stock—using the oldest fabric first in a “first-in, first-out” system. It’s also wise to insure the stored inventory. A balanced plan uses buffer stock for core, timeless fabrics (like basic poplin or denim), not for highly trend-sensitive items.

How to Create a Clear Communication Protocol for Crises?

When a disruption hits, confusion is your biggest enemy. A clear, pre-defined communication protocol ensures the right people get the right information quickly, so decisions can be made based on facts, not panic. This protocol is the nervous system of your contingency plan.

The protocol should be a simple, one-page document that answers: Who needs to be contacted? In what order? What information is needed? It must list your internal team (logistics, production, sales) and key external contacts (primary supplier, backup suppliers, freight forwarder, 3PL). Crucially, it should designate a single crisis communication lead within your sourcing team to avoid mixed messages. The protocol should also include template communication scripts for different scenarios (e.g., “Factory Delay Notification,” “Port Diversion Request”) to save time and ensure clarity.

What information should I demand from my supplier during a disruption?

Demand factual, actionable updates, not apologies. Your protocol should specify that any alert from a supplier must include:

- The Nature and Scope: What happened? Is it affecting one machine, one factory, or an entire region?

- Quantified Impact: What is the new estimated timeline? How many meters/pieces are delayed? What is the revised completion date?

- Proposed Solution: What is the supplier doing to mitigate this? Are they shifting production? Air freighting samples? Providing partial shipments?

- Evidence: If possible, request photos or reports.

For example, during a local power rationing issue in Zhejiang in August 2023, our team immediately notified affected clients with: “Issue: Government-mandated power reduction for 5 days. Impact: Your order XX will be delayed by 7 business days. Solution: We are prioritizing your order on generators and will ship 30% via air to meet your initial cut date. Here is the government notice.” This level of detail allows your team to make informed decisions.

How often should the contingency plan be tested and updated?

A plan that sits in a drawer is useless. It must be a living document. Test it annually with a tabletop simulation—walk through a hypothetical scenario (e.g., “Primary factory fire”) and have your team walk through the steps. Update it quarterly with new supplier information, lead times, and contact details. Any time you onboard a new critical supplier or fabric, integrate them into the plan. Furthermore, after any real minor disruption (even a small delay), conduct a brief post-mortem: Did the plan work? What information was missing? Use this to refine the protocol. Sharing these post-disruption analysis templates for supply chain teams can help standardize this improvement process across your organization.

Conclusion

Building a contingency plan for your fabric supply chain is not an optional luxury; it's a fundamental component of modern, resilient business operations. It transforms you from a passive victim of global disruptions into an active, prepared manager of risk. By systematically mapping vulnerabilities, cultivating smart supplier relationships, holding strategic inventory for your core items, and establishing crystal-clear communication lines, you create a buffer against uncertainty that protects your revenue, your reputation, and your peace of mind.

Remember, the goal is not to eliminate risk—that's impossible. The goal is to reduce your recovery time and cost when the inevitable disruption occurs. If the process of building this plan feels daunting, or if you need a supply partner whose very structure is designed for resilience, we are here to help. At Shanghai Fumao, our integrated model and deep network across China's textile heartland provide built-in redundancy for our clients. Let's discuss how we can be part of your contingency solution. For a detailed consultation on creating a tailored risk mitigation strategy for your fabric needs, contact our Business Director, Elaine, at elaine@fumaoclothing.com. Let's build a supply chain that's as strong as your brand.