If you think Quality Control (QC) ends when the last meter of fabric passes inspection, you’re setting yourself up for a logistics nightmare and a customs crisis. In our two decades at the heart of Keqiao’s textile district, we’ve learned that the real finish line isn’t the factory gate—it’s your warehouse door. And the bridge between those two points is built entirely on documents. QC isn’t just about checking boxes on a form; it’s about generating the evidence that makes your export documents bulletproof.

The link is absolute and causal. Quality Control is the source of truth for your export documentation. Every test report, every inspection certificate, and every compliance check we perform at Shanghai Fumao doesn’t just ensure the fabric is good; it creates the legal and commercial data needed to populate export documents accurately. A mismatch between what’s in the box and what’s on the paper is the fastest way to get your shipment held, fined, or rejected. Think of QC as the science lab, and the export documents as the peer-reviewed paper publishing its findings. One cannot exist without the other in international trade.

Let me give you a real picture. A client’s perfect, pre-sold batch of organic cotton jersey can be stuck rotting in a port warehouse because the Certificate of Origin states a generic “100% cotton” while the commercial invoice, based on our QC-verified lab dip report, specifies “GOTS-certified organic cotton.” The goods are correct, but the documents tell a conflicting story. Customs hates confusion. This disconnect costs thousands per day in demurrage fees. At Shanghai Fumao, we’ve built a system where our QC process is the first step in document creation, ensuring every detail from fiber content to weight and value flows seamlessly into the export packet. This isn’t just admin work; it’s a critical part of the product itself.

How Does QC Data Directly Feed into Your Commercial Invoice?

The commercial invoice is more than a bill; it’s the foundational legal document for your shipment. Its accuracy dictates customs valuation, duty calculation, and import compliance. Guesswork here is a direct path to financial loss.

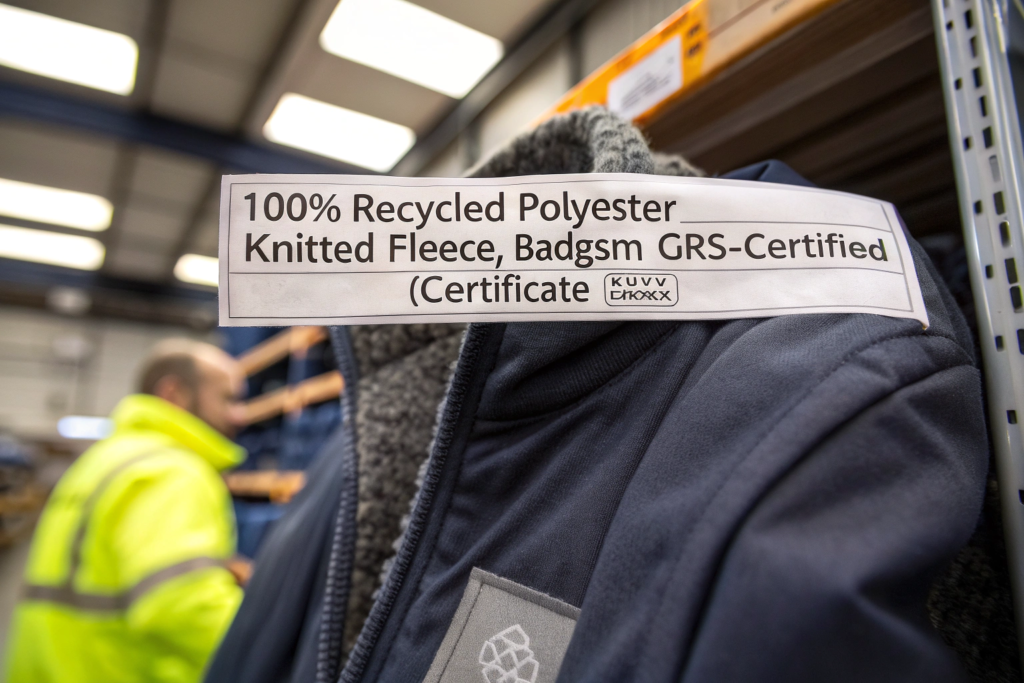

Every data point on a professional commercial invoice should be traceable back to a QC checkpoint. The description of goods isn’t just “polyester fabric.” It should be “100% Recycled Polyester Knitted Fleece, 280gsm, GRS-Certified (Certificate #XXX),” exactly as verified by our lab’s composition test and certification audit. The unit price is often derived from the confirmed quality grade after final inspection—a first-quality roll commands a different price than a roll with minor, agreed-upon deviations. Most critically, the Harmonized System (HS) code we advise on is determined by the fabric’s composition, weight, and finish, all of which are definitively established during QC. Getting the HS code wrong due to poor QC data can lead to massive duty underpayments or overpayments. We saw a case where a supplier incorrectly described a laminated fabric as “coated,” leading to a 5% higher duty tariff at U.S. customs—a mistake that cost the importer thousands. Our process at Shanghai Fumao ensures the QC report is the single source of truth that our logistics team uses to generate the invoice.

Why Is Precise Fabric Description in the Invoice a Legal Necessity?

A vague description is a liability. Customs authorities worldwide use the commercial invoice to assess duties and enforce regulations (like fiber labeling laws, FTC rules in the U.S., or REACH in the EU). If your invoice says “knitted fabric” but our QC report specifies “95% Cotton, 5% Spandex Jersey, 220gsm,” you have a problem. The spandex content affects both duty rate and import quotas. For brands concerned with U.S. Customs and Border Protection (CBP) textile enforcement, precise description is your first defense. We generate the description directly from the technical passport created for each batch during our final inspection. This includes the detailed breakdown that platforms like the U.S. International Trade Commission’s (USITC) Harmonized Tariff Schedule require for accurate classification.

Can QC Affect the Declared Value and Save on Duties?

Absolutely, and legally. The “transaction value” for customs is typically the price paid. However, QC can uncover issues that justify a price adjustment before the invoice is finalized. For example, in a bulk order earlier this year for a UK client, our final inspection found a consistent 2% width variance (still within general tolerances but below the perfect spec). We immediately informed the client and offered a proportional price reduction. They accepted. The commercial invoice was then issued with the adjusted, lower value, which was fully justified by the QC report we provided as evidence. This saved the client on import VAT and duties. This transparent process builds trust. It’s different from fraudulent undervaluation; it’s an accurate reflection of the agreed value for the goods as delivered. Understanding these nuances is key for navigating international trade compliance for apparel importers.

What Role Does QC Play in Obtaining Certificates of Origin?

The Certificate of Origin (COO) is your fabric’s nationality passport. It determines eligibility for preferential duty rates under trade agreements like USMCA or RCEP. Its core question—“Where did this product originate?”—cannot be answered without rigorous QC of the supply chain.

“Origin” isn’t just where the fabric was cut and packed. Rules of origin are complex, often requiring a specific percentage of value or a substantial transformation to occur within a country. For us at Shanghai Fumao, proving Chinese origin for our fabrics means meticulously documenting every step. Our QC system tracks the origin of the raw materials (e.g., Chinese-made polyester chips or Xinjiang cotton bales with its associated requirements for sourcing cotton from Xinjiang region) and verifies that the substantial transformation—weaving, dyeing, finishing—happens in our Keqiao cluster. We maintain batch records and mill certificates that our certifying chamber of commerce can audit. Without this QC paper trail, we cannot legally issue a COO. A client once asked us for a ASEAN COO for a fabric that was only finished in Vietnam but woven in China. Our QC records showed the weaving (the substantial transformation) was in China, making it Chinese origin. Issuing an ASEAN COO would have been fraudulent and risked severe penalties for the client upon import.

How Do Different Types of Certificates of Origin (Non-Preferential vs. Preferential) Rely on QC?

- Non-Preferential COO (the standard form): This simply states the country of origin. It relies on QC to verify the “substantial transformation” rule. Our factory audit records and production logs are the evidence.

- Preferential COO (e.g., Form A for GSP, Form F for China-Chile FTA): These allow for reduced or zero tariffs. They have much stricter requirements. They demand QC data that proves the product meets the specific agreement’s rules, often a detailed value-add calculation. We must provide cost statements, lists of all materials, and their origins to prove that a defined percentage (e.g., 40-50%) of the value comes from China. Our QC team’s material tracking system is essential for this. Resources like the International Chamber of Commerce’s (ICC) guides on rules of origin are vital for understanding preferential trade agreement documentation.

What Happens If QC Fails to Track Material Origin Accurately?

The consequences are direct and financial. If you claim a preferential duty rate under a trade agreement but cannot prove origin upon audit, you will face: 1) Back payment of all duties owed, plus interest. 2) Potential fines for fraud. 3) Loss of preferential status for future shipments. In 2023, we helped a Canadian client leverage the CPTPP agreement. To qualify for the tariff benefit, we had to provide verifiable QC records proving that from yarn spinning to finishing, over 55% of the value was added within the CPTPP region (specifically, China-Japan-Vietnam chain we managed). Our digital QC platform allowed us to generate this report instantly, securing their duty-free entry. Without that granular, QC-driven data, the opportunity would have been lost.

How Are Inspection Certificates Used to Clear Customs and Satisfy Buyers?

The inspection certificate (like SGS, ITS, or our own CNAS-accredited report) is the QC story told to outsiders. It’s the independent, or internally verified, proof that the goods match the contract and the regulations. For customs, it’s a risk-reducer; for your buyer, it’s a release of payment trigger.

Customs agencies are risk managers. A shipment accompanied by a reputable inspection certificate signals that a professional party has verified the quantity, quality, and description. This can expedite clearance, especially for sensitive goods like children’s wear or fabrics with chemical treatments. More importantly, for buyers, the inspection certificate is often the “golden ticket” that releases the letter of credit payment. The LC will state clauses like: “Payment against presentation of a Clean Report of Findings issued by SGS.” If our internal QC fails and the third-party inspector finds major defects, that report won’t be “clean,” and the payment gets frozen. This makes our in-house QC a financial safeguard for both sides. We treat every pre-shipment inspection as a dress rehearsal for the third-party one. For instance, we know that managing pre-shipment inspections for clothing orders from Asia is a major buyer concern, so we’ve made our process transparent and collaborative.

What’s the Difference Between a Supplier’s QC Report and a Third-Party Inspection?

- Supplier’s QC Report (Ours): This is our internal due diligence. It’s comprehensive, frequent, and process-oriented. We check every roll for over 15 parameters. It’s for us and our trusted clients to monitor production. It holds weight because of our reputation and accredited lab, but it’s not “independent.”

- Third-Party Inspection (e.g., SGS): This is the independent verification for the buyer or a regulatory body. It’s usually a statistical sampling of the final lot. Its power comes from the impartiality of the agency.

The magic happens when they align perfectly. Our goal at Shanghai Fumao is for the third-party report to be a boring confirmation of what we already know. We achieve this by being harder on ourselves than any inspector would be. A common forum topic on QualityInspection.org, a key resource for developing effective supplier quality assurance protocols, emphasizes this internal rigor as the hallmark of a top-tier supplier.

Can a QC Inspection Certificate Help Resolve Disputes?

It is the primary tool for dispute resolution. Imagine a buyer claims the fabric shade is off. If we have a signed-off lab dip and a spectrophotometer report from our QC files showing the bulk production is within the agreed Delta E tolerance (we use ΔE < 1.0 for critical colors), the dispute is resolved in our favor. The certificate is objective data. We had a situation with an Eastern European retailer where the receiver claimed short rolls. Our QC records, including timestamped videos of the measuring and packing process, plus the independent inspector’s report, proved the length was correct. The claim was dropped. This is why we invest in digital, timestamped QC records—they are legal evidence.

How Does Packaging and Labeling QC Integrate with Shipping Documents?

The packing list and shipping marks are the literal map to your goods. If the physical packaging doesn’t match the document, your shipment becomes a mystery box in a warehouse—unidentifiable and un-deliverable. QC of packaging is the final physical step that validates the documents.

Our QC doesn’t stop at the fabric edge. We inspect the packaging itself: are the rolls properly wrapped in moisture-resistant material? Are the cartons strong enough for ocean freight? Most critically, we verify that every single carton is labeled correctly with the shipping mark, product code, quantity, and gross/net weight. This information is then compiled into the packing list, which must match the commercial invoice and bill of lading. A mismatch of even one digit in a carton number between the physical label and the packing list can cause chaos at the destination warehouse during unloading. We use barcode scanning during final packing to eliminate human error. The data from this scan auto-generates the packing list. This seamless integration is why partners like Shanghai Fumao are chosen by brands needing reliability.

Why Is Verifying Shipping Marks a Critical QC Step?

Shipping marks (the unique codes on each carton) are how everyone in the logistics chain—from the forklift driver in our warehouse to the consignee’s receiving clerk—identifies the cargo. If a carton is mislabeled, it can be lost, sent to the wrong destination, or trigger a discrepancy claim. Our QC team does a 100% check of shipping marks against the master list before sealing any container. This is a non-negotiable final checkpoint. It’s a simple step that prevents incredibly expensive headaches. Discussions on logistics platforms like Freightos’s freight guidance blog often cite managing shipping marks and packing lists for container loads as a common pitfall for new importers.

How Does QC of Packaging Prevent Damage and Documentary Disputes?

Damaged goods lead to insurance claims, and insurance claims require evidence. Part of our packaging QC is documenting that the goods left our facility in a seaworthy condition. We take photos and videos of the loaded, secured container before sealing it. This visual QC record is attached to the shipment file. If damage occurs in transit, these records help prove the damage was not due to poor packing, protecting both us and the client during the insurance investigation. It turns a subjective “the goods were damaged” into an objective review of the documented chain of custody. This level of detail is what we mean by end-to-end service.

Conclusion

The link between Quality Control and export documents is not administrative; it’s fundamental. QC is the process of creating verified, factual data about your product. Export documents are the formal, legal translation of that data for the world’s logistics and customs systems. When QC is weak, documents are based on guesswork, and guesswork in international trade leads to delays, fines, and lost trust. When QC is robust, integrated, and digitally documented like it is at Shanghai Fumao, your documents become powerful tools that smooth customs clearance, trigger payments, protect against disputes, and deliver exactly what was promised.

We don’t see these as two separate departments. In our Keqiao operations, the QC technician and the document specialist work from the same digital dashboard. The fabric’s story—from its fiber origin to its final roll dimensions—is captured once and flows everywhere. This is how we ensure that the quality we promise in the showroom is the quality that arrives at your door, with the paperwork to prove it. If you’re tired of navigating the gray area between product quality and paper compliance, and want a partner where one seamlessly guarantees the other, let’s talk. For a detailed discussion on how our integrated QC and documentation system can secure your next fabric import, contact our Business Director, Elaine, at elaine@fumaoclothing.com.