You've just finished a call with a frantic logistics manager. The container of spring collection fabrics is stuck at the port, and they're asking for the "BL details from the certificate." You scramble through emails, finding various documents—but which one is the certificate they need? If you've ever faced this chaos, you know that in global trade, the wrong document or a missing detail can mean costly demurrage fees, customs holds, or even rejected shipments. So, what exactly should you expect to find in the key shipping documents provided by your supplier, and how do they keep your logistics chain moving?

The primary commercial and logistics document we provide is the Commercial Invoice and Packing List, often combined, which contains all critical logistics information for customs clearance and freight handling. This includes the detailed shipper/consignee info, HS codes, product descriptions, quantities, weights, package dimensions, and declared value. Additionally, for certain materials or markets, Certificate of Origin (COO) and Preferential Certificate of Origin (like Form A or Form E) are included, which detail the product's manufacturing origin to qualify for tariff reductions. Crucially, Phytosanitary Certificates for natural fibers or Non-Wood Packing Material Certificates are provided when legally required to avoid port rejection.

Think of these documents as the passport, visa, and health records for your cargo. Without them, or with errors, your goods go nowhere fast. For importers, understanding what's in these certificates isn't about paperwork—it's about ensuring predictable lead times, avoiding unexpected costs, and maintaining full supply chain visibility from our factory floor to your warehouse door.

So, let's decode the specific data points housed in each document, clarify which certificate does what, and outline how getting this right from the start—with a partner who understands the intricacies—saves you time, money, and immense stress.

Decoding the Commercial Invoice & Packing List

This document duo is the undisputed workhorse of international shipping. It's the first thing customs officers look at and the primary data source for your freight forwarder. A professionally prepared invoice and packing list doesn't just list items—it tells the complete story of the shipment in a language that banks, customs, and carriers all understand. Getting it wrong is an invitation for inspections, delays, and fines.

Our Commercial Invoice includes the full legal names and addresses of the seller (Shanghai Fumao) and the buyer, the date and invoice number, a detailed line-item description of goods with Harmonized System (HS) codes, quantities, unit prices, total value (in the agreed currency, e.g., USD), and the applicable Incoterms® 2020 (like FOB Shanghai or CIF Los Angeles). The Packing List, often on the same document, provides the physical shipment blueprint: number of cartons/rolls, gross/net weights, dimensions per package and total, and a clear marking/carton number system.

To move from theory to practice, let’s examine the two most critical yet commonly misunderstood elements on this document.

Why is the HS Code the Most Important Number on the Invoice?

The Harmonized System (HS) code is a globally standardized 6-10 digit number that classifies your product. It dictates the import duty rate, determines if your goods are subject to quotas or anti-dumping duties, and flags any required import licenses or safety regulations. An incorrect HS code can lead to underpayment of duties (resulting in fines and back-payments) or overpayment (wasting money). For example, the duty rate for "woven fabrics of synthetic filament yarn" can differ drastically from "woven fabrics of artificial filament yarn." We invest significant time in classifying our products correctly. In late 2023, we helped a U.S. client importing our BAMSILK (bamboo silk) blend fabrics avoid a 12% duty classification error. By providing the precise HS code on the invoice and sharing our rationale for classifying innovative blended fabrics under the HS system, we saved them thousands on a single shipment. This precision is part of our service.

How Do Net/Weights and Dimensions Impact Your Freight Costs?

Freight charges are calculated based on Chargeable Weight, which is the greater of the Gross Weight or the Volumetric Weight (dimensions-based). Inaccurate weights or dimensions on the Packing List cause major problems. If you quote freight based on our provided data and the carrier discovers heavier/larger cargo, you'll face surprise "re-weighting" fees and delays. Our process is meticulous: we weigh and measure a sample of packed cartons from every batch. For a recent order of lightweight puffer jacket fabrics for a Finnish brand, the volumetric weight was critical. By providing exact carton dimensions (e.g., 58x42x36 cm), their forwarder could accurately plan container space and cost. Providing this level of detail, as outlined in many guides to calculating freight chargeable weight for textiles, is a basic expectation clients should have from their supplier.

The Critical Role of Certificates of Origin

While the invoice handles the "what" and "how much," the Certificate of Origin (COO) answers the "where"—and in international trade, origin is everything. It determines eligibility for preferential tariff treatments under Free Trade Agreements (FTAs), compliance with "Made in..." labeling laws, and adherence to trade sanctions. There are two main types: the standard Non-Preferential COO and the Preferential COO (like Form E for ASEAN-China FTA or Form A for Generalized System of Preferences).

A standard COO, often issued by a Chamber of Commerce, simply certifies the country of origin of the goods. A Preferential COO is a legal document that certifies the goods originate from a specific country and meet the particular FTA's "rules of origin" (e.g., a certain percentage of value must be added in the exporting country), allowing them to be imported at a reduced or zero tariff rate.

Understanding and obtaining the correct COO can directly translate into 5-15% savings on your landed cost. Let's explore how.

What are "Rules of Origin" and How Do We Fulfill Them?

Rules of Origin are the specific criteria that determine the "economic nationality" of a product. For textiles, the rule is often "substantial transformation"—like the "yarn-forward" rule common in US FTAs, meaning the yarn production, fabric formation, and finishing must occur in the member country. For our clients in RCEP (Regional Comprehensive Economic Partnership) member countries, we meticulously track the origin of our yarns. If we use Vietnamese viscose yarn to weave and dye fabric in China, we calculate if the value-added meets the RCEP's percentage rule (often 40%). If it does, we can issue a Preferential COO (RCEP Certificate of Origin). We recently assisted a Thai apparel factory in securing a preferential rate for our Tencel™ twill by documenting the complete value-addition process for textile origin qualification. This documentation is part of our package, not an extra.

What's the Process for Getting a Preferential Certificate of Origin?

It's a multi-step, proactive process that we manage for our clients. First, we determine eligibility based on the product's bill of materials and the destination country's FTAs with China. Then, we prepare a detailed manufacturing cost statement and apply to the authorized issuer (usually China Council for the Promotion of International Trade). After review, the physical or electronic COO is issued. The key is starting early. For a long-term Australian client shipping to Malaysia under the ASEAN-Australia-New Zealand FTA (AANZFTA), we initiate the COO application the moment production is confirmed. This foresight, informed by resources like the International Chamber of Commerce's guide to rules of origin, ensures the document is ready when the goods are, preventing shipment delays. We treat document lead time as part of the production timeline.

Specialized Certificates for Specific Materials & Markets

Beyond universal commercial documents, certain materials and destination countries mandate additional, highly specialized certificates. These are not "nice-to-haves" but legal requirements for entry. Failure to provide them results in the goods being refused entry, destroyed, or returned at your expense. The two most common in the textile trade relate to plant-based materials and packing materials.

For goods containing regulated natural fibers (like cotton, linen, hemp, or bamboo visa viscose), many countries require a Phytosanitary Certificate. This is an official document from the exporting country's plant protection agency (e.g., China's General Administration of Customs) certifying that the products have been inspected and are free from regulated pests and diseases. Similarly, to prevent the spread of pests via wood packaging, the ISPM 15 Certificate (or Mark) for wood, or a Non-Wood Packing Material Declaration for non-wood packaging, is required by nearly all major markets.

Navigating these requirements demands specific knowledge and certified processes.

![]()

When is a Phytosanitary Certificate Required for Fabrics?

It's required when your destination country's plant health regulations list the specific plant-based fiber as a regulated article. The United States, European Union, Australia, and Turkey, for example, have strict requirements for raw cotton or certain non-processed plant fibers. The key factor is often the level of processing. Highly processed, bleached, and dyed woven cotton fabric may be exempt, while raw cotton or lightly processed linen may require it. We maintain an updated database of country-specific requirements. For instance, when shipping our organic cotton knits to a client in Turkey, we always procure the Phytosanitary Certificate as Turkish customs are notoriously strict. We guide our clients through this by referencing official country-specific phytosanitary import requirement databases, ensuring zero surprises at their port.

How Do We Comply with ISPM 15 for Wood Packaging?

ISPM 15 is the international standard requiring all solid wood packaging material (like pallets, crates, dunnage) over 6mm thick to be heat-treated or fumigated and marked with a certified stamp. We have a strict policy: for all exports, we use only ISPM 15-compliant heat-treated wood pallets from certified suppliers. Each pallet bears the visible IPPC (International Plant Protection Convention) mark. For clients who prefer to avoid wood entirely, we offer alternative packaging solutions with reinforced cardboard bases or plastic pallets, accompanied by a formal Non-Wood Packing Material Declaration letter. This declaration is a simple but critical document stating the packaging contains no solid wood. We once helped a Canadian client avoid a costly 7-day quarantine at Vancouver port because their previous supplier used non-compliant pallets. Our systematic compliance turned a potential risk into a routine clearance.

Our Document Package: From Issuance to Your Hands

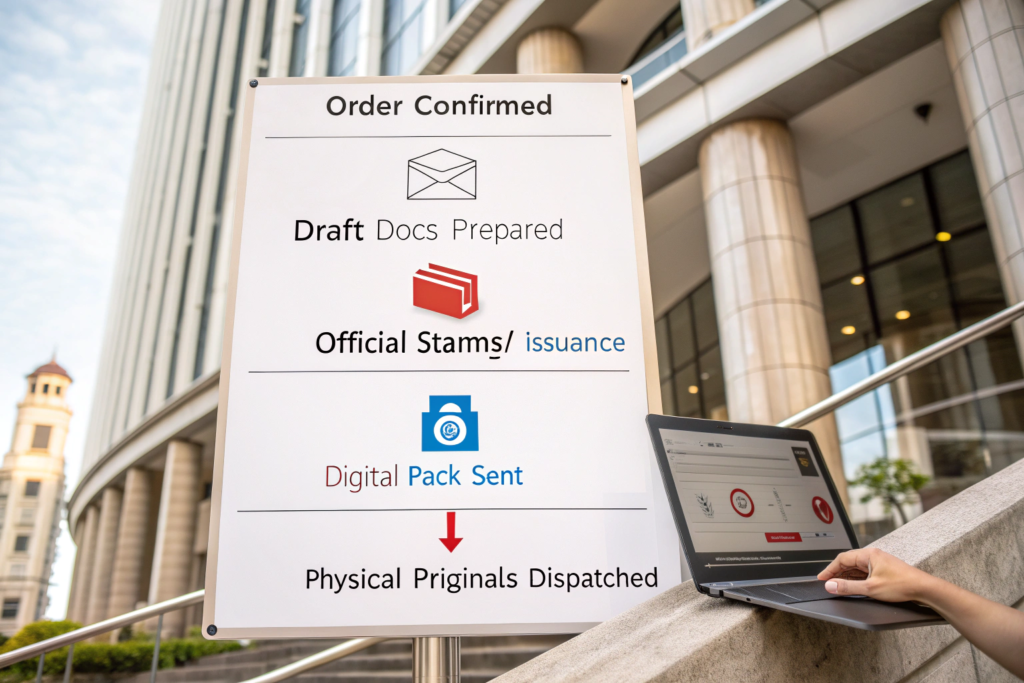

Providing accurate certificates is one thing; ensuring they are delivered to the right people at the right time in the right format is another operational layer. A perfect certificate stuck in our office is useless when your freight forwarder needs it for customs pre-filing 72 hours before vessel arrival. We have a streamlined, digital-first process for document flow that integrates with modern logistics.

Our process kicks off at the sales order stage, where we confirm all required documents with the client. During production, our logistics team prepares draft documents for review. Once goods are ready for shipment, we obtain final, signed/stamped originals from the relevant authorities. We then send a complete digital document pack (scanned PDFs) to the client and their nominated forwarder via email and/or a secure client portal before the vessel sails. The physical originals are couriered via DHL/UPS or shipped with the original Bills of Lading as required.

This seamless handoff is what turns documents from a headache into a tool for visibility and control.

What is the Typical Timeline for Receiving Full Documents?

Timelines vary by document type. Commercial documents (Invoice, Packing List) are ready within 24 hours of final shipment details being confirmed. A standard Chamber of Commerce COO takes 2-3 working days. Preferential COOs (Form E, etc.) can take 5-7 working days for issuance. Phytosanitary certificates require pre-shipment inspection and take 3-5 working days. We build these lead times into our shipping schedule and communicate them clearly. For a recurring EU client, we have a standing instruction to apply for the Form A (GSP) certificate immediately upon their written production confirmation. This proactive approach, akin to strategies discussed in forums on streamlining export documentation for just-in-time manufacturing, means the certificate is often ready before the container is even loaded at the port.

How Do We Handle Document Errors or Re-issuance?

Even with the best systems, errors happen—a typo in the consignee address, a wrong HS code, or a client request for a change. Our policy is to act with urgency and cover the cost of re-issuance for errors on our part. The process is straightforward: the client identifies the error, we immediately contact the issuing authority, submit a correction application with supporting evidence, and expedite the new certificate. For example, if a client's forwarder needs the HS code adjusted for a specific port's interpretation, we re-issue the invoice promptly. This commitment to accuracy and responsiveness, which we see as foundational to our service, minimizes any potential downstream delays for our partners.

Conclusion

In the complex symphony of global logistics, the certificates and documents provided by your supplier are the sheet music. They direct every subsequent movement—shipping, customs clearance, warehousing, and final delivery. As we've unpacked, these documents contain far more than just prices and quantities; they house the critical logistics DNA of your shipment: its classification, origin, compliance status, and physical characteristics. Understanding what information is included and why it matters transforms you from a passive recipient into an active, informed manager of your supply chain.

The true mark of a reliable supplier is not just making quality products, but also mastering the art of flawless documentation. It's a discipline that prevents costly delays, unlocks financial savings through tariff programs, and ensures smooth passage through the labyrinth of international regulations. When your supplier gets this right, you gain predictability, control, and peace of mind.

Don't let documentation be the weakest link in your supply chain. Partner with a supplier who treats paperwork with the same precision as product quality. At Shanghai Fumao, our vertically integrated control extends to our logistics documentation process. From accurate HS coding and FTA optimization to managing specialized certificates, we ensure your shipment's paperwork is as robust and reliable as the fabrics inside the container. Let us handle the complexity, so you can focus on your business. Contact our Business Director Elaine to experience a seamless, well-documented sourcing journey: elaine@fumaoclothing.com.